Berkshire Hathaway 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

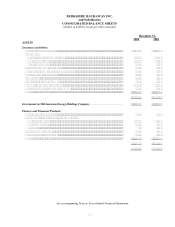

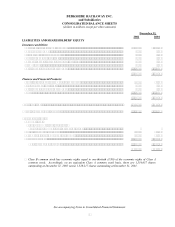

BERKSHIRE HATHAWAY INC.

and Subsidiaries

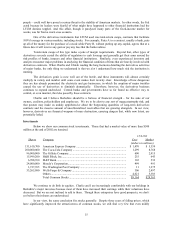

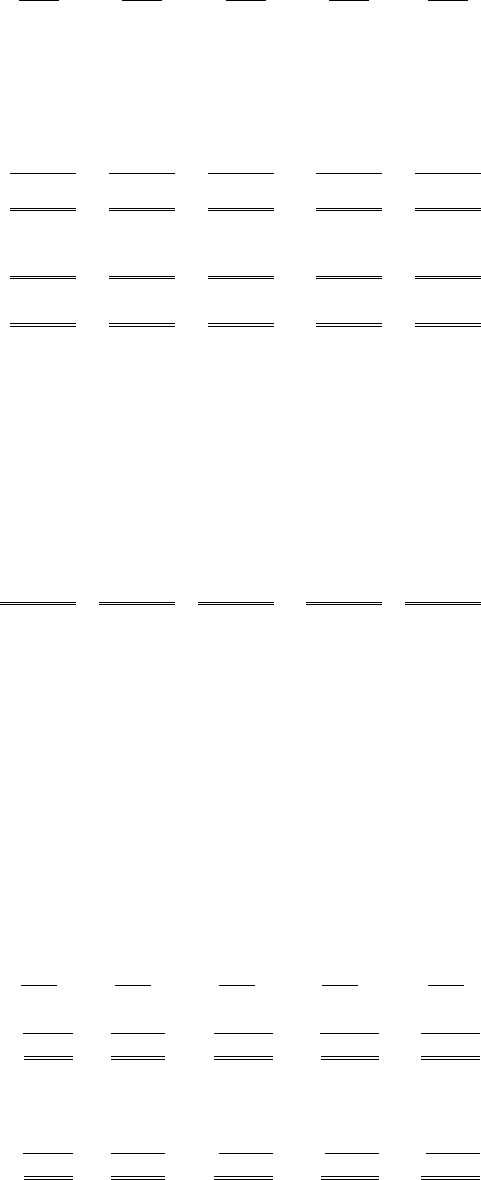

Selected Financial Data for the Past Five Years

(dollars in millions except per share data)

2002 2001 2000 1999 1998

Revenues:

Insurance premiums earned .......................................... $19,182 $17,905 $19,343 $14,306 $ 5,481

Sales and service revenues............................................ 17,347 14,902 7,361 5,918 4,675

Interest, dividend and other investment income ........... 3,061 2,815 2,725 2,314 1,049

Revenues of finance and financial products

businesses .................................................................. 2,126 1,658 1,505 987 394

Realized investment gains (1) ........................................ 637 1,363 3,955 1,365 2,415

Total revenues............................................................... $42,353 $38,643 $34,889 $24,890 $14,014

Earnings:

Net earnings (1) (3) (4)....................................................... $ 4,286 $ 795 $ 3,328 $ 1,557 $ 2,830

Net earnings per share (4) .............................................. $ 2,795 $ 521 $ 2,185 $ 1,025 $ 2,262

Year-end data: (2)

Total assets ................................................................... $169,544 $162,752 $135,792 $131,416 $122,237

Notes payable and other borrowings

of non-finance businesses .......................................... 4,807 3,485 2,663 2,465 2,385

Notes payable and other borrowings of

finance businesses ..................................................... 4,481 9,019 2,116 1,998 1,503

Shareholders’ equity ..................................................... 64,037 57,950 61,724 57,761 57,403

Class A equivalent common shares

outstanding, in thousands........................................... 1,535 1,528 1,526 1,521 1,519

Shareholders’ equity per outstanding

Class A equivalent common share............................. $ 41,727 $ 37,920 $ 40,442 $ 37,987 $ 37,801

(1) The amount of realized investment gains and losses for any given period has no predictive value, and variations in amount

from period to period have no practical analytical value, particularly in view of the unrealized appreciation now existing in

Berkshire's consolidated investment portfolio. After-tax realized investment gains were $383 million in 2002, $842 million

in 2001, $2,392 million in 2000, $886 million in 1999, and $1,553 million in 1998.

(2) Year-end data for 1998 includes General Re Corporation acquired by Berkshire on December 21, 1998.

(3) Net earnings for the year ending December 31, 2001 includes pre-tax underwriting losses of $2.4 billion in connection with

the September 11th terrorist attack. Such loss reduced net earnings by approximately $1.5 billion and earnings per share by

$982.

(4) Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (“SFAS”) No. 142 “Goodwill

and Other Intangible Assets.” SFAS No. 142 changed the accounting for goodwill from a model that required amortization

of goodwill, supplemented by impairment tests, to an accounting model that is based solely upon impairment tests.

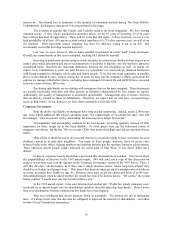

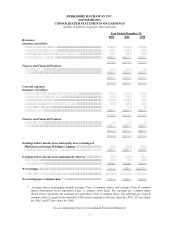

A reconciliation of Berkshire’s Consolidated Statements of Earnings for each of the five years ending December 31, 2002 from

amounts reported to amounts exclusive of goodwill amortization is shown below. Goodwill amortization for the years ending

December 31, 2001 and 2000 includes $78 million and $65 million, respectively, related to Berkshire’s equity method investment

in MidAmerican Energy Holdings Company.

2002 2001 2000 1999 1998

Net earnings as reported........................................................... $4,286 $ 795 $ 3,328 $ 1,557 $ 2,830

Goodwill amortization, after tax ............................................... — 636 548 476 111

Net earnings as adjusted ........................................................... $4,286 $ 1,431 $ 3,876 $ 2,033 $ 2,941

Earnings per Class A equivalent common share:

As reported................................................................................ $2,795 $ 521 $ 2,185 $ 1,025 $ 2,262

Goodwill amortization............................................................... — 416 360 313 88

Earnings per share as adjusted................................................. $2,795 $ 937 $ 2,545 $ 1,338 $ 2,350