Berkshire Hathaway 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

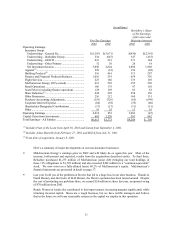

Our 2002 results were hurt by 1) a painful charge at General Re for losses that should have been

recorded as costs in earlier years, and 2) a “desirable” charge we incur annually for retroactive insurance (see

the next section for more about these items). These costs totaled $1.75 billion, or about 4.6% of float.

Fortunately, our overall underwriting experience on 2002 business was excellent, which allowed us, even

after the charges noted, to approach a no-cost result.

Absent a megacatastrophe, I expect our cost of float in 2003 to again be very low – perhaps even less

than zero. In the rundown of our insurance operations that follows, you will see why I’ m optimistic that, over

time, our underwriting results will both surpass those achieved by the industry and deliver us investable funds

at minimal cost.

Insurance Operations

If our insurance operations are to generate low-cost float over time, they must: (a) underwrite with

unwavering discipline; (b) reserve conservatively; and (c) avoid an aggregation of exposures that would allow

a supposedly “impossible” incident to threaten their solvency. All of our major insurance businesses, with

one exception, have regularly met those tests.

The exception is General Re, and there was much to do at that company last year to get it up to

snuff. I’ m delighted to report that under Joe Brandon’ s leadership, and with yeoman assistance by Tad

Montross, enormous progress has been made on each of the fronts described.

When I agreed in 1998 to merge Berkshire with Gen Re, I thought that company stuck to the three

rules I’ ve enumerated. I had studied the operation for decades and had observed underwriting discipline that

was consistent and reserving that was conservative. At merger time, I detected no slippage in Gen Re’ s

standards.

I was dead wrong. Gen Re’ s culture and practices had substantially changed and unbeknownst to

management – and to me – the company was grossly mispricing its current business. In addition, Gen Re had

accumulated an aggregation of risks that would have been fatal had, say, terrorists detonated several large-

scale nuclear bombs in an attack on the U.S. A disaster of that scope was highly improbable, of course, but it

is up to insurers to limit their risks in a manner that leaves their finances rock-solid if the “impossible”

happens. Indeed, had Gen Re remained independent, the World Trade Center attack alone would have

threatened the company’ s existence.

When the WTC disaster occurred, it exposed weaknesses in Gen Re’ s operations that I should have

detected earlier. But I was lucky: Joe and Tad were on hand, freshly endowed with increased authority and

eager to rapidly correct the errors of the past. They knew what to do – and they did it.

It takes time for insurance policies to run off, however, and 2002 was well along before we managed

to reduce our aggregation of nuclear, chemical and biological risk (NCB) to a tolerable level. That problem is

now behind us.

On another front, Gen Re’ s underwriting attitude has been dramatically altered: The entire

organization now understands that we wish to write only properly-priced business, whatever the effect on

volume. Joe and Tad judge themselves only by Gen Re’ s underwriting profitability. Size simply doesn’ t

count.

Finally, we are making every effort to get our reserving right. If we fail at that, we can’ t know our

true costs. And any insurer that has no idea what its costs are is heading for big trouble.