Capital One 1996 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

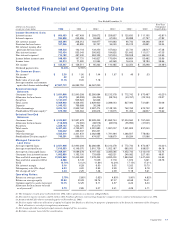

Table 5 Delinquencies(1)

December 31

1996 1995 1994 1993 1992

% of % of % of % of % of

Total Total Total Total Total

(dollars in thousands) Loans Loans Loans Loans Loans Loans Loans Loans Loans Loans

Reported:

Loans outstanding $ 4,343,902 100.00% $ 2,921,679 100.00% $2,228,455 100.00% $1,862,744 100.00% $1,304,560 100.00%

Loans delinquent:

30-59 days 96,819 2.23 65,711 2.25 29,032 1.30 19,186 1.03 21,525 1.65

60-89 days 55,679 1.28 38,311 1.31 14,741 .66 10,618 .57 11,089 .85

90 or more days 111,791 2.57 79,694 2.73 24,445 1.10 18,255 .98 23,352 1.79

Total $ 264,289 6.08% $ 183,716 6.29% $ 68,218 3.06% $ 48,059 2.58% $ 55,966 4.29%

Managed:

Loans outstanding $12,803,969 100.00% $10,445,480 100.00% $7,378,455 100.00% $4,832,400 100.00% $1,984,560 100.00%

Loans delinquent:

30-59 days 279,787 2.19 165,306 1.58 90,733 1.23 46,391 .96 40,088 2.02

60-89 days 162,668 1.27 92,665 .89 45,277 .61 25,128 .52 21,433 1.08

90 or more days 356,700 2.78 181,243 1.73 81,720 1.11 43,975 .91 43,661 2.20

Total $ 799,155 6.24% $ 439,214 4.20% $ 217,730 2.95% $ 115,494 2.39% $ 105,182 5.30%

(1) Includes consumer loans held for securitization.

Capital One 27

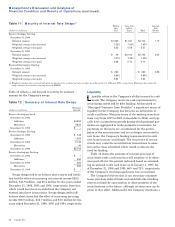

Delinquencies

Table 5 shows the Company’s consumer loan delinquency

trends for the periods presented as reported for finan-

cial statement purposes and on a managed basis. The

entire balance of an account is contractually delinquent if

the minimum payment is not received by the billing date.

However, the Company generally continues to accrue inter-

est until the loan is charged off. Delinquencies not only

have the potential to impact earnings in the form of net

charge-offs, they also are costly in terms of the personnel

and other resources dedicated to resolving them.

The 30-plus day delinquency rate for the reported con-

sumer loan portfolio decreased to 6.08% as of December 31,

1996, from 6.29% as of December 31, 1995. The modest

decrease in 1996 reported delinquency reflects the securiti-

zation of certain second generation receivables in 1996.

The delinquency rate for the total managed consumer

loan portfolio was 6.24% of related loans as of December

31, 1996, up from 4.20% as of December 31, 1995, while the

dollar amount of delinquent managed consumer loans

increased approximately $359.9 million. The managed

portfolio’s delinquency rate as of December 31, 1996 princi-

pally reflected the continued seasoning of accounts and

consumer loan balances, the increased presence of second

generation products and general economic trends in

consumer credit performance.

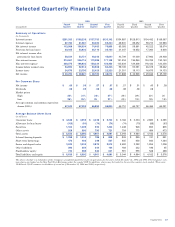

‘94

Managed Net Charge-Off

and 30+ Day

Delinquency Rate

‘95 ‘96

■ Net Charge-off Rate

■ Delinquency Rate

1.48%

2.25%

4.24%

2.95%

4.20%

6.24%