Capital One 1996 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One 19

costs of $59.8 million, or 41%, and other non-interest

expenses of $155.9 million, or 44%, reflect the increase in

marketing investment in existing and new product oppor-

tunities and the cost of operations to build infrastructure

and manage the growth in accounts. Average managed con-

sumer loans grew 24% for the year ended December 31,

1996, to $11.3 billion from $9.1 billion for the year ended

December 31, 1995, and average managed accounts grew

30% for the same period to 7.5 million from 5.7 million as a

result of the continued success of the Company’s solicita-

tion and account management strategies.

Year Ended December 31, 1995 Compared to

Year Ended December 31, 1994

Net income for the year ended December 31, 1995 of

$126.5 million increased $31.2 million, or 33%, over

net income of $95.3 million in 1994. The increase in net

income was partially attributable to the $31.9 million

(after-tax) nonrecurring charge for 1994 settlement costs to

terminate a long-term data processing services contract.

Other factors affecting net income include the increase

in net interest income of $43.0 million, or 26%, the result of

a 66% increase in average earning assets, offset by a

decrease in the net interest margin to 5.35% from 7.02%.

The decrease in net interest margin reflected overall increas-

es in average short-term market interest rates plus the

absence of a stand-alone hedging program prior to the

Separation. The provision for loan losses increased $35.2

million, or 114%, as average reported consumer loans

increased 37% and the reported net charge-off rate

increased to 2.03% in 1995 from 1.13%

in 1994 as the accounts seasoned. Non-interest income

increased $156.1 million, or 39%, primarily due to the

increase in average managed loans, including those securi-

tized. Increases in solicitation costs of $45.9 million, or

46%, and other non-interest expenses (excluding the con-

tract termination expense of $49.0 million) of $116.2 mil-

lion, or 50%, reflect the increase in marketing investment

in existing and new product opportunities and the cost of

operations to manage the growth in accounts. Average

managed loans grew to $9.1 billion, or 47%, from $6.2 bil-

lion as a result of the success of the Company’s solicitation

and account management strategies.

Managed Consumer Loan Portfolio

The Company analyzes its financial performance on a

managed consumer loan portfolio basis. Managed con-

sumer loan data adjusts the balance sheet and income

statement to add back the effect of securitizing consumer

loans. The Company also evaluates its interest rate

exposure on a managed portfolio basis.

The Company’s managed consumer loan portfolio is com-

prised of on-balance sheet loans, loans held for securitiza-

tion and securitized loans. Securitized loans are not

assets of the Company and, therefore, are not shown on the

balance sheet. Reported consumer loans consist of on-balance

sheet loans and loans held for securitization and excludes

securitized loans. Table 1 summarizes the Company’s

managed consumer loan portfolio.

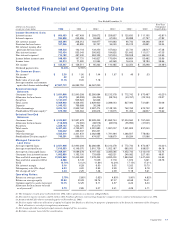

Table 1 Managed Consumer Loan Portfolio

Year Ended December 31

(in thousands) 1996 1995 1994 1993 1992

Year-End Balances:

Consumer loans held for securitization $ 400,000

On-balance sheet consumer loans $ 4,343,902 2,521,679 $2,228,455 $1,862,744 $1,304,560

Securitized consumer loans 8,460,067 7,523,801 5,150,000 2,969,656 680,000

Total managed consumer loan portfolio $12,803,969 $10,445,480 $7,378,455 $4,832,400 $1,984,560

Average Balances:

Consumer loans held for securitization $ 699,044 $ 402,602 $ 432,581 $ 393,835

On-balance sheet consumer loans 2,952,864 2,537,606 1,854,103 1,819,543 $ 772,742

Securitized consumer loans 7,616,553 6,149,070 3,910,739 1,052,187 680,000

Total average managed consumer loan portfolio $11,268,461 $ 9,089,278 $6,197,423 $3,265,565 $1,452,742