Capital One 1996 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

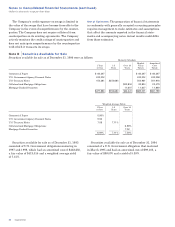

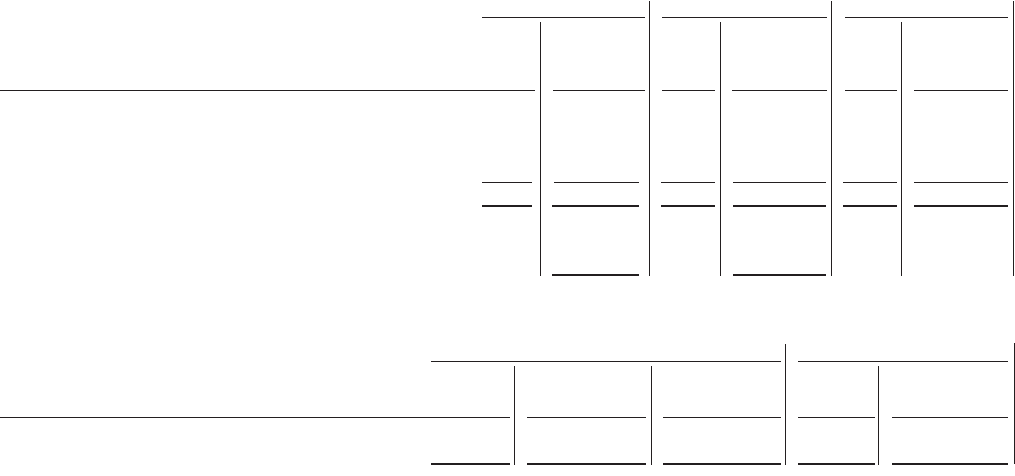

A summary of the status of the Company’s options as of December 31, 1996, 1995 and 1994, and changes for the years

then ended is presented below:

1996 1995 1994

Weighted- Weighted- Weighted-

Average Average Average

Options Exercise Price Options Exercise Price Options Exercise Price

(000s) Per Share (000s) Per Share (000s) Per Share

Outstanding - beginning of year 3,315 $19.67 2,036 $16.00

Granted 2,694 29.04 1,361 25.08 2,036 $16.00

Exercised (12) 16.40 (6) 16.00

Canceled (103) 21.82 (76) 18.25

Outstanding - end of year 5,894 $23.92 3,315 $19.67 2,036 $16.00

Exercisable - end of year 1,196 $18.98 454 $16.00

Weighted-average fair value of

options granted during the year $11.22 $ 8.19

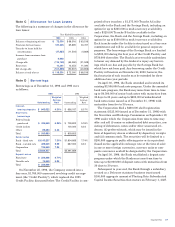

The following table summarizes information about options outstanding as of December 31, 1996:

Options Outstanding Options Exercisable

Number Weighted-Average Number

Outstanding Remaining Weighted-Average Exercisable Weighted-Average

Range of Exercise Prices (000s) Contractual Life Exercise Price (000s) Exercise Price

$16.00 - $24.99 2,463 8.0 years $16.75 950 $16.33

$25.00 - $33.99 3,431 8.7 29.07 246 29.18

Capital One 49

its President and Chief Operating Officer became effective.

This grant was for performance-based options to purchase

2,500,000 common shares at the September 15, 1995

market price of $29.19 per share. Options vest if the fair

market value of the common stock remains at or above the

following specified levels for at least ten trading days in

any 30 consecutive calendar day period: Fifty percent of the

options vest if the Company’s stock reaches $37.50 per

share, 25% vest if the stock reaches $43.75 per share and

the remaining 25% vest if the stock reaches $50.00 per

share. If these price levels are not achieved within five

years from the date of grant, the portion of the options not

previously vested will expire. The Company recognized

$7,728 of compensation cost for the year ended

December 31, 1996.

On April 26, 1995, the Company adopted the 1995 Non-

Associate Directors Stock Incentive Plan. This plan

authorizes a maximum of 500,000 shares of the Company’s

common stock for the automatic grant of restricted stock

and stock options to eligible members of the Company’s

Board of Directors. As of December 31, 1996 and 1995,

respectively, 417,500 and 452,500 shares were available for

grant under this plan. The options vest after one year and

their maximum term is 10 years. Restrictions on the

restricted stock (of which 12,500 shares were issued in

1995 at the then fair value of $19.88 per share) expire after

one year. The exercise price of each option equals the

market price of the Company’s stock on the date of grant.

For the purpose of pro forma disclosures above, the fair

value of the options was estimated at the date of grant

using a Black-Scholes option-pricing model with the follow-

ing weighted-average assumptions for 1996 and 1995,

respectively: dividend yield of 0.90%, volatility factors of

the expected market price of the Company’s common stock

of 32% and 33%, risk-free interest rates of 5.90% and 6.30%

and expected option lives of six and four years.

Under the 1994 Stock Incentive Plan, the Company has

reserved 7,370,880 common shares as of December 31, 1996

(5,370,880 as of December 31, 1995 and 1994) for issuance

in the form of incentive stock options, nonstatutory stock

options, stock appreciation rights, restricted stock and

incentive stock. The exercise price of each stock option

issued to date equals the market price of the Company’s

stock on the date of grant, and an option’s maximum term

is 10 years. The number of shares available for future

grants were 1,508,352, 2,061,640 and 3,334,473 as of

December 31, 1996, 1995 and 1994, respectively. Other

than the performance-based options discussed below,

options generally vest annually over three to five years and

expire beginning November 2004. The restrictions on

restricted stock (of which 23,215 shares were issued in

1995 at the then fair value of $16.75 per share) expire

annually over three years.

On April 18, 1996, stockholders approved an increase of

2,000,000 in shares available for issuance under the 1994

Stock Incentive Plan. With this approval, a September 15,

1995 grant to the Company’s Chief Executive Officer and