Capital One 1996 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Capital One

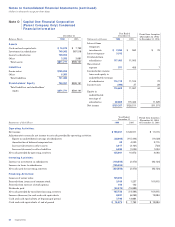

Notes to Consolidated Financial Statements

(dollars in thousands, except per share data)

Securities Available for Sale: Debt securities for which the

Company does not have the positive intent and ability to

hold to maturity are classified as securities available for

sale. These securities are stated at fair value, with the

unrealized gains and losses, net of tax, reported as a com-

ponent of retained earnings. The amortized cost of debt

securities is adjusted for amortization of premiums and

accretion of discounts to maturity. Such amortization is

included in other interest income.

Consumer Loans Held for Securitization: Consumer loans

held for securitization are loans management intends to

securitize, generally within three to six months, and are

carried at the lower of aggregate cost or market value.

Consumer Loans: Interest income is generally recognized

until a loan is charged off. Consumer loans are typically

charged off (net of any collateral) in the next billing cycle

after becoming 180 days past-due, although earlier charge-

offs may occur on accounts of bankrupt or deceased

customers. Bankrupt customers’ accounts are generally

charged off within 30 days of verification. The accrued

interest portion of a charged off loan balance is deducted

from current period interest income with the remaining

principal balance charged off against the allowance for loan

losses. Annual membership fees and direct loan origination

costs are deferred and amortized over one year on a

straight-line basis. Deferred fees (net of deferred costs)

were $58,059 and $33,438 as of December 31, 1996 and

1995, respectively.

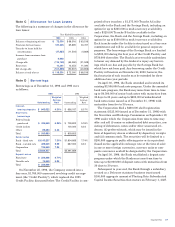

Allow ance for Loan Losses: The allowance for loan losses

is maintained at the amount estimated to be sufficient to

absorb possible future losses, net of recoveries (including

recovery of collateral), inherent in the existing on-balance

sheet loan portfolio. The provision for loan losses is the

periodic cost of maintaining an adequate allowance. In

evaluating the adequacy of the allowance for loan losses,

management takes into consideration several of the follow-

ing factors: historical charge-off and recovery activity (not-

ing any particular trend changes over recent periods);

trends in delinquencies; trends in loan volume and size of

credit risks; the degree of risk inherent in the composition

of the loan portfolio; current and anticipated economic

conditions; credit evaluations and underwriting policies.

Note A Significant Accounting Policies

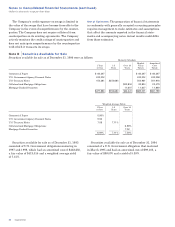

Organization and Basis of Presentation: The consolidated

financial statements include the accounts of Capital One

Financial Corporation (the “Corporation”) and its sub-

sidiaries. The Corporation is a holding company whose

subsidiaries provide a variety of products and services to

consumers. The principal subsidiaries are Capital One

Bank (the “Bank”) which offers credit card products and

Capital One, F.S.B. (the “Savings Bank”), which was estab-

lished in 1996, and provides certain consumer lending and

deposit services. The Corporation and its subsidiaries are

collectively referred to as the “Company.”

Prior to November 1994, the Company operated as the

credit card division of Signet Bank, a wholly owned sub-

sidiary of Signet Banking Corporation (“Signet”). On

November 22, 1994, Signet Bank contributed designated

assets and liabilities of its credit card division and approxi-

mately $358,000 of equity capital into the Bank (the

“Separation”).

The historic financial statements for the Company for

the periods prior to November 22, 1994 have been prepared

based upon the transfer of assets and assumption of liabili-

ties contemplated by an agreement entered into among the

Corporation, Signet and Signet Bank at the time of the

Separation (the “Separation Agreement”). Prior to the

Separation, the operations of the Company were conducted

as a division within Signet Bank, to which Signet and its

various subsidiaries had provided significant financial and

operational support. As of December 31, 1996, substantially

all services previously performed by Signet were performed

by the Company.

The following is a summary of the significant accounting

policies used in preparing the accompanying financial

statements.

Cash and Cash Equivalents: Cash and cash equivalents

includes cash and due from banks, federal funds sold and

interest-bearing deposits at other banks. Cash paid for

interest for the years ended December 31, 1996, 1995 and

1994, was $288,568, $184,729 and $84,431, respectively.

Cash paid for income taxes for the years ended

December 31, 1996, 1995 and 1994, was $107,065, $82,561

and $46,094, respectively.