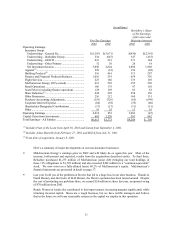

Berkshire Hathaway 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

It’ s almost impossible, for example, in a boardroom populated by well-mannered people, to raise the

question of whether the CEO should be replaced. It’ s equally awkward to question a proposed acquisition

that has been endorsed by the CEO, particularly when his inside staff and outside advisors are present and

unanimously support his decision. (They wouldn’ t be in the room if they didn’ t.) Finally, when the

compensation committee – armed, as always, with support from a high-paid consultant – reports on a

megagrant of options to the CEO, it would be like belching at the dinner table for a director to suggest that the

committee reconsider.

These “social” difficulties argue for outside directors regularly meeting without the CEO – a reform

that is being instituted and that I enthusiastically endorse. I doubt, however, that most of the other new

governance rules and recommendations will provide benefits commensurate with the monetary and other

costs they impose.

The current cry is for “independent” directors. It is certainly true that it is desirable to have directors

who think and speak independently – but they must also be business-savvy, interested and shareholder-

oriented. In my 1993 commentary, those are the three qualities I described as essential.

Over a span of 40 years, I have been on 19 public-company boards (excluding Berkshire’ s) and have

interacted with perhaps 250 directors. Most of them were “independent” as defined by today’ s rules. But the

great majority of these directors lacked at least one of the three qualities I value. As a result, their

contribution to shareholder well-being was minimal at best and, too often, negative. These people, decent and

intelligent though they were, simply did not know enough about business and/or care enough about

shareholders to question foolish acquisitions or egregious compensation. My own behavior, I must ruefully

add, frequently fell short as well: Too often I was silent when management made proposals that I judged to be

counter to the interests of shareholders. In those cases, collegiality trumped independence.

So that we may further see the failings of “independence,” let’ s look at a 62-year case study covering

thousands of companies. Since 1940, federal law has mandated that a large proportion of the directors of

investment companies (most of these mutual funds) be independent. The requirement was originally 40% and

now it is 50%. In any case, the typical fund has long operated with a majority of directors who qualify as

independent.

These directors and the entire board have many perfunctory duties, but in actuality have only two

important responsibilities: obtaining the best possible investment manager and negotiating with that manager

for the lowest possible fee. When you are seeking investment help yourself, those two goals are the only ones

that count, and directors acting for other investors should have exactly the same priorities. Yet when it comes

to independent directors pursuing either goal, their record has been absolutely pathetic.

Many thousands of investment-company boards meet annually to carry out the vital job of selecting

who will manage the savings of the millions of owners they represent. Year after year the directors of Fund

A select manager A, Fund B directors select manager B, etc. … in a zombie-like process that makes a

mockery of stewardship. Very occasionally, a board will revolt. But for the most part, a monkey will type

out a Shakespeare play before an “independent” mutual-fund director will suggest that his fund look at other

managers, even if the incumbent manager has persistently delivered substandard performance. When they are

handling their own money, of course, directors will look to alternative advisors – but it never enters their

minds to do so when they are acting as fiduciaries for others.

The hypocrisy permeating the system is vividly exposed when a fund management company – call it

“A” – is sold for a huge sum to Manager “B”. Now the “independent” directors experience a “counter-

revelation” and decide that Manager B is the best that can be found – even though B was available (and

ignored) in previous years. Not so incidentally, B also could formerly have been hired at a far lower rate than

is possible now that it has bought Manager A. That’ s because B has laid out a fortune to acquire A, and B

must now recoup that cost through fees paid by the A shareholders who were “delivered” as part of the deal.

(For a terrific discussion of the mutual fund business, read John Bogle’ s Common Sense on Mutual Funds.)

A few years ago, my daughter was asked to become a director of a family of funds managed by a

major institution. The fees she would have received as a director were very substantial, enough to have

increased her annual income by about 50% (a boost, she will tell you, she could use!). Legally, she would

have been an independent director. But did the fund manager who approached her think there was any

chance that she would think independently as to what advisor the fund should employ? Of course not. I am