Capital One 1996 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

specialty segments, include secured

cards, college student cards, affinity

cards and a variety of cards for under-

served markets. These products tend to

have lower credit limits, slower asset

growth, higher operational costs, and

somewhat higher delinquencies and

charge-offs. But their most salient

characteristic is their high profitability,

due to our customized pricing and the

fact that competition is less intense in

these specialty markets.

Strong Gains in a

Difficult Credit Environment

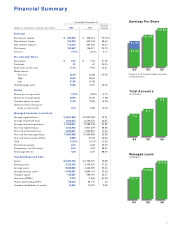

These new products, coupled with

introductory-rate repricings, have con-

tributed to a dramatic surge in rev-

enue. In 1996, Capital One’s total rev-

enue (managed net interest income

plus non-interest income) grew 63% to

$1.5 billion from $906 million in 1995.

Put another way, risk adjusted revenue

(total revenue less charge-offs) rose to a

record 8.02% of average earning assets

in 1996 from 6.99% in 1995. While our

margins expanded, many of our com-

petitors suffered shrinking returns.

Our information-based strategy

also gives us the ability to make oppor-

tunistic moves even with mature prod-

ucts. Despite decreasing our market-

ing emphasis on the balance transfer

product in 1996, we continued exten-

sive research and testing in this arena.

Out of these efforts came a number

of important breakthroughs, which we

have begun to market.

Conservative

Risk M anagement

Consumer credit is a cyclical business

and, unlike many industry observers,

we believe that the problems of the

current cycle have yet to peak. Our

information-based strategy gives us

the data and the tools to manage risk

effectively. We use sophisticated mod-

els to analyze risk, and we base

our decisions on highly conservative

forecasts.

To minimize total credit exposure,

our average credit lines are well below

the industry average ($3,100 versus

$5,700). Products are also priced and

structured to provide appropriate risk

coverage at the individual customer

level. Anticipating a rise in credit loss-

es again in 1997, we added to our

reserves. And our margins are suffi-

ciently large to cushion the impact of

Our information-based

strategy gives us the

data and the tools

to manage risk effec-

tively. We use sophis-

ticated models to

analyze risk, and we

base our decisions on

highly conservative

forecasts.