Capital One 1996 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

22

has been principally the result of this balance transfer fea-

ture. Industry competitors have continuously solicited the

Company’s customers with similar low-rate introductory

strategies. Management believes that these competitive

pressures have and will continue to put additional pressure

on low-rate introductory strategies.

In applying its Information-Based Strategies (“IBS”) and

in response to competitive pressures during late 1994, the

Company began to shift a significant amount of its solicita-

tion expense to second generation product opportunities.

Second generation products consist of secured card prod-

ucts and other customized card products including affinity

and co-branded cards, college student cards and other

cards targeted to certain markets that were underserved

by the Company’s competitors. These products do not have

the immediate impact on managed loan balances of the

first generation products but typically consist of lower cred-

it limit accounts which build balances over time. The terms

of the second generation products tend to include annual

membership fees and higher annual finance charge rates.

The higher risk profile of the customers targeted for the

second generation products and the lower credit limit asso-

ciated with these products also tend to result in higher

delinquency and net charge-off rates and consequently

higher past-due and overlimit fees than the first generation

products.

Although these second generation products have differ-

ing characteristics, both the first generation and second

generation products meet the Company’s objective of maxi-

mizing revenue for the level of risk undertaken.

Management believes that comparable measures for exter-

nal analysis are the risk adjusted revenue and risk adjusted

margin of the portfolio. Risk adjusted revenue is defined as

net interest income and non-interest income less net

charge-offs. Risk adjusted margin measures risk adjusted

revenue as a percent of managed earning assets. It consid-

ers not only the finance charge yield and net interest mar-

gin, the primary focus of the first generation products, but

also the fee income associated with the second generation

products. By deducting net charge-offs, consideration is

given to the risk inherent in these differing products.

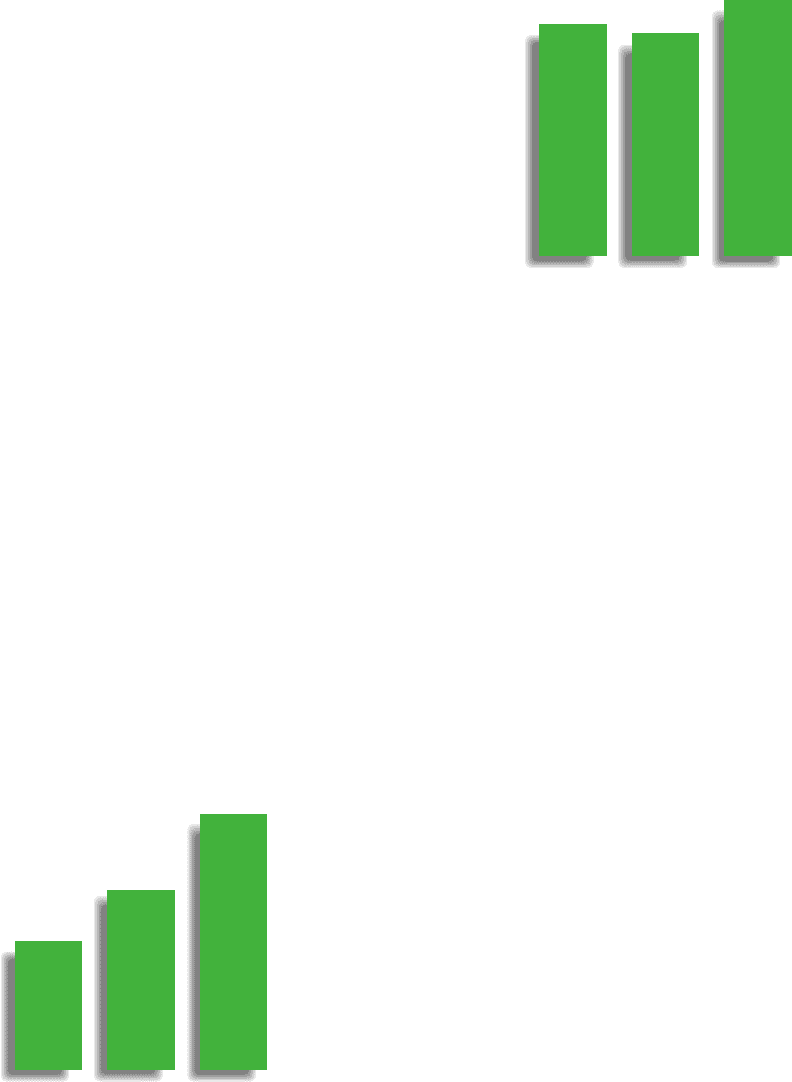

Risk adjusted revenue of $996.3 million for the year

ended December 31, 1996 increased $294.9 million, or 42%,

over risk adjusted revenue of $701.4 million in 1995. This

increase resulted from an increase in managed net interest

income of $383.6 million to $1.0 billion and an increase in

managed non-interest income of $184.2 million to $460.5

million, offset by an increase in managed net charge-offs of

$272.9 million to $477.7 million in 1996 as compared to

1995. Risk adjusted margin increased to 8.02% for the year

ended December 31, 1996 from 6.99% in 1995. This

increase resulted from an increase in managed net interest

margin to 8.16% in 1996 from 6.28% in 1995, an increase in

managed non-interest income as a percent of managed

earning assets to 3.71% in 1996 from 2.75% in 1995 offset

by an increase in managed net charge-offs as a percentage

of managed earning assets to 3.85% in 1996 from 2.04% in

1995. The cause of increases and decreases in the various

components of risk adjusted revenue are discussed in

further detail in subsequent sections of this analysis.

Risk adjusted revenue of $701.4 million for the year

ended December 31, 1995 increased $199.8 million, or

39.8%, over pro forma risk adjusted revenue of $501.6 mil-

lion in 1994. This increase resulted from an increase in

managed net interest income of $234.8 million to $630.0

million and an increase in managed non-interest income of

$78.2 million to $276.3 million, offset by an increase in

managed net charge-offs of $113.2 million to $204.8 million

‘94* *

Managed Risk

Adjusted Revenue*

(in millions)

‘95 ‘96

*Net interest income plus non-interest

income less net charge-offs.

$502

$701

$996

** Pro forma.

** Pro forma.

‘94* *

Managed Risk

Adjusted Margin*

‘95 ‘96

*Net interest income plus non-interest

income less net charge-offs divided by

average earning assets.

7.29% 6.99%

8.02%