Capital One 1996 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

34

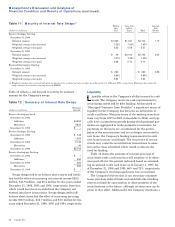

Table 11 Maturity of Interest Rate Swaps(1)

Within Over One Average

One to Five Life

(dollars in millions) Year Years Total (Years)

Receive fixed/pay floating:

December 31, 1996

Notional amount $1,063 $1,041 $2,104 1.15

Weighted average rates received 7.36% 7.55% 7.45%

Weighted average rates paid 5.55 5.59 5.57

December 31, 1995

Notional amount $ 40 $2,104 $2,144 2.03

Weighted average rates received 7.07% 7.45% 7.45%

Weighted average rates paid 5.88 5.73 5.73

Received floating/pay floating:

December 31, 1995

Notional amount $ 260 $ 260 0.56

Weighted average rates received 5.84% 5.84%

Weighted average rates paid 5.94 5.94

(1) Weighted average rates received and paid are based on the contractual rates in effect as of December 31, 1996 and 1995, respectively. Floating rates under the

swap contracts are based on varying terms of LIBOR.

Table 12 reflects a roll forward of activity by notional

amount for the Company’s swaps.

Table 12 Summary of Interest Rate Sw aps

Notional

(dollars in millions) Amount

Receive floating/pay fixed:

December 31, 1994

Additions $4,800

Maturities 4,800

December 31, 1995 $ –

Receive fixed/pay floating:

December 31, 1994 $ 539

Additions 1,605

December 31, 1995 2,144

Maturities 40

December 31, 1996 $2,104

Receive floating/pay floating:

December 31, 1994 $ –

Additions 260

December 31, 1995 260

Maturities 260

December 31, 1996 $ –

Swaps designated to on-balance sheet assets and liabili-

ties had the effect of increasing net interest income $20.0

million, $15.9 million, and $0.4 million for the years ended

December 31, 1996, 1995 and 1994, respectively, from that

which would have been recorded had the Company not

entered into these transactions. Swaps designated to off-

balance sheet items had the effect of increasing servicing

income $18.0 million, $12.7 million and $1.0 million for the

years ended December 31, 1996, 1995 and 1994, respectively.

Liquidity

Liquidity refers to the Company’s ability to meet its cash

needs. The Company meets its cash requirements by

securitizing assets and by debt funding. As discussed in

“Managed Consumer Loan Portfolio,” a significant source of

liquidity for the Company has been the securitization of

credit card loans. Maturity terms of the existing securitiza-

tions vary from 1997 to 2001 (extendable to 2004) and typi-

cally have accumulation periods during which principal pay-

ments are aggregated to make payments to investors. As

payments on the loans are accumulated for the partici-

pants in the securitization and are no longer reinvested in

new loans, the Company’s funding requirements for such

new loans increase accordingly. The occurrence of certain

events may cause the securitization transactions to amor-

tize earlier than scheduled which would accelerate the

need for funding.

Table 13 shows the amounts of investor principal of

securitized credit card loans that will amortize or be other-

wise paid off over the periods indicated based on outstand-

ing securitized credit card loans as of January 1, 1997. As

of December 31, 1996 and 1995, 66% and 72%, respectively,

of the Company’s total managed loans were securitized.

The Company believes that it can securitize consumer

loans, purchase federal funds and establish other funding

sources to fund the amortization or other payment of the

securitizations in the future, although no assurance can be

given to that effect. Additionally, the Company maintains a