Capital One 1996 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital One

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

32

upon the receipt of dividends or other payments from its

subsidiaries. Banking regulations applicable to the Bank

and the Saving Bank and provisions that may be contained

in borrowing agreements of the Company or its sub-

sidiaries may restrict the ability of the Company’s sub-

sidiaries to pay dividends to the Company or the ability of

the Company to pay dividends to its stockholders.

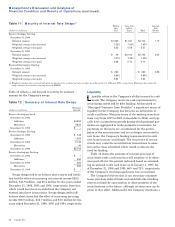

Capital Adequacy

The Bank and the Savings Bank are subject to capital

adequacy guidelines adopted by the Federal Reserve

Board and the Office of Thrift Supervision (the “regula-

tors”), respectively. The capital adequacy guidelines and

the regulatory framework for prompt corrective action

require the Bank and the Savings Bank to attain specific

capital levels based upon quantitative measures of their

assets, liabilities and off-balance sheet items as calculated

under Regulatory Accounting Principles. The inability to

meet and maintain minimum capital adequacy levels could

result in regulators taking actions that could have a material

effect on the Company’s consolidated financial statements.

Additionally, the regulators have broad discretion in apply-

ing higher capital requirements. Regulators consider a

range of factors in determining capital adequacy, such as

an institution’s size, quality and stability of earnings, inter-

est rate risk exposure, risk diversification, management

expertise, asset quality, liquidity and internal controls.

The most recent notifications from the regulators catego-

rized the Bank and the Savings Bank as “well capitalized”.

The Bank must maintain minimum Tier 1 Capital, Total

Capital and Tier 1 Leverage ratios of 4%, 8% and 4%, and

the Savings Bank must maintain minimum Tangible

Capital, Total Capital and Core Capital ratios of 1.5%, 8%

and 3%, respectively, under capital adequacy requirements,

and 6%, 10% and 5%, respectively, to be well capitalized

under the regulatory framework for prompt corrective

action. As of December 31, 1996, the Bank’s Tier 1 Capital,

Total Capital and Tier 1 Leverage ratios were 11.61%,

12.87% and 9.04%, respectively. As of December 31, 1996,

the Savings Bank’s Tangible Capital, Total Capital and

Core Capital ratios were 9.18%, 16.29% and 9.18%, respec-

tively. In addition, the Savings Bank is subject for the first

three years of its operations to additional capital require-

ments, including the requirement to maintain a minimum

Core Capital ratio of 8% and a Total Capital ratio of 12%.

As of December 31, 1996, there are no conditions or events

since the notifications discussed above that Management

believes have changed either the Bank’s or the Savings

Bank’s capital category. The Bank’s ratio of common equity

to managed assets was 4.92%. These capital levels make

the Company among the highest capitalized institutions in

the credit card sector.

During 1996, the Bank received regulatory approval to

establish a branch office in the United Kingdom. In connec-

tion with such approval, the Company committed to the

Federal Reserve Board that, for so long as the Bank main-

tains such branch in the United Kingdom, the Company will

maintain a minimum Tier 1 leverage ratio of 3.0%. As of

December 31, 1996, the Company’s Tier 1 leverage ratio was

11.13%.

Additionally, certain regulatory restrictions exist which

limit the ability of the Bank and the Savings Bank to trans-

fer funds to the Corporation. As of December 31, 1996,

retained earnings of the Bank and the Savings Bank of

$113.7 million and $4.6 million, respectively, were available

for payment of dividends to the Corporation, without prior

approval by the regulators. The Savings Bank is required to

give the Office of Thrift Supervision at least 30 days’

advance notice of any proposed dividend.

Off-Balance Sheet Risk

The Company is subject to off-balance sheet risk in the

normal course of business including commitments to

extend credit, excess servicing income from securitization

and interest rate swaps. In order to reduce the interest rate

sensitivity and to match asset and liability repricing, the

Company has entered into swaps which involve elements of

credit or interest rate risk in excess of the amount recog-

nized on the balance sheet. Swaps present the Company

with certain credit, market, legal and operational risks. The

Company has established credit policies for off-balance

sheet items as it does for on-balance sheet instruments.

Interest Rate Sensitivity

Interest rate sensitivity refers to the change in earnings

that may result from changes in the level of interest rates.

To the extent that interest income and interest expense do

not respond equally to changes in interest rates, or that all

rates do not change uniformly, earnings will be affected.

Prior to the Separation, the Company’s interest rate sensi-

tivity was managed by Signet, as part of Signet’s overall

asset and liability management process at the corporate

level, not at the divisional level.

In determining interest rate sensitivity, the Company

uses simulation models to identify changes in net interest

income based on different interest rate scenarios. The

Company manages its interest rate sensitivity through sev-

eral techniques which include changing the maturity and

distribution of assets and liabilities, the impact of securiti-

zations, interest rate swaps, repricing of consumer loans

and other methods.