Capital One 1996 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One 31

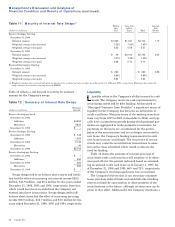

bank notes with maturities from five to 30 years. In 1996,

the Bank issued $200 million in senior bank notes due

September 15, 2006, with an attached three-year, one-time

investor put option that significantly reduced the Company’s

funding costs on this transaction. As of December 31, 1996,

the Company had $3.6 billion in senior bank notes out-

standing, a 43% increase from $2.5 billion outstanding as

of December 31, 1995. As of December 31, 1996, bank notes

issued totaling $2.9 billion have fixed interest rates and

mature from one to five years. The Company had previously

entered into interest rate swap agreements (“swaps”) total-

ing $974 million to effectively convert fixed rates on senior

notes to variable rates which match the variable rates

earned on consumer loans (see “Interest Rate Sensitivity”).

As of December 31, 1996, no subordinated bank notes have

been issued.

The Corporation filed a $200 million shelf registration

statement ($125 million issued as of December 31, 1996)

with the Securities and Exchange Commission on

September 19, 1996 under which the Corporation from

time to time may offer and sell (i) senior or subordinated

debt securities consisting of debentures, notes and/or other

unsecured evidences, (ii) preferred stock, which may be

issued in the form of depository shares evidenced by depos-

itory receipts and (iii) common stock. The securities will be

limited to $200 million aggregate public offering price or its

equivalent (based on the applicable exchange rate at the

time of sale) in one or more foreign currencies, currency

units or composite currencies as shall be designated by the

Corporation.

Also on April 30, 1996, the Bank established a deposit

note program under which the Bank may issue from time

to time up to $2.0 billion of deposit notes with maturities

from 30 days to 30 years. As of December 31, 1996, the

Company had $300 million in deposit notes outstanding.

Subsequent to year-end, the Bank through a subsidiary

created as a Delaware statutory business trust issued $100

million aggregate amount of Floating Rate Subordinated

Capital Income Securities that mature on February 1, 2027.

The Company’s primary source of funding, securitization

of consumer loans, increased to $8.5 billion as of December

31, 1996 from $7.5 billion as of December 31, 1995. In

1996, the Company securitized $2.7 billion in four transac-

tions, consisting predominantly of LIBOR-based, variable-

rate deals maturing from 1997 through 2001, $500 million

of which may be extended at the Company’s option until

2004.

In January 1996, the Company implemented a dividend

reinvestment and stock purchase plan (the “DRIP”) to pro-

vide existing stockholders with the opportunity to purchase

additional shares of the Company’s common stock by

reinvesting quarterly dividends or making optional cash

investments. The Company uses proceeds from the DRIP

for general corporate purposes.

On November 17, 1995, the Company entered into a

three-year, $1.7 billion unsecured revolving credit arrange-

ment, with three tranches (A,B and C) of committed bor-

rowings (the “1995 Credit Facility”). Under tranches A and

B, the Bank could borrow up to $1.3 billion and $200 mil-

lion, respectively, subject to an unused commitment fee of

.17%. Tranche B allowed the Bank to borrow in major

foreign currencies. Under Tranche C, the Company or the

Bank could borrow up to $215 million.

For the periods prior to the Separation, the Company

operated as a division of Signet Bank and, therefore, had

no direct, independent funding. For the financial state-

ments for these periods, the Company’s reported interest

expense was determined by taking into account the nature

of the Company’s assets and their interest rate repricing

characteristics and by using an allocation of Signet’s

funding cost for the respective period.

Although the Company expects to reinvest a substantial

portion of its earnings in its business, the Company

intends to continue to pay regular quarterly cash dividends

on the Common Stock. The declaration and payment of div-

idends, as well as the amount thereof, is subject to the dis-

cretion of the Board of Directors of the Company and will

depend upon the Company’s results of operations, financial

condition, cash requirements, future prospects and other

factors deemed relevant by the Board of Directors.

Accordingly, there can be no assurance that the Company

will declare and pay any dividends. As a holding company,

the ability of the Company to pay dividends is dependent

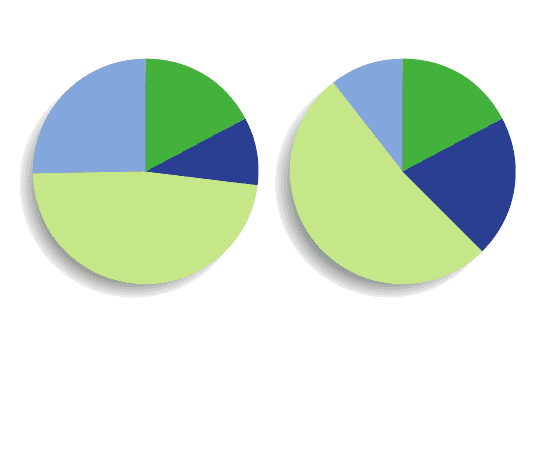

$415

$2,077

Interest-Bearing Liabilities

(in millions)

$3,998

December 31,1995

$5,468

December 31,1996

$810

$696

$1,378

$2,616

$531

$943

■ Interest-bearing Deposits

■ Short-term Borrowings

■ Senior Notes < 3 years

■ Senior Notes > 3 years