Capital One 1996 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 Capital One

Notes to Consolidated Financial Statements (continued)

(dollars in thousands, except per share data)

Note K Related Party Transactions

In the ordinary course of business, executive officers and

directors of the Company may have credit card loans issued

by the Company. Pursuant to the Company’s policy, such

loans are issued on the same terms as those prevailing at

the time for comparable loans with unrelated persons and

do not involve more than the normal risk of collectability.

Prior to November 22, 1994, and on a declining basis

thereafter, Signet and its various subsidiaries provided sig-

nificant financial and operational support to the Company,

the estimated costs of which have been allocated to the

Company. Since the Company operated as a division of

Signet Bank for all periods prior to November 22, 1994,

these allocations did not necessarily represent expenses

that would have been incurred directly by the Company

had it operated on a stand-alone basis historically. The

following table summarizes the effects of these allocations

(including interest expense) and servicing income related to

the retained credit card portfolio reflected in the financial

statements. Revenues and expenses generated in 1995 from

agreements with Signet through February 28, 1995 were

immaterial.

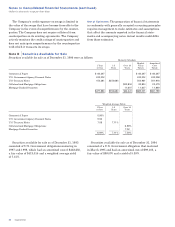

Year Ended

December 31

1994

Revenues:

Loan servicing income pertaining to

retained credit card portfolio $11,046

Expenses:

Interest expense on affiliate borrowings 67,161

Salaries and associate benefits 7,509

Data processing services 16,524

Contract termination 49,000

Other 6,303

Incremental expenses, other than interest expense, that

the Company would have incurred directly had it operated

on a stand-alone basis were estimated to be $6,000

(unaudited) for the year ended December 31, 1994.

Premises and equipment with a net book value of $21,800

were transferred from Signet on November 22, 1994.

Effective November 22, 1994, the Company entered into

a Separation Agreement, Interim Service Agreement and

long-term Intercompany Servicing Agreements, a Tax

Sharing Agreement and an Associate Benefits Agreement,

which provide for certain ongoing operational and financial

relationships between the Company and Signet that expire

in 1997.

card customers who were not residents of Virginia. These

cases were filed in the Superior Court of California in the

County of Alameda, Southern Division, on behalf of a class

of California residents, in the United States District Court

for the District of Connecticut on behalf of a nationwide

class and in the United States District Court for the Middle

District of Florida on behalf of a nationwide class (except

for California). The complaints in these three cases seek

unspecified statutory damages, compensatory damages,

punitive damages, restitution, attorneys’ fees and costs, a

permanent injunction and other equitable relief.

On July 31, 1996, the Florida case was dismissed with-

out prejudice, which permits further proceedings. The

plaintiff has since noticed her appeal to the United States

Court of Appeals for the Eleventh Circuit and refiled cer-

tain claims arising out of state law in Florida state court.

On September 30, 1996, the Connecticut court entered

judgement in favor of the Bank on plaintiff’s federal claims

and dismissed without prejudice plaintiff’s state law

claims. The plaintiff has refiled, on behalf of a class of

Connecticut residents, her claims arising out of state law in

a Connecticut state court.

Subsequent to year-end 1996, the California court

entered judgment in favor of the Bank on all of the plain-

tiff’s claims. The time period in which plaintiffs may file an

appeal of the court’s decision has not yet expired.

In connection with the transfer of substantially all of

Signet Bank’s credit card business to the Bank in

November 1994, the Company and the Bank agreed to

indemnify Signet Bank for certain liabilities incurred in lit-

igation arising from that business, which may include

liabilities, if any, incurred in the three purported class

action cases described above. Because no specific measure

of damages is demanded in any of the complaints and each

of these cases is in early stages of litigation, an informed

assessment of the ultimate outcome of these cases cannot

be made at this time. Management believes, however, that

there are meritorious defenses to these lawsuits and

intends to defend them vigorously.

The Company is commonly subject to various other

pending and threatened legal actions arising from the con-

duct of its normal business activities. In the opinion of the

Management of the Company, the ultimate aggregate lia-

bility, if any, arising out of any pending or threatened

action will not have a material adverse effect on the consol-

idated financial condition of the Company. At the present

time, however, Management is not in a position to deter-

mine whether the resolution of pending or threatened liti-

gation will have a material effect on the Company’s results

of operations in any future reporting period.