Capital One 1996 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One 21

amortization period, the investors’ share of principal pay-

ments are paid to the certificateholders until they are

paid in full. During the accumulation period, the investors’

share of principal payments are paid into a principal fund-

ing account designed to accumulate amounts so that the

certificates can be paid in full on the expected final pay-

ment date. The trust continues in existence until all

amounts required to be paid to certificateholders of all

series are repaid, at which time any remaining receivables

and funds held in the trust will be reassigned to the

Company.

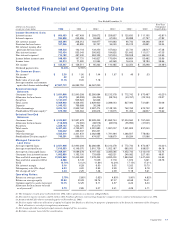

Table 2 indicates the impact of the credit card securiti-

zations on the income statement, average assets, return on

assets, yield and net interest margin for the periods presented.

The Company intends to continue to securitize consumer

loans.

Table 2 Impact of Credit Card Securitizations

Year Ended December 31

(dollars in thousands) 1996 1995 1994

Statements of Income (as reported):

Net interest income $ 365,484 $ 208,013 $ 164,977

Provision for loan losses 167,246 65,895 30,727

Non-interest income 763,424 553,043 396,902

Non-interest expense 713,182 497,430 384,325

Income before income taxes $ 248,480 $ 197,731 $ 146,827

Adjustments for Securitizations:

Net interest income $ 648,073 $ 421,983 $ 267,201

Provision for loan losses 345,141 145,209 65,921

Non-interest income (302,932) (276,774) (201,280)

Non-interest expense

Income before income taxes $ – $ – $ –

Managed Statements of Income (as adjusted):

Net interest income $ 1,013,557 $ 629,996 $ 432,178

Provision for loan losses 512,387 211,104 96,648

Non-interest income 460,492 276,269 195,622

Non-interest expense 713,182 497,430 384,325

Income before income taxes $ 248,480 $ 197,731 $ 146,827

Operating Data and Ratios:

Reported:

Average earning assets $ 4,798,987 $ 3,890,131 $2,349,310

Return on average assets 2.79% 2.85% 3.62%

Net interest margin(1) 7.62 5.35 7.02

Managed:

Average earning assets $12,415,540 $10,039,201 $6,260,049

Return on average assets 1.18% 1.20% 1.46%

Net interest margin(1) 8.16 6.28 6.90

Yield on managed portfolio 14.76 13.12 11.84

(1) Net interest margin is equal to net interest income divided by average earning assets.

Risk Adjusted Revenue and M argin

In originating its consumer loan portfolio in recent years,

the Company had pursued a low introductory interest

rate strategy with accounts repricing to higher rates after

six to sixteen months from the date of origination (“first

generation products”). The amount of repricing is actively

managed in an effort to maximize return at the customer

level, reflecting the risk and expected performance of the

account. Accounts also may be repriced upwards or down-

wards based on individual customer performance. Many of

the Company’s first generation products had a balance

transfer feature under which customers could transfer

balances held in their other credit card accounts to the

Company. The Company’s historic managed loan growth