Capital One 1996 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table 9 shows the maturation of certificates of deposit in

denominations of $100,000 or greater (large denomina-

tion CDs) as of December 31, 1996.

Table 9 M aturities of Domestic Large

Denomination Certificates —

$100,000 or M ore

As of December 31, 1996

(dollars in thousands) Balance Percent

3 months or less $155,961 40.80%

Over 3 through 6 months 27,293 7.14

Over 6 through 12 months 198,981 52.06

Total $382,235 100.00%

In addition to large denomination CDs, as of December

31, 1996, retail deposits of $560.8 million had been raised

through the Savings Bank as an additional source of

company funding.

During 1996, the Company continued its transition to

longer-term financing and established increased access to

the capital markets. As the chart on page 31 indicates,

during 1996 the Company increased its proportion of senior

note maturities in excess of three years. The Company

successfully completed a number of large transactions with

maturities ranging from two to ten years.

On November 25, 1996, the Company entered into a

four-year, $1.7 billion unsecured revolving credit arrange-

ment (the “Credit Facility”), which replaced the 1995

Credit Facility, discussed below. The Credit Facility is com-

prised of two tranches: a $1.375 billion Tranche A facility

available to the Bank and the Savings Bank, including an

option for up to $225 million in multi-currency availability,

and a $325 million Tranche B facility available to the

Corporation, the Bank and the Savings Bank, including an

option for up to $100 million in multi-currency availability.

Each Tranche under the facility is structured as a four-year

commitment and is available for general corporate purposes.

The borrowings of the Savings Bank are limited to $500

million during the first year of the Credit Facility, and $750

million thereafter. The Bank has irrevocably undertaken to

honor any demand by the lenders to repay any borrowings

which are due and payable by the Savings Bank but which

have not been paid. Any borrowing under the Credit

Facility will mature on November 24, 2000; however, the

final maturity of each tranche may be extended for three

additional one-year periods.

On April 30, 1996, the Bank amended and restated its

existing $3.5 billion bank note program. Under the amended

bank note program, the Bank may issue from time to time

up to $4.5 billion of senior bank notes with maturities from

30 days to 30 years and up to $200 million of subordinated

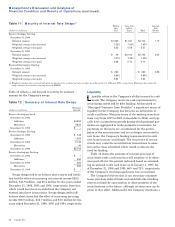

Table 8 Short-Term Borrow ings

Following is a summary of the components of short-term borrowings as of and for each of the years ended December 31,

1996, 1995 and 1994: Maximum

Outstanding at Outstanding Average Average Year-End

(dollars in thousands) Any Month-End at Year-End Outstanding Interest Rate Interest Rate

1996

Federal funds purchased $ 617,303 $ 445,600 $ 342,354 5.63% 6.26%

Other short-term borrowings 207,689 85,383 112,545 8.20 6.43

Total $ 530,983 $ 454,899 6.27% 6.29%

1995

Federal funds purchased $1,146,678 $ 709,803 $ 747,350 6.14% 5.76%

Bank facility 1,000,000 100,000 277,945 7.26 6.03

Affiliate borrowings 2,780 5.86

Total $ 809,803 $1,028,075 6.44% 5.79%

1994

Federal funds purchased $ 686,688 $ 686,688 $ 47,332 6.18% 6.29%

Bank facility 1,700,000 1,300,000 175,342 6.89 6.74

Affiliate borrowings 3,261,506 54,000 2,064,105 3.69 6.00

Total $2,040,688 $2,286,779 4.00% 6.57%

Funding

Table 8 reflects the costs of short-term borrowings of the

Company for each of the years ended December 31,

1996, 1995 and 1994.

Capital One

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (continued)

30