Capital One 1996 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

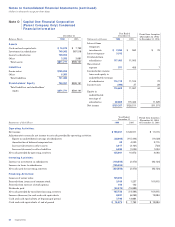

During 1996, the Bank received regulatory approval to

establish a branch office in the United Kingdom. In connec-

tion with such approval, the Company committed to the

Federal Reserve Board that, for so long as the Bank main-

tains such branch in the United Kingdom, the Company

will maintain a minimum Tier 1 Leverage ratio of 3.0%. As

of December 31, 1996, the Company’s Tier 1 Leverage ratio

was 11.13%.

Additionally, certain regulatory restrictions exist which

limit the ability of the Bank and the Savings Bank to

transfer funds to the Corporation. As of December 31, 1996,

retained earnings of the Bank and the Savings Bank of

$113,700 and $4,600, respectively, were available for pay-

ment of dividends to the Corporation, without prior

approval by the regulators. The Savings Bank is required

to give the Office of Thrift Supervision at least 30 days’

advance notice of any proposed dividend.

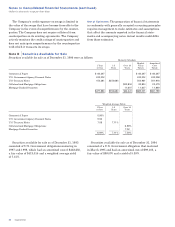

Note I Income Taxes

Deferred income taxes reflect the net tax effects of tempo-

rary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the

amounts used for income tax purposes. Significant compo-

nents of the Company’s deferred tax assets and liabilities

as of December 31, 1996 and 1995 were as follows:

December 31

1996 1995

Deferred tax assets:

Allowance for loan losses $41,475 $26,177

Stock incentive plan 2,758

Other 7,542 2,590

Total deferred tax assets 51,775 28,767

Deferred tax liabilities:

Service charge accrual 5,368

Deferred issuance & replacement costs 3,119 2,376

Depreciation 2,546 1,872

Unrealized gains on

securities available for sale 1,121 3,768

Finance charge accrual 9,794

Other 542 2,054

Total deferred tax liabilities 12,696 19,864

Net deferred tax assets $39,079 $ 8,903

Significant components of the provision for income taxes

attributable to continuing operations were as follows:

Year Ended December 31

1996 1995 1994

Federal taxes $119,027 $63,162 $51,942

State taxes 1,715 600

Deferred income taxes (27,529) 7,458 (378)

Income taxes $ 93,213 $71,220 $51,564

The reconciliation of income tax attributable to continu-

ing operations computed at the U.S. federal statutory tax

rates to income tax expense was:

Year Ended December 31

1996 1995 1994

Income tax at statutory

federal tax rate of 35% $86,968 $69,206 $51,389

State taxes, net of federal benefit 1,115 390

Other 5,130 1,624 175

Income taxes $93,213 $71,220 $51,564

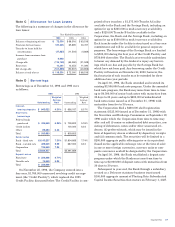

Note J Commitments and Contingencies

As of December 31, 1996, the Company had outstanding

lines of credit of approximately $26,800,000 committed to

its customers. Of that total commitment, approximately

$14,000,000 was unused. While this amount represented

the total available lines of credit to customers, the

Company had not experienced and does not anticipate that

all of its customers will exercise their entire available line

at any given point in time. The Company has the right to

increase, reduce, cancel, alter or amend the terms of these

available lines of credit at any time.

Certain premises and equipment are leased under

agreements that expire at various dates through 2006,

without taking into consideration available renewal

options. Many of these leases provide for payment by the

lessee of property taxes, insurance premiums, cost of main-

tenance and other costs. In some cases, rentals are subject

to increase in relation to a cost of living index. Total rental

expense amounted to $12,603, $5,394 and $3,700 for the

years ended December 31, 1996, 1995 and 1994, respectively.

Future minimum rental commitments as of

December 31, 1996 for all non-cancelable operating leases

with initial or remaining terms of one year or more are as

follows:

1997 $10,813

1998 10,603

1999 8,483

2000 6,800

2001 5,227

Thereafter 14,863

$56,789

During 1995, the Company and the Bank became

involved in three purported class action suits relating to

certain collection practices engaged in by Signet Bank and,

subsequently, by the Bank. The complaints in these three

cases allege that Signet Bank and/or the Company violated

a variety of federal and state statutes and constitutional

and common law duties by filing collection lawsuits,

obtaining judgments and pursuing garnishment proceed-

ings in the Virginia state courts against defaulted credit

Capital One 51