Capital One 1996 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

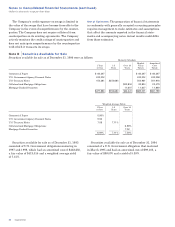

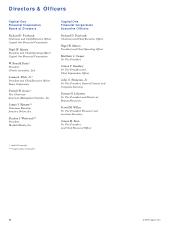

Note B Securities Available for Sale

Securities available for sale as of December 31, 1996 were as follows: Maturity Schedule

Market Amortized

1 Year 1-5 Over 10 Value Cost

or less Years Years Totals Totals

Commercial Paper $ 84,297 $ 84,297 $ 84,297

U.S. Government Agency Discount Notes 243,302 243,302 243,258

U.S. Treasury Notes 150,281 $354,680 504,961 501,916

Collateralized Mortgage Obligations $20,834 20,834 20,479

Mortgage Backed Securities 11,607 11,607 11,849

$477,880 $354,680 $32,441 $865,001 $861,799

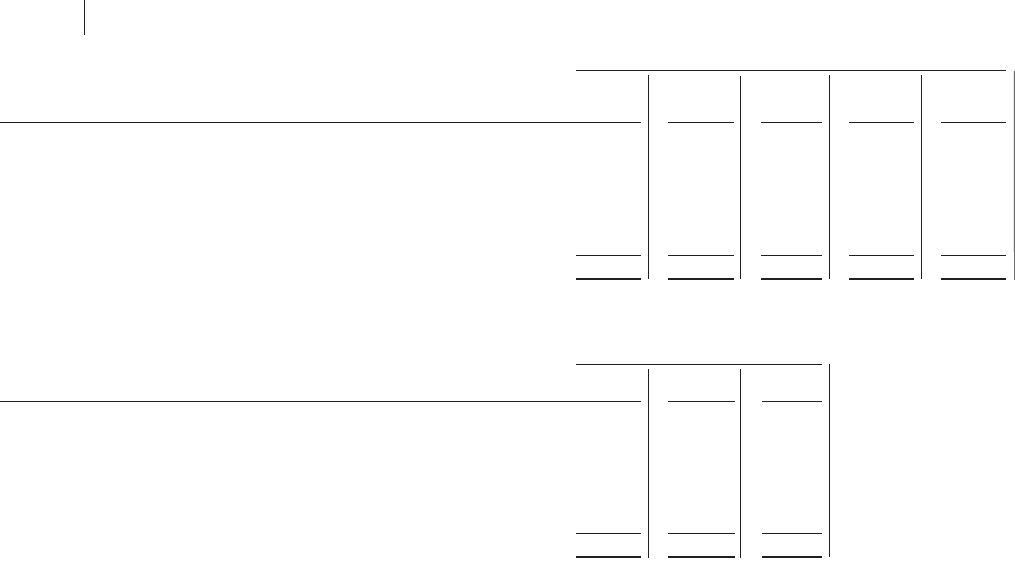

Weighted Average Yields

1 Year 1-5 Over 10

or less Years Years

Commercial Paper 5.90%

U.S. Government Agency Discount Notes 5.54

U.S. Treasury Notes 7.08 7.11%

Collateralized Mortgage Obligations 6.99%

Mortgage Backed Securities 7.02

6.09% 7.11% 7.00%

Securities available for sale as of December 31, 1995

consisted of U.S. Government obligations maturing in

1997 and 1998, which had an amortized cost of $402,250,

a fair value of $413,016 and a weighted average yield

of 7.15%.

46 Capital One

Notes to Consolidated Financial Statements (continued)

(dollars in thousands, except per share data)

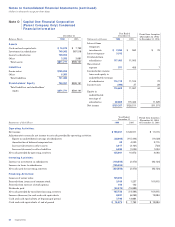

Use of Estimates: The preparation of financial statements

in conformity with generally accepted accounting principles

requires management to make estimates and assumptions

that affect the amounts reported in the financial state-

ments and accompanying notes. Actual results could differ

from those estimates.

The Company’s credit exposure on swaps is limited to

the value of the swaps that have become favorable to the

Company in the event of nonperformance by the counter-

parties. The Company does not require collateral from

counterparties on its existing agreements. The Company

actively monitors the credit ratings of counterparties and

does not anticipate nonperformance by the counterparties

with which it transacts its swaps.

Securities available for sale as of December 31, 1994

consisted of a U.S. Government obligation that matured

in March 1995 and had an amortized cost of $99,103, a

fair value of $99,070 and a yield of 5.39%.