Capital One 1996 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

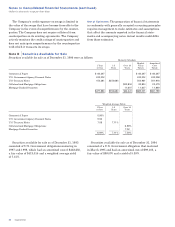

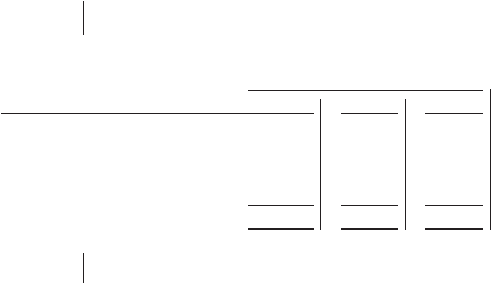

Note G Other Non-Interest Expense

Other non-interest expense consisted of the following:

Year Ended December 31

1996 1995 1994

Professional services $ 43,968 $28,787 $ 9,203

Fraud losses 26,773 27,721 10,852

Bankcard association assessments 15,045 13,116 8,344

Other 46,397 27,919 12,677

Total $132,183 $97,543 $41,076

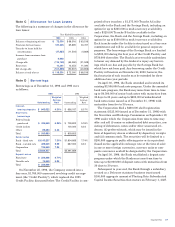

Note H Regulatory M atters

The Bank and the Savings Bank are subject to capital ade-

quacy guidelines adopted by the Federal Reserve Board

and the Office of Thrift Supervision (the “regulators”),

respectively. The capital adequacy guidelines and the regu-

latory framework for prompt corrective action require the

Bank and the Savings Bank to attain specific capital levels

based upon quantitative measures of their assets, liabili-

ties and off-balance sheet items as calculated under

Regulatory Accounting Principles. The inability to meet

and maintain minimum capital adequacy levels could

result in regulators taking actions that could have a material

effect on the Company’s consolidated financial statements.

Additionally, the regulators have broad discretion in apply-

ing higher capital requirements. Regulators consider a

range of factors in determining capital adequacy, such as

an institution’s size, quality and stability of earnings, inter-

est rate risk exposure, risk diversification, management

expertise, asset quality, liquidity and internal controls.

The most recent notifications from the regulators catego-

rized the Bank and the Savings Bank as “well capitalized”.

The Bank must maintain minimum Tier 1 Capital, Total

Capital and Tier 1 Leverage ratios of 4%, 8% and 4%, and

the Savings Bank must maintain minimum Tangible

Capital, Total Capital and Core Capital ratios of 1.5%, 8%

and 3%, respectively, under capital adequacy guidelines,

and 6%, 10% and 5%, respectively, to be well capitalized

under the regulatory framework for prompt corrective

action. As of December 31, 1996, the Bank’s Tier 1 Capital,

Total Capital and Tier 1 Leverage ratios were 11.61%,

12.87% and 9.04%, respectively. As of December 31, 1996,

the Savings Bank’s Tangible Capital, Total Capital and

Core Capital ratios were 9.18%, 16.29% and 9.18%, respec-

tively. In addition, the Savings Bank is subject for the first

three years of its operations to additional capital require-

ments, including the requirement to maintain a minimum

Core Capital ratio of 8% and a Total Capital ratio of 12%.

As of December 31, 1996, there are no conditions or events

since the notifications discussed above that Management

believes have changed either the Bank’s or the Savings

Bank’s capital category.

50 Capital One

Notes to Consolidated Financial Statements (continued)

(dollars in thousands, except per share data)

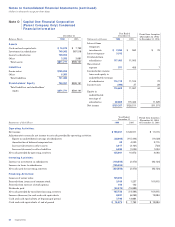

Under the Company’s Associate Stock Purchase Plan

(the “Purchase Plan”), associates of the Company and its

subsidiaries are eligible to purchase common stock through

monthly salary deductions of a maximum of 15% and a

minimum of 1% of monthly base pay. The amounts deduct-

ed are applied to the purchase of unissued common stock of

the Company at 85% of the current market price. An aggre-

gate of 1,000,000 common shares have been authorized for

issuance under the plan, of which 822,001 and 934,355

shares were available for issuance as of December 31, 1996

and 1995, respectively.

Additionally, pursuant to a Marketing and Management

Services Agreement between Signet Bank and Fairbank

Morris, Inc. (“FMI”), a corporation controlled by members

of the Company’s executive management, 464,400 shares of

restricted stock, at the then fair value of $16.00 per share,

were awarded to FMI for services rendered for the period

from January 1, 1994 to December 31, 1995. In connection

with this award, $3,715 in compensation cost was recog-

nized in both 1995 and 1994. The restrictions on this stock

expired on November 15, 1995, one year after the grant date.

On November 16, 1995, the Board of Directors of the

Company declared a dividend distribution of one Right for

each outstanding share of common stock. Each Right

entitles a registered holder to purchase from the Company

one one-hundredth of a share of the Company’s authorized

Cumulative Participating Junior Preferred Stock (the

“Junior Preferred Shares”) at a price of $150 (the

“Purchase Price”), subject to adjustment. The Company has

reserved 1,000,000 shares of its authorized preferred stock

for the Junior Preferred Shares. Because of the nature of

the Junior Preferred Shares’ dividend and liquidation

rights, the value of the one one-hundredth interest in a

Junior Preferred Share purchasable upon exercise of each

Right should approximate the value of one share of com-

mon stock. Initially, the Rights are not exercisable and

trade automatically with the common stock. However, the

Rights generally become exercisable and separate certifi-

cates representing the Rights will be distributed, if any

person or group acquires 15% or more of the Company’s

outstanding common stock or a tender offer or exchange

offer is announced for the Company’s common stock. The

Rights expire on November 29, 2005, unless earlier

redeemed by the Company at $0.01 per Right prior to the

time any person or group acquires 15% of the outstanding

common stock. Until the Rights become exercisable, the

Rights have no dilutive effect on earnings per share.