Capital One 1996 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

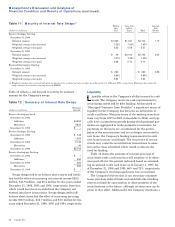

Table 10 Interest Rate Sensitivity

As of December 31,1996

Subject to Repricing

Within > 180 Days- > 1 Year- Over

(dollars in millions) 180 Days 1 Year 5 Years 5 Years

Earning assets

Federal funds sold $ 450

Interest-bearing deposits at other banks 30

Securities available for sale 479 $ 367 $ 32

Consumer loans 2,189 $ 569 1,586

Total earning assets 3,148 569 1,953 32

Interest-bearing liabilities

Interest-bearing deposits 345 39 559

Short-term borrowings 531

Senior and deposit notes 1,054 161 2,439 340

Total interest-bearing liabilities 1,930 200 2,998 340

Non-rate related net assets (234)

Interest sensitivity gap 1,218 369 (1,045) (542)

Impact of swaps (1,580) 539 1,041

Impact of consumer loan securitzations (2,145) 215 1,930

Interest sensitivity gap adjusted for impact of securitization and swaps $(2,507) $1,123 $ 1,926 $ (542)

Adjusted interest sensitivity gap as a percentage of managed assets (16.80)% 7.52)% 12.90)% (3.63)%

Cumulative interest sensitivity gap $(2,507) $(1,384) $ 542

Adjusted cumulative interest sensitivity gap as a percentage of managed assets (16.80)% (9.27)% 3.63)% 0.00)%

Capital One 33

The Company has entered into swaps to reduce the

interest rate sensitivity associated with its securitizations.

In 1995, the Company entered into swaps with notional

amounts totaling $591 million which are scheduled to

mature in 1998 and 1999 to coincide with the final pay-

ment date of a 1993 securitization. In 1994, the Company

entered into swaps with notional amounts totaling

$539 million which are scheduled to mature in 1997 to

coincide with the final payment date of the remaining term

of a 1994 securitization. These swaps paid floating rates of

three-month LIBOR (weighted average contractual rate

of 5.55% and 5.78% as of December 31, 1996 and 1995,

respectively) and received a weighted average fixed rate of

7.23% as of December 31, 1996 and 1995.

The Company entered into swaps for purposes of man-

aging its interest rate sensitivity. The Company designates

swaps to on-balance sheet instruments to alter the interest

rate characteristics of such instruments and to modify

interest rate sensitivity. The Company also designates

swaps to off-balance sheet items to reduce interest rate

sensitivity. Table 11 reflects the type and terms of out-

standing interest rate swaps as of December 31, 1996 and

1995.

The Company entered into swaps to effectively convert

certain of the bank notes from fixed to variable. The swaps,

which had a notional amount totaling $974 million as of

December 31, 1996, will mature in 1997 through 2000 to

coincide with maturities of fixed bank notes. As of

December 31, 1996, these swaps paid three-month LIBOR

at a weighted average contractual rate of 5.59% and

received a weighted average fixed rate of 7.71%.

The Company’s asset/liability policy is to manage inter-

est rate risk to limit the impact of an immediate and

sustained 100 basis point change in interest rates to no

more than a 5% change in managed net interest income

over a twelve month period. As of December 31, 1996, the

Company’s interest rate sensitivity to this change in rates

was 2.09%, which was substantially within Company

guidelines. Management may reprice interest rates on out-

standing credit card loans subject to the right of the cus-

tomers in certain states to reject such repricing by

giving timely written notice to the Company and thereby

relinquishing charging privileges. However, the repricing of

consumer loans may be limited by competitive factors as

well as certain legal bounds.

Interest rate sensitivity at a point in time can also be

analyzed by measuring the mismatch in balances of earn-

ing assets and interest-bearing liabilities that are subject

to repricing in future periods. Table 10 reflects the interest

rate repricing schedule for earning assets and interest-

bearing liabilities as of December 31, 1996.