Cisco 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THIS IS THE POWER OF THE NETWORK.

now.

CISCO SYSTEMS, INC. 2003 ANNUAL REPORT

Table of contents

-

Page 1

THIS IS THE POWER OF THE NETWORK. now. CISCO SYSTEMS, INC. 2003 ANNUAL REPORT -

Page 2

...Cisco sells its products and services, both directly through its own sales force and indirectly through channel partners, to large enterprises, commercial businesses, service providers, and consumers. As a company, Cisco operates on core values of customer focus and corporate citizenship. We express... -

Page 3

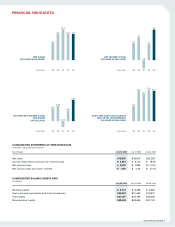

...CONSOLIDATED STATEMENTS OF OPERATIONS DATA (In millions, except per-share amounts) Years Ended July 26, 2003 July 27, 2002 July 28, 2001 Net sales Income (loss) before provision for income taxes Net income (loss) Net income (loss) per share-diluted $18,878 $ 5,013 $ 3,578 $ 0.50 $ 18,915 $ 2,710... -

Page 4

... foundation of the Cisco culture. Throughout this Annual Report you will read stories from customers and partners describing how the power of the network has changed the way they work, live, play, and learn. Overall, we are very proud of our achievements in fiscal 2003, and in terms of our financial... -

Page 5

... OF OUR CUSTOMERS, PARTNERS, INVESTORS, AND EMPLOYEES. " In fiscal 2003, we continued to be very active with our share repurchase program. During fiscal 2003, we repurchased approximately $6 billion or 424 million shares of our stock at an average price of $14.10. Our cumulative purchases since the... -

Page 6

... highest-quality Cisco products and services to our customers. Over the last year, we strengthened our alliances and entered into new key relationships that will help both Cisco and these companies succeed in the marketplace, including relationships with AT&T, Bell South, EDS, EMC, HP , Hitachi, IBM... -

Page 7

..., we would like to thank our employees, customers, partners, and shareholders for your continued confidence and for your support. JOHN T. CHAMBERS PRESIDENT AND CHIEF EXECUTIVE OFFICER JOHN P . MORGRIDGE CHAIRMAN OF THE BOARD DONALD T. VALENTINE VICE CHAIRMAN OF THE BOARD 2003 ANNUAL REPORT 5 -

Page 8

..., hotels, hospitals, even coffee shops. Always there, always on.They have the power to change the way we work, live, play, and learn. This power exists today. In our routers. In our switches. In the networks that connect students to teachers, customers to corporations, ideas to people. People who... -

Page 9

2003 ANNUAL REPORT 7 -

Page 10

... vendors can collaborate in real time, regardless of location. Wireless networks keep staff connected while away from their desks. IP telephony helps them bypass expensive long distance charges. And Cisco IP Communications gives them anytime access to voice messages, e-mail, and faxes from their PCs... -

Page 11

... the next few years, all 240,000 employees in 28 countries will rely on the network for communications, IP telephony, training, and internal operations. Routers, switches, IP phones, wireless and content networks-all work together to do nothing short of transforming a business. 2003 ANNUAL REPORT 9 -

Page 12

...-to-hospital telerobotics assisted surgery over an IP network. To the outside observer, it may seem a simple matter of data transfer. But for the patient who got the operation she needed without having to travel away from home and family, it's still a modern medical miracle. 10 CISCO SYSTEMS, INC. -

Page 13

... grounds. Internet-powered telephones allow them to check flight status, access news headlines, even confirm conference agendas. And, business professionals can link to their corporate networks over a highly secure virtual private network (VPN) connection without worrying that data might be... -

Page 14

... is saving money-and keeping the peace-by allowing everyone to connect to the Internet and share applications, files, printers, even music and games. Broadband connections and IP networks are becoming the center of home entertainment. Linksys, a division of Cisco, is behind this new level of... -

Page 15

... provide real-time access to information on more than 45,000 items. While online, shoppers can instantly browse product information to make sure they can get just the right equipment. Customers can also access the company's adventure travel division, REI Adventures, to research and purchase trips... -

Page 16

... 38 online courses with voice, video, and data. Using Cisco switching technology, and Web collaboration software from Cisco partner First Virtual Communications, the portal provides virtual classrooms to keep students up to speed-and gives parents and teachers peace of mind. 14 CISCO SYSTEMS, INC... -

Page 17

..., it's streamlining operations, integrating policy implementation, and saving money. A lot of money. In five years, Centrelink has not only saved a half-billion dollars due to time reductions and process improvements, but also delivered a much higher level of customer service. 2003 ANNUAL REPORT 15 -

Page 18

..., and our Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls, or auditing matters • We have adopted a code of ethics that applies to our principal executive officer and all members of our finance department, including the... -

Page 19

...per share is computed using the weighted-average number of common shares and excludes dilutive potential common shares, as their effect is antidilutive. The weighted-average dilutive potential common shares, which were antidilutive for fiscal 2001, amounted to 348 million shares. 2003 ANNUAL REPORT... -

Page 20

...to be performed, which is typically from one to three years. Our total deferred revenue for services was $2.5 billion and $2.2 billion as of July 26, 2003 and July 27, 2002, respectively. Contracts and customer purchase orders are generally used to determine the existence of an arrangement. Shipping... -

Page 21

....) Our products sold are generally covered by a warranty for periods of 90 days, one year, or five years, and for some products, we provide a limited lifetime warranty. We accrue for warranty costs as part of our cost of sales based on associated material costs and technical support labor costs... -

Page 22

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Goodwill Impairments Our methodology for allocating the purchase price relating to purchase acquisitions is determined through established valuation techniques in the high-technology communications equipment ... -

Page 23

... Years Ended July 26, 2003 July 27, 2002 July 28, 2001 July 26, 2003 GROSS MARGIN July 27, 2002 July 28, 2001 Gross margin: Product Service Total $ 10,971 2,262 $ 13,233 $ 9,755 2,258 $ 12,013 $ 9,361 1,711 $11,072 70.5% 68.3% 70.1% 62.3% 69.6% 63.5% 47.9% 62.6% 49.7% 2003 ANNUAL REPORT... -

Page 24

... telecommunications service providers, price and product competition in the communications and networking industries, introduction and market acceptance of new technologies and products, adoption of new networking standards, and financial difficulties experienced by our customers. 22 CISCO SYSTEMS... -

Page 25

... volume, loss of cost savings due to changes in component pricing, impact of value engineering, inventory holding charges, price competition and introduction of new products or entering new markets, and different pricing and cost structures of new markets. If warranty costs associated with our... -

Page 26

... Consolidated Financial Statements.) In-Process Research and Development Our methodology for allocating the purchase price relating to purchase acquisitions to in-process R&D is determined through established valuation techniques in the high-technology communications equipment industry and based on... -

Page 27

... are subject to the continuous examination of our income tax returns by the Internal Revenue Service and other tax authorities. We regularly assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our provision for income taxes. 2003 ANNUAL REPORT 25 -

Page 28

.... In addition, revenue from consultative support of our technologies for specific customer networking needs increased. During fiscal 2002, technical support service contract renewals associated with product sales increased, compared with the prior fiscal year. Gross Margin Gross margin in fiscal... -

Page 29

... of our services. Research and Development, Sales and Marketing, and General and Administrative Expenses Total R&D, sales and marketing, and G&A expenses decreased in absolute dollars from fiscal 2001, primarily due to the impact of the restructuring program and cost control measures to contain... -

Page 30

... due to the impact of nondeductible in-process R&D, acquisition-related costs, research and experimentation tax credits, state taxes, and the tax impact of non-U.S. operations. RECENT ACCOUNTING PRONOUNCEMENT Financial Accounting Standards Board Interpretation No. 46, "Consolidation of Variable... -

Page 31

... is located, and certain other facilities, both completed and under construction, in the areas of San Jose, California; Boxborough, Massachusetts; Salem, New Hampshire; Richardson, Texas; and Research Triangle Park, North Carolina. Under these agreements, we could, at our option, purchase the... -

Page 32

... due to customers not meeting specific business milestones and not satisfying certain financial covenants. As of July 26, 2003, structured loans were $42 million, compared with $61 million as of July 27, 2002. We have entered into several agreements to purchase or develop real estate, subject to... -

Page 33

... minimum purchase price, and the maximum purchase price is limited to approximately $2.5 billion in shares of our common stock valued at the time of closing. The acquisition has received the required approvals of the Board of Directors from both companies and is subject to various closing conditions... -

Page 34

... through September 12, 2003. In March 2003, the Board of Directors increased our stock repurchase program by an additional $5.0 billion with no termination date. During fiscal 2003, we repurchased and retired 424 million shares of our common stock for an aggregate purchase price of $6.0 billion. As... -

Page 35

... and fixed income securities were related to our portfolio management strategies and did not have a material adverse impact on our existing levels of interest rate risk. At any time, a sharp rise in interest rates could have a material adverse impact on the fair value of our investment portfolio... -

Page 36

... Notional Amount Fair Value Forward contracts: Purchased Sold $ Option contracts: Purchased Sold $ $ 877 527 $ $ 759 - $ $- (6) $ 22 - Our foreign exchange forward contracts related to current assets and liabilities generally range from one to three months in original maturity. Additionally, we... -

Page 37

..., except per-share amounts) Years Ended July 26, 2003 July 27, 2002 July 28, 2001 NET SALES: Product Service Total net sales COST OF SALES: Product Service Total cost of sales GROSS MARGIN OPERATING EXPENSES: Research and development Sales and marketing General and administrative Restructuring... -

Page 38

... (Note 8) Minority interest Shareholders' equity: Preferred stock, no par value: 5 shares authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 6,998 and 7,303 shares issued and outstanding at July 26, 2003 and July 27, 2002... -

Page 39

... investments Acquisition of property and equipment Acquisition of businesses, net of cash and cash equivalents Change in lease receivables, net Purchases of investments in privately held companies Lease deposits Purchase of minority interest of Cisco Systems, K.K. (Japan) Other Net cash used... -

Page 40

... (Loss) Shares of Common Stock Retained Earnings Total Shareholders' Equity BALANCE AT JULY 29, 2000 Net loss Change in unrealized gains and losses on investments, net of tax Other Comprehensive loss Issuance of common stock Tax benefits from employee stock option plans Purchase acquisitions... -

Page 41

.... Cisco provides a broad line of products for transporting data, voice, and video within buildings, across campuses, and around the world. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Fiscal Year The Company's fiscal year is the 52 or 53 weeks ending on the last Saturday in July. Fiscal 2003... -

Page 42

... are given business terms to return a portion of inventory, receive credits for changes in selling prices, and participate in various cooperative marketing programs. The Company maintains estimated accruals and allowances for such exposures. The Company accrues for warranty costs, sales returns, and... -

Page 43

...K.K. (Japan). At July 26, 2003, the Company owned all issued and outstanding common stock amounting to 94.8% of the voting rights. Each share of preferred stock is convertible into one share of common stock of Cisco Systems, K.K. (Japan) at any time at the option of the holder. 2003 ANNUAL REPORT 41 -

Page 44

...(0.38) The value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model, which was developed for use in estimating the value of traded options that have no vesting restrictions and are fully transferable. Because the Company's employee stock options have... -

Page 45

...beginning of fiscal year Purchase acquisitions Amortization Canceled unvested options Balance at end of fiscal year $ 182 227 (131) (16) $ 262 $ 293 91 (187) (15) $ 182 $ 109 446 (262) - $ 293 The Company's methodology for allocating the purchase price to in-process research and development ("in... -

Page 46

...material on either an individual or aggregate basis to the Company's results. The Company acquired AuroraNetics, Inc. in the first quarter of fiscal 2002. During fiscal 2003, the Company issued approximately 2.7 million shares of common stock with a value of $39 million to the former stockholders of... -

Page 47

... of Operations (in millions): Years Ended July 26, 2003 July 27, 2002 July 28, 2001 Reported as: Cost of sales Operating expenses Total $ 15 394 $ 22 699 $ 721 $ $ 22 365 387 $ 409 The estimated future amortization expense of purchased intangible assets as of July 26, 2003 is as follows (in... -

Page 48

... quarter and fourth quarter of fiscal 2003, due to changes in real estate market conditions. The increase in restructuring liabilities was recorded as expenses related to research and development ($18 million), sales and marketing ($18 million), general and administrative ($4 million), and cost of... -

Page 49

...26, 2003 July 27, 2002 Inventories: Raw materials Work in process Finished goods Demonstration systems Total Property and equipment, net: Land, buildings, and leasehold improvements Computer equipment and related software Production, engineering, and other equipment Operating lease assets Furniture... -

Page 50

...The following tables summarize the Company's investments (in millions): July 26, 2003 Amortized Cost Fair Value U.S. government notes and bonds Corporate notes and bonds Municipal notes and bonds Corporate equity securities Total Reported as: Short-term investments Investments Total $ 5,302 9,978... -

Page 51

... is located, and certain other facilities, both completed and under construction, in the areas of San Jose, California; Boxborough, Massachusetts; Salem, New Hampshire; Richardson, Texas; and Research Triangle Park, North Carolina. Under these agreements, the Company could, at its option, purchase... -

Page 52

... price, and the maximum purchase price is limited to approximately $2.5 billion in shares of the Company's common stock valued at the time of closing. The acquisition has received the required approvals of the Board of Directors from both companies and is subject to various closing conditions... -

Page 53

...based on associated material product costs and technical support labor costs. The products sold are generally covered by a warranty for periods of 90 days, one year, or five years, and for some products, the Company provides a limited lifetime warranty. In the normal course of business to facilitate... -

Page 54

... 12, 2003. In March 2003, the Board of Directors increased Cisco's stock repurchase program by an additional $5.0 billion with no termination date. During fiscal 2003, the Company repurchased and retired 424 million shares of Cisco common stock for an aggregate purchase price of $6.0 billion... -

Page 55

.... Eligible employees may purchase a limited number of shares of the Company's common stock at a discount of up to 15% of the market value at certain plan-defined dates. The Purchase Plans terminate on January 3, 2005. In fiscal 2003, 2002, and 2001, the shares issued under the Purchase Plans were 23... -

Page 56

... of the outstanding shares on the last trading day of the immediately preceding November. Options granted under the 1996 Plan have an exercise price equal to the fair market value of the underlying stock on the grant date and expire no later than nine years from the grant date. Although the Board of... -

Page 57

... fiscal 2003, a total of approximately 4 million shares of the Company's common stock has been reserved for issuance under the assumed plans and the related options are included in the following table. OPTIONS OUTSTANDING Options Available for Grant Number Outstanding Weighted-Average Exercise Price... -

Page 58

... Company's employee stock options. Under the Black-Scholes option pricing model, the weighted-average estimated values of employee stock options granted during fiscal 2003, 2002, and 2001 were $5.67, $8.60, and $13.31, respectively. The value of shares of common stock relating to the Purchase Plans... -

Page 59

... Plan. Employee contributions are limited to a maximum annual amount as set periodically by the Internal Revenue Service. Through December 31, 2002, the Company matched employee contributions dollar for dollar up to a maximum of $1,500 per person per year. Effective January 1, 2003, the new matching... -

Page 60

... deferred tax assets (liabilities) are as follows (in millions): July 26, 2003 July 27, 2002 ASSETS Allowance for doubtful accounts and returns Sales-type and direct-financing leases Loan reserves Inventory allowances and capitalization Investment provisions In-process R&D, goodwill, and purchased... -

Page 61

... on the ordering location of the customer. The Company's management makes financial decisions and allocates resources based on the information it receives from this internal management system. The Company does not allocate research and development, sales and marketing, or general and administrative... -

Page 62

... services (in millions): Years Ended July 26, 2003 July 27, 2002 July 28, 2001 Net sales: Routers Switches Access Other Product Service Total $ 4,859 7,721 965 2,020 15,565 3,313 $ 18,878 $ 5,487 7,651 1,042 1,489 15,669 3,246 $ 18,915 $ 7,095 9,141 1,869 1,454 19,559 2,734 $22,293 The Company... -

Page 63

... 2001, respectively, were outstanding, but were not included in the computation of diluted earnings per share because the exercise price of the stock options was greater than the average share price of the common shares and, therefore, the effect would have been antidilutive. 2003 ANNUAL REPORT 61 -

Page 64

... statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. San Jose, California August 5, 2003 62 CISCO SYSTEMS, INC. -

Page 65

....55 $ 8.12 $ 10.14 $ 12.33 $ 14.40 $ $ $ $ 20.75 21.92 20.00 17.49 $ $ $ $ 11.04 16.06 13.91 11.45 The Company has never paid cash dividends on its common stock and has no present plans to do so. There were 85,041 registered shareholders as of July 25, 2003. 2003 ANNUAL REPORT 63 -

Page 66

...: Investor Relations Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 (408) 227-CSCO (2726) You may also contact us by sending an e-mail to [email protected] or by visiting the Investor Relations section on the Cisco Website at www.cisco.com/go/investors. Transfer Agent... -

Page 67

WORLDWIDE OFFICES Corporate Headquarters San Jose, California, USA European Headquarters Amsterdam, Netherlands Americas Headquarters San Jose, California, USA Asia Pacific Headquarters Singapore Cisco has offices in the following countries. Addresses, phone numbers, and fax numbers are listed at ... -

Page 68

Corporate Headquarters Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 USA Tel: (408) 526-4000 (800) 553-NETS (6387) www.cisco.com Printed on recycled paper. Lit# 9560850308 SKU# 1028-AR-03