Capital One 1996 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

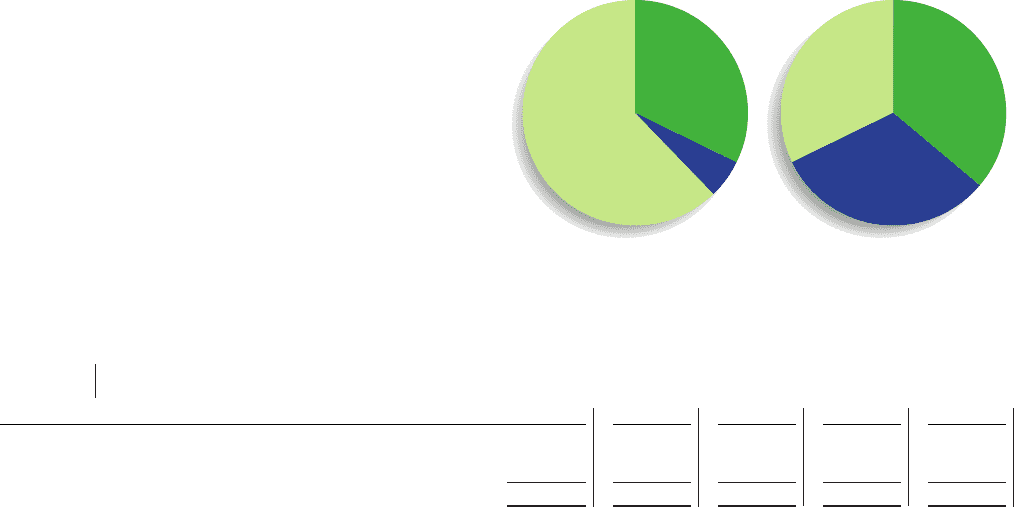

$407

$413

Liquid Assets

(in millions)

$1,285

December 31,1995

$1,394

December 31,1996

$465

$865

$79

$450

■ Federal Funds Sold

■ Cash and Interest-bearing Deposits

■ Securities Available for Sale

Table 13 Securitizations – Scheduled Amortization Table

(dollars in thousands) 1997 1998 1999 2000 2001-2004

Beginning balance, January 1 $8,460,067 $7,367,986 $4,656,588 $3,824,468 $1,830,764

Less repayment amounts 1,092,081 2,711,398 832,120 1,993,704 1,830,764

Ending balance, December 31 $7,367,986 $4,656,588 $3,824,468 $1,830,764 $ –

Capital One 35

portfolio of high-quality securities such as U.S.

Government securities, interest-bearing deposits with

other banks and overnight federal funds in order to provide

adequate liquidity and to meet its ongoing cash needs. As

of December 31, 1996, the Company had $1.0 billion of cash

and cash equivalents and securities available for sale with

maturities of 90 days or less.

Liability liquidity is measured by the Company’s ability

to obtain borrowed funds in the financial markets in ade-

quate amounts and at favorable rates. As of December 31,

1996, the Company, the Bank and the Savings Bank

collectively had $1.7 billion in unused commitments under

the credit facility available for liquidity needs.

Business Outlook

This business outlook section summarizes the

Company’s expectations for earnings for the year end-

ing December 31, 1997 and its primary goals and strategies

for continued growth. The statements contained in this

section are based on management’s current expectations.

Certain of the statements are forward looking statements

and, therefore, actual results could differ materially.

Factors which could materially influence results are set

forth in the last paragraph of this section and in the

Company’s Annual Report on Form 10-K for the year ended

December 31, 1996 (Part I, Item I, Cautionary Statements).

The Company has set a target that its earnings per

share for the year ending December 31, 1997 will increase

by approximately 20% over earnings per share for the year

ended December 31, 1996. As discussed above, the Company’s

actual earnings are a function of its revenues (interest

income and non-interest income on its earning assets), con-

sumer usage patterns, credit quality of its earning assets,

solicitation expenses and operating expenses. Each of these

in turn are subject to the factors discussed in this section.

The Company’s strategy for future growth has been, and

it is expected to continue to be, to apply its proprietary IBS

to its credit card business as well as to other businesses,

both financial and non-financial, to identify new product

opportunities and to make informed investment decisions

regarding its existing products. See the Company’s Annual

Report on Form 10-K for the year ended December 31, 1996

for a further description of the Company’s IBS (Part I, Item

1, Business).

Historically, the Company has concentrated its efforts on

credit card opportunities. These opportunities have included,

and are expected to continue to include, various first

generation low-rate balance transfer products, as well as

second generation credit card products. Generally, these

second generation products tend to have lower credit lines,

balances that build over time, less attrition, higher mar-

gins (including fees), higher operational costs and, in some

cases, higher delinquencies and credit losses than the

Company’s traditional low-rate balance transfer products.

In general, these second generation products have had

overall higher returns than the traditional balance transfer

products in recent market conditions. The Company uses

its IBS in an effort to balance the mix of credit card prod-

ucts to optimize profitability within the context of accept-

able risk. The Company continues to test market a wide

variety of first and second generation credit card products.

The Company believes that its testing approach will enable

it to react effectively as general market conditions change.

In this manner, the Company intends to remain flexible in

the allocation of marketing expenses spent on specific prod-

ucts to take advantage of market opportunities as they

emerge and will make its marketing decisions based on the

then current market conditions. As a result, the Company

expects to continue to offer a variety of first and second

generation credit card products; however, the mix of such

products in the Company’s portfolio may vary significantly

over time.