Berkshire Hathaway 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Notes to Consolidated Financial Statements (Continued)

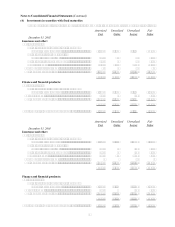

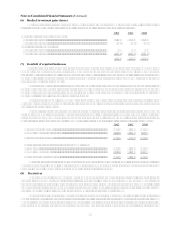

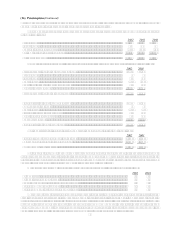

(6) Realized investment gains (losses)

Realized gains (losses) from sales and redemptions of investments are summarized below (in millions). Realized

losses include impairment charges of $574 million and $247 million in 2002 and 2001, respectively.

2002 2001 2000

Equity securities and other investments

Gross realized gains...................................................................................... $ 787 $1,522 $4,467

Gross realized losses..................................................................................... (583) (369) (317)

Securities with fixed maturities

Gross realized gains...................................................................................... 688 411 153

Gross realized losses..................................................................................... (255) (201) (348)

$ 637 $1,363 $3,955

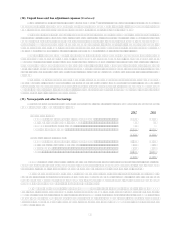

(7) Goodwill of acquired businesses

Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (SFAS) No. 142

Goodwill and Other Intangible Assets. SFAS No. 142 changed the accounting for goodwill from a model that

required amortization of goodwill, supplemented by impairment tests, to an accounting model that is based solely upon

impairment tests. Thus, Berkshires Consolidated Statement of Earnings for the year ended December 31, 2002 includes

no periodic amortization of goodwill.

Berkshire completed its initial assessment of goodwill during the second quarter of 2002 and no transitional

impairment charges were required. In addition, goodwill was reviewed during the fourth quarter of 2002 and no

impairment charges were required. Subsequently, goodwill must be reviewed for impairment at least annually, and

impairments, if any, will be charged to operating earnings.

The increase in goodwill from December 31, 2001 to December 31, 2002 reflects Berkshires acquisitions that

were completed during 2002. Substantially all of the $788 million increase is attributable to the several business

acquisitions described in Note 2.

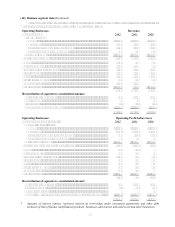

A reconciliation of Berkshires Consolidated Statements of Earnings for each of the three years ended December

31, 2002 from amounts reported to amounts exclusive of goodwill amortization is shown below. Goodwill amortization

for the years ended December 31, 2001 and 2000 includes $78 million, and $65 million, respectively, related to

Berkshires equity method investment in MidAmerican. Dollar amounts are in millions, except per share amounts.

2002 2001 2000

Net earnings as reported............................................................................ $4,286 $ 795 $3,328

Goodwill amortization, after tax................................................................ ─ 636 548

Net earnings as adjusted............................................................................ $4,286 $1,431 $3,876

Earnings per equivalent share of Class A common stock:

As reported ................................................................................................ $2,795 $ 521 $2,185

Goodwill amortization............................................................................... ─ 416 360

Earnings per share as adjusted................................................................... $2,795 $ 937 $2,545

During the fourth quarter of 2000, Berkshire concluded that an impairment of goodwill existed with respect to the

Dexter Shoe business. Goodwill amortization shown in the accompanying Consolidated Statement of Earnings for 2000

includes a goodwill impairment charge of $219 million related to this business.

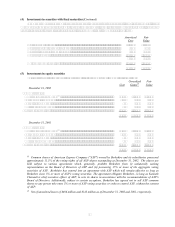

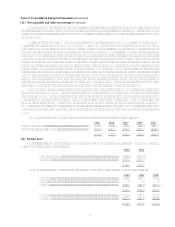

(8) Derivatives

General Re Securities (GRS), a wholly owned subsidiary of Berkshire, regularly utilizes derivatives in

providing risk management products to clients. In January 2002, it was announced that GRS would commence a long-

term run-off of its operations. The run-off is expected to occur over a number of years during which GRS will limit its

new business to certain risk management transactions and will unwind its existing asset and liability positions in an

orderly manner. Additional information regarding GRSs derivative instruments follows.

The derivative financial instruments involve, to varying degrees, elements of market, credit, and liquidity risks.

GRS controls market risk exposures by taking offsetting positions in either cash instruments or other derivatives. GRS

manages its exposures on a portfolio basis and monitors its market risk on a daily basis across all products by calculating

the effect on operating results of potential changes in market variables, which include volatility, correlation and