Capital One 1996 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital One

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

18

Introduction

Capital One Financial Corporation (the “Corporation”)

is a holding company whose subsidiaries provide a

variety of products and services to consumers. The princi-

pal subsidiaries are Capital One Bank (the “Bank”) which

offers credit card products and Capital One, F.S.B. (the

“Savings Bank”) which provides certain consumer lending

and deposit services. The Corporation and its subsidiaries

are collectively referred to as the “Company.” The Company

is one of the oldest continually operating bank card issuers

in the United States, having commenced operations in

1953, the same year as the formation of what is now

MasterCard International. As of December 31, 1996, the

Company had approximately 8.6 million customers and

$12.8 billion in managed loans outstanding and was one of

the largest providers of MasterCard and Visa credit cards

in the United States.

Prior to November 1994, the Company operated as the

credit card division of Signet Bank, a wholly owned sub-

sidiary of Signet Banking Corporation (“Signet”). On

November 22, 1994, Signet Bank contributed designated

assets and liabilities of its credit card division and approxi-

mately $358 million of equity capital into the Bank (the

“Separation”).

The historic financial statements for the Company for

the periods prior to November 22, 1994 have been prepared

based upon the transfer of assets and assumption of liabili-

ties contemplated by an agreement entered into among the

Corporation, Signet and Signet Bank at the time of the

Separation (the “Separation Agreement”). Prior to the

Separation, the operations of the Company were conducted

as a division within Signet Bank, to which Signet and its

various subsidiaries had provided significant financial and

operational support. As of December 31, 1996, substantially

all services previously performed by Signet were performed

by the Company.

The Company’s profitability is affected by the net inter-

est margin and non-interest income earned on earning

assets, consumer usage patterns, credit quality, the level of

solicitation (marketing) expenses and operating efficiency.

The Company’s revenues consist primarily of interest

income on consumer loans and securities, and non-interest

income consisting of servicing income and fees, which

include annual membership, interchange, cash advance,

overlimit, past-due and other fee income. The Company’s

primary expenses are the costs of funding assets, credit

losses, operating expenses (including salaries and associate

benefits), solicitation (marketing) expenses, processing

expenses and income taxes.

Significant marketing expenses (e.g., advertising, print-

ing, credit bureau costs and postage) to implement the

Company’s new product strategies are incurred and

expensed prior to the acquisition of new accounts while

the resulting revenues are recognized over the life of the

acquired accounts. Revenues recognized are a function of

the response rate of the initial marketing program, usage

and attrition patterns, credit quality of accounts, product

pricing and effectiveness of account management programs.

Certain pro forma information discussed within this

annual report present the Company as if it had been an

independently funded and operated stand-alone organization

for the full year in 1994. Pro forma income includes, for the

period prior to the Separation, interest income earned on a

hypothetical portfolio of high-quality liquid securities that

the Company would have purchased in order to provide ade-

quate liquidity and to meet its ongoing cash needs, interest

expense as if the Company were separately funded and cer-

tain operating costs as a public stand-alone entity rather

than as a division of a larger organization. These operating

expenses include the expenses associated with the owner-

ship of additional buildings transferred upon

consummation of the Separation and other additional

administrative expenses.

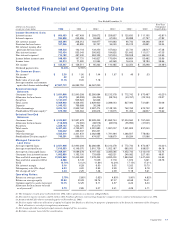

Earnings Summary

The following discussion provides a summary of 1996

results compared to 1995 results and 1995 results com-

pared to the 1994 historic results of the Company which,

prior to November 22, 1994, are as a division of Signet.

Each component is discussed in further detail in subse-

quent sections of this analysis.

Year Ended December 31, 1996 Compared to

Year Ended December 31, 1995

Net income of $155.3 million for the year ended

December 31, 1996 increased $28.8 million, or 23%,

over net income of $126.5 million in 1995. The increase in

net income is primarily a result of an increase in both asset

volumes and rates. Net interest income increased $157.5

million, or 76%, as average earning assets increased 23%

and the net interest margin increased to 7.62% from 5.35%.

The provision for loan losses increased $101.4 million, or

154%, as average reported consumer loans increased 24%

and the reported net charge-off rate increased to 3.63% in

1996 from 2.03% in 1995 as the average age of the accounts

increased (generally referred to as “seasoning”). Non-inter-

est income increased $210.4 million, or 38%, primarily due

to the increase in average managed consumer loans and a

shift to more fee intensive products. Increases in solicitation