Capital One 1996 Annual Report Download

Download and view the complete annual report

Please find the complete 1996 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capturing

The Essence Of

Capital One

Financial Corporation

1996 Annual Report

Table of contents

-

Page 1

Financial Corporat ion 1 9 9 6 A nnual Report Capt uring The Essence Of Capit al One -

Page 2

...headquart ered in Falls Church, V irginia, is a f inancial services com pany w hose principal subsidiaries - Capit al One Bank and Capit al One, F.S.B.-of f er consum er lending product s and are am ong t he largest credit card issuers in t he U nit ed St at es. Capit al One' s subsidiaries collect... -

Page 3

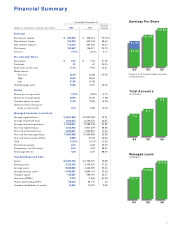

... er Loan D at a Average reported loans Average securitized loans Average total managed loans Year-end reported loans Year-end securitized loans Year-end total managed loans Year-end total accounts (000's) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate 6 .1 $ 3,651,908... -

Page 4

...m ark et ing invest m ent . a 40% gain and the highest rate of account growth of the 10 largest credit card issuers. Creating strong, steady, proï¬table growth is Capital One's top priority. By nearly every ï¬nancial yardstick, the Company is ï¬ve times larger than it was four years ago. At that... -

Page 5

...seven million customers in the last four years. Customization also enables us to offer our products at highly competitive rates while simultaneously generating favorable returns for Capital One. Grow t h Through Const ant Innovat ion We believe that every business or product idea has a limited shelf... -

Page 6

...-based strategy gives us the data and the tools to manage risk effectively. We use sophisticated models to analyze risk, and we base our decisions on highly conservative forecasts. To minimize total credit exposure, our average credit lines are well below the industry average ($3,100 versus... -

Page 7

... and one in the Dallas-Fort Worth area. A major expansion is also under way in Tampa. Additionally, we established Capital One, F.S.B. in Falls Church, Virginia and opened a branch of Capital One Bank in London. These new operations will allow us to develop new products, expand our customer base and... -

Page 8

... into action. We are proud of our associates for all they have done to help execute our unique strategy, create and market products that meet the needs of millions of customers, and serve those customers well. Our principles, and the company-wide commitment to them, are what have enabled Capital One... -

Page 9

...the Industrial Age gives way to the Information Age, management paradigms will inevitably be revolutionized. Capital One is an Information Age company built to leverage technology and knowledge capital for rapid exploitation of market opportunities. As competitors strive to emulate Capital One, they... -

Page 10

.... One that is extraordinarily data-rich, allowing the capture of information on every customer interaction and transaction. With this information, we can conduct scientiï¬c tests; build actuarially-based models of consumer behavior; and tailor products, pricing, credit lines and account management... -

Page 11

..., from strategy and marketing to operations management and human resources. Information technology allows extensive testing and the rapid rollout of innovation after innovation. And it has added signiï¬cant efï¬ciency to call center functions by equipping associates with power tools for account... -

Page 12

... programs, exposure to management, coaching, job rotation and early opportunities for unusually broad responsibility. We view our career development efforts as critical in building the competencies required by Capital One's information-based strategy. In 1996, we promoted 1,296 of our associates... -

Page 13

... spirit of ownership throughout the Company by making all associates eligible for our employee stock ownership program. Through that program, our 401(k) plan and stock options, 65% of our associates have become Capital One stockholders or have options to purchase Capital One stock. Ow ners M ake It... -

Page 14

...-minute information. Information technology systems and operational plans are built into new products from the beginning so that prototypes can be created quickly and testing and marketing can be scaled up as fast as results warrant. With our integrated systems and people, Capital One is endlessly... -

Page 15

... of existing opportunities, plan for the obsolescence of our products, and challenge the organization to ï¬nd new sources of growth. While our management of credit risk employs highly sophisticated statistical models, extensive testing and monitoring, and constant recalibration of models as markets... -

Page 16

..., the industry growth rate. And industry structures change over time, creating great vulnerabilities or opportunities. Most companies take industry as a given and manage within the industry's constraints. At Capital One, industry is a variable. We have pursued credit cards because the industry... -

Page 17

... opportunities for advancement foster teamwork by eliminating a principal source of friction in stagnant organizations-competition over limited possibilities for promotion. Growth enhances job security, and it's just plain fun. Two independent surveys have found that Capital One's associate morale... -

Page 18

... and A nalysis of Financial Condit ion and Result s of Operat ions 1 8 Select ed Quart erly Financial D at a 3 7 M anagem ent 's Report on Consolidat ed Financial St at em ent s and Int ernal Cont rols Over Financial Report ing 3 8 Report of Independent A udit ors 3 9 Consolidat ed Financial... -

Page 19

... equity(4) M anaged Consum er Loan D at a: Average reported loans Average securitized loans Average total managed loans Consumer loan interest income Year-end total managed loans Year-end total accounts (000's) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate(5) Operat ing... -

Page 20

...% in 1995 as the average age of the accounts increased (generally referred to as "seasoning"). Non-interest income increased $210.4 million, or 38%, primarily due to the increase in average managed consumer loans and a shift to more fee intensive products. Increases in solicitation 18 Capital One -

Page 21

....0 million) of $116.2 million, or 50%, reï¬,ect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in accounts. Average managed loans grew to $9.1 billion, or 47%, from $6.2 billion as a result of the success of the Company... -

Page 22

... credit enhancement fee and servicing fee and are available to absorb the investors' share of credit losses. Certiï¬cateholders in the Company's securitization program are generally entitled to receive principal payments either through monthly payments during an amortization period or in one lump... -

Page 23

... or downwards based on individual customer performance. Many of the Company's ï¬rst generation products had a balance transfer feature under which customers could transfer balances held in their other credit card accounts to the Company. The Company's historic managed loan growth Capital One 21 -

Page 24

... limit accounts which build balances over time. The terms of the second generation products tend to include annual membership fees and higher annual ï¬nance charge rates. The higher risk proï¬le of the customers targeted for the second generation products and the lower credit limit associated... -

Page 25

... for the year ended December 31, 1996 from 13.12% in 1995 principally reï¬,ected the 1996 repricing of introductory rate loans, changes in product mix and the increase in past-due fees charged on delinquent accounts as noted above. Additionally, the decrease in average rates paid on managed interest... -

Page 26

... and Rat es Year Ended December 31 1996 1995 Yield/ Rate Average Balance Income/ Expense Yield/ Rate Average Balance 1994 Income/ Expense Yield/ Rate Average Balance Income/ Expense (dollars in thousands) A sset s: Earning assets Consumer loans(1) Federal funds sold Other securities Total earning... -

Page 27

... the average number of accounts of 30% for the year ended December 31, 1996 from 1995, an increase in charge volume, a shift to more fee intensive second generation products and changes in the timing and amount of overlimit fees charged. Other reported non-interest income increased to $143.1 million... -

Page 28

... 41%, to $206.6 million in 1996 from $146.8 million in 1995. Solicitation expense represents the cost to select, print and mail the Company's product offerings to potential and existing customers utilizing its information-based strategy and account management techniques. This increase also reï¬,ects... -

Page 29

....9 million. The managed portfolio's delinquency rate as of December 31, 1996 principally reï¬,ected the continued seasoning of accounts and consumer loan balances, the increased presence of second generation products and general economic trends in consumer credit performance. M anaged N et Charge... -

Page 30

... result of the signiï¬cant growth in average balances (47%), the average age of accounts (51% of accounts, representing 50% of the total managed loan balance, were less than 18 months old), prudent solicitation and underwriting processes enhanced by the application of the information-based strategy... -

Page 31

... credit performance. Net charge-offs as a percentage of average reported consumer loans increased to 3.63% for the year ended December 31, 1996 from 2.03% in the prior year. Additionally, growth in second generation products which have modestly higher charge-off rates than ï¬rst generation products... -

Page 32

... an option for up to $100 million in multi-currency availability. Each Tranche under the facility is structured as a four-year commitment and is available for general corporate purposes. The borrowings of the Savings Bank are limited to $500 million during the ï¬rst year of the Credit Facility... -

Page 33

... 30 days to 30 years. As of December 31, 1996, the Company had $300 million in deposit notes outstanding. Subsequent to year-end, the Bank through a subsidiary created as a Delaware statutory business trust issued $100 million aggregate amount of Floating Rate Subordinated Capital Income Securities... -

Page 34

...Savings Bank to attain speciï¬c capital levels based upon quantitative measures of their assets, liabilities and off-balance sheet items as calculated under Regulatory Accounting Principles. The inability to meet and maintain minimum capital adequacy levels could result in regulators taking actions... -

Page 35

... Within 180 Days > 180 Days1 Year > 1 Year5 Years Over 5 Years (dollars in millions) Earning assets Federal funds sold Interest-bearing deposits at other banks Securities available for sale Consumer loans Total earning assets Interest-bearing liabilities Interest-bearing deposits Short-term... -

Page 36

... of investor principal of securitized credit card loans that will amortize or be otherwise paid off over the periods indicated based on outstanding securitized credit card loans as of January 1, 1997. As of December 31, 1996 and 1995, 66% and 72%, respectively, of the Company's total managed loans... -

Page 37

..., interest-bearing deposits with other banks and overnight federal funds in order to provide adequate liquidity and to meet its ongoing cash needs. As of December 31, 1996, the Company had $1.0 billion of cash and cash equivalents and securities available for sale with maturities of 90 days or less... -

Page 38

...to assist in the management and operations of new products and services; and other factors listed from time to time in the Company's SEC reports, including but not limited to the Annual Report on Form 10-K for the year ended December 31, 1996 (Part I, Item 1, Cautionary Statements). 36 Capital One -

Page 39

...is a tabulation of the Company's unaudited quarterly results of operations for the years ended December 31, 1996 and 1995. The Company's common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 14... -

Page 40

... an objective assessment of the degree to which the Company's Management meets its responsibility for ï¬nancial reporting. Their opinion on the ï¬nancial statements is based on auditing procedures which include reviewing accounting systems and internal controls and performing selected tests of... -

Page 41

... the accompanying consolidated balance sheets of Capital One Financial Corporation as of December 31, 1996 and 1995, and the related consolidated statements of income, changes in stockholders' equity, and cash ï¬,ows for each of the three years in the period ended December 31, 1996. These ï¬nancial... -

Page 42

Consolidat ed Balance Sheet s December 31 (dollars in thousands, except per share data) 1996 1995 A sset s: Cash and due from banks Federal funds sold Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans held for securitization Consumer ... -

Page 43

... Expense: Salaries and associate beneï¬ts Solicitation Communications and data processing Supplies and equipment Occupancy Contract termination Other Total non-interest expense Income before income taxes Income taxes Net income Earnings per share Dividends paid per share Weighted average common and... -

Page 44

... Initial public offering Restricted stock grants Amortization of deferred compensation Change in unrealized losses on securities available for sale, net of income taxes of $12 Balance, December 31, 1994 Net income Cash dividends - $.24 per share Issuance of common stock Exercise of stock options Tax... -

Page 45

...from exercise of stock options Net proceeds from issuance of common stock Dividends paid Capital contributed from Signet Net cash provided by ï¬nancing activities (Decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year... -

Page 46

... a variety of products and services to consumers. The principal subsidiaries are Capital One Bank (the "Bank") which offers credit card products and Capital One, F.S.B. (the "Savings Bank"), which was established in 1996, and provides certain consumer lending and deposit services. The Corporation... -

Page 47

... Accounting Standards ("SFAS") No. 77, "Reporting by Transferors for Transfers of Receivables with Recourse." Due to the relatively short average life of credit card loans securitized (approximately 8 to 12 months), no gains are recorded at the time of sale. Rather, excess servicing fees related... -

Page 48

... generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the ï¬nancial statements and accompanying notes. Actual results could differ from those estimates. N ot e B Securit ies Available f or Sale Maturity Schedule 1 Year... -

Page 49

...ii) preferred stock, which may be issued in the form of depository shares evidenced by depository receipts and (iii) common stock. The securities will be limited to a $200,000 aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale) in one or more... -

Page 50

... dates from 1996 through 2000, paid three-month LIBOR at a weighted average contractual rate of 5.69% and received a weighted average ï¬xed rate of 7.68%. In 1995, the Company entered into basis swaps (notional amounts totaling $260,000) to effectively convert bank notes, with a variable rate based... -

Page 51

... value of $19.88 per share) expire after one year. The exercise price of each option equals the market price of the Company's stock on the date of grant. A summary of the status of the Company's options as of December 31, 1996, 1995 and 1994, and changes for the years then ended is presented below... -

Page 52

...Savings Bank to attain speciï¬c capital levels based upon quantitative measures of their assets, liabilities and off-balance sheet items as calculated under Regulatory Accounting Principles. The inability to meet and maintain minimum capital adequacy levels could result in regulators taking actions... -

Page 53

... 31 1996 1995 Deferred tax assets: Allowance for loan losses Stock incentive plan Other Total deferred tax assets Deferred tax liabilities: Service charge accrual Deferred issuance & replacement costs Depreciation Unrealized gains on securities available for sale Finance charge accrual Other Total... -

Page 54

...dollars in thousands, except per share data) card customers who were not residents of Virginia. These cases were ï¬led in the Superior Court of California in the County of Alameda, Southern Division, on behalf of a class of California residents, in the United States District Court for the District... -

Page 55

... rate and estimates of future cash ï¬,ows. In that regard, the derived fair value estimates cannot be substantiated by comparison to independent markets and, in many cases, could not be realized in immediate settlement of the instrument. As required under generally accepted accounting principles... -

Page 56

... share data) N ot e O Capit al One Financial Corporat ion (Parent Com pany Only) Condensed Financial Inf orm at ion December 31 Year Ended December 31 Statements of Income 1996 1995 Period from Inception (November 22, 1994) to December 31, 1994 Balance Sheets 1996 1995 A sset s Cash and cash... -

Page 57

... M eet ing Thursday, April 24, 1997 10:00 AM Eastern Time Fairview Park Marriott Hotel 3111 Fairview Park Drive Falls Church, VA 22042 Com m on St ock Listed on New York Stock Exchange Stock Symbol COF Principal Financial Cont act Paul Paquin Vice President, Investor Relations Capital One Financial... -

Page 58

..., Jr.* President and Chief Executive Ofï¬cer Dome Corporation John G. Finneran, Jr. Sr. Vice President, General Counsel and Corporate Secretary Patrick W. Gross* Vice Chairman American Management Systems, Inc. Dennis H. Liberson Sr. Vice President and Director of Human Resources James V. Kimsey... -

Page 59

® 2 9 8 0 Fairv i ew Par k D r iv e Suit e 1 3 0 0 Falls Church, VA 2 2 0 4 2 -4 5 25