Capital One 1996 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One

42

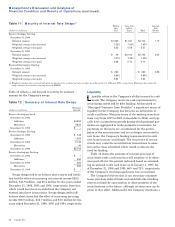

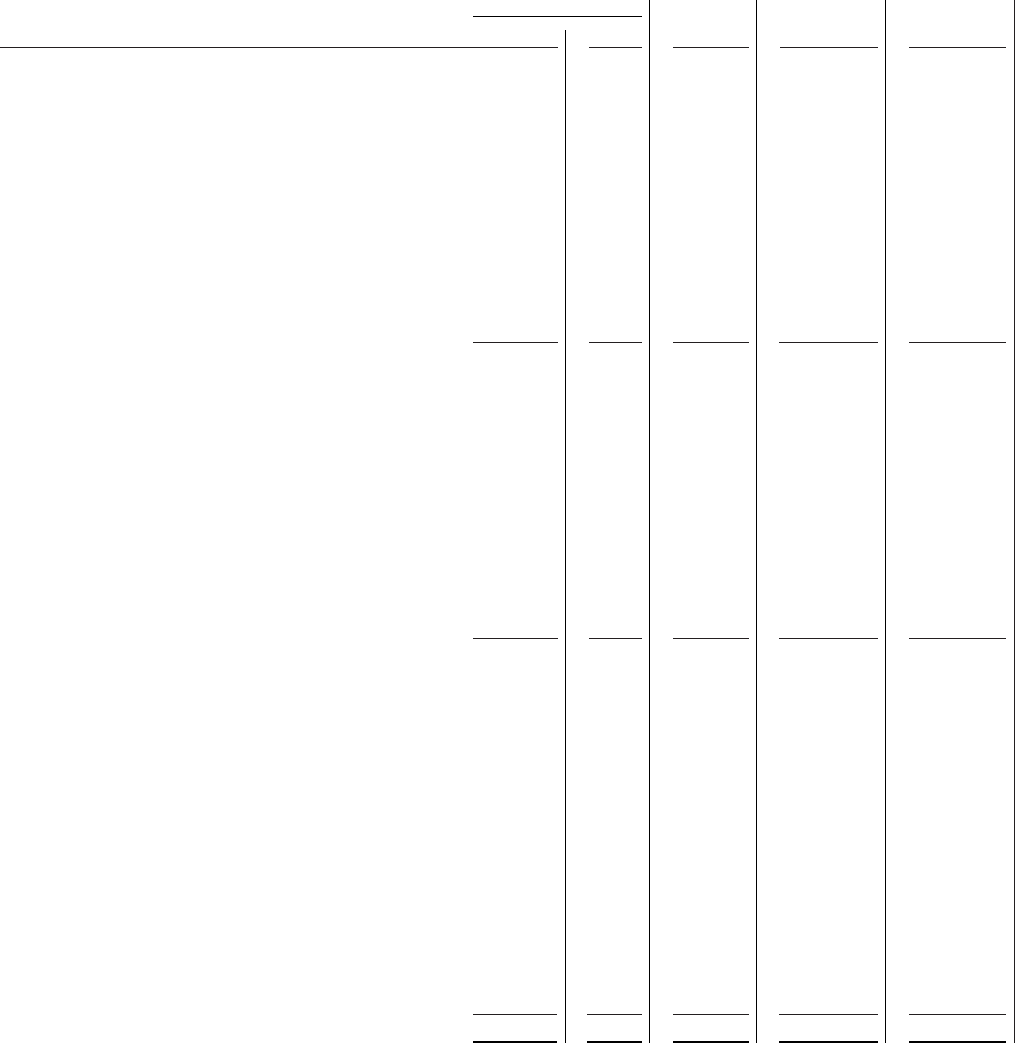

Common Stock Retained Total

Paid-in Earnings/ Stockholders’/

(dollars in thousands, except per share data) Shares Amount Capital, Net Division Equity Division Equity

Balance, December 31, 1993 $ 168,879 $168,879

Net income 95,263 95,263

Recapitalization and capital

contribution from Signet $357,875 (253,069) 104,806

Issuance of common stock

Initial public offering 65,602,850 $656 101,259 101,915

Restricted stock grants 464,400 5 (5)

Amortization of deferred compensation 3,715 3,715

Change in unrealized losses on

securities available for sale,

net of income taxes of $12 (21) (21)

Balance, December 31, 1994 66,067,250 661 462,844 11,052 474,557

Net income 126,511 126,511

Cash dividends - $.24 per share (15,883) (15,883)

Issuance of common stock 65,645 1 1,256 1,257

Exercise of stock options 6,582 132 132

Tax benefit from stock awards 1,578 1,578

Restricted stock, net 35,090

Amortization of deferred compensation 4,020 4,020

Change in unrealized gains on

securities available for sale,

net of income taxes of $3,780 7,019 7,019

Balance, December 31, 1995 66,174,567 662 469,830 128,699 599,191

Net income 155,267 155,267

Cash dividends - $.32 per share (20,573) (20,573)

Issuance of common stock 139,858 1 3,108 3,109

Exercise of stock options 11,500 186 186

Tax benefit from stock awards 338 338

Restricted stock, net (664)

Amortization of deferred compensation 193 193

Common stock issuable under

incentive plan 7,728 7,728

Foreign currency translation (132) (132)

Change in unrealized gains on

securities available for sale,

net of income taxes of $2,647 (4,916) (4,916)

Balance, December 31, 1996 66,325,261 $663 $481,383 $ 258,345 $740,391

See notes to consolidated financial statements.

Consolidated Statements of Changes in

Stockholders’ Equity