Berkshire Hathaway 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

(8) Derivatives (Continued)

liquidity over a one week period. GRS has established $15 million as its value at risk limit with a 99th percentile

confidence interval for potential losses over a weekly horizon.

GRS evaluates and records a fair value adjustment against trading revenue to recognize counterparty credit

exposure and future costs associated with administering each contract. The fair value adjustment for counterparty credit

exposures and future administrative costs on existing contracts was $95 million at December 31, 2002. Counterparty

credit limits are established, and credit exposures are monitored in accordance with these limits. GRS receives cash and/or

investment grade securities from certain counterparties as collateral and, where appropriate, may purchase credit

insurance or enter into other transactions to mitigate its credit exposure. GRS also incorporates into contracts with certain

counterparties provisions which allow the unwinding of these transactions in the event of a downgrade in credit rating or

other indications of decline in creditworthiness of the counterparty.

At December 31, 2002, GRS had accepted collateral that is permitted by contract or industry practice to sell or

repledge with a fair value of $1,884 million. Of the securities held as collateral, approximately $83 million were

repledged as of December 31, 2002. At December 31, 2002, securities owned by GRS with a fair value of approximately

$421 million (which includes $83 million of repledged securities as described above) were pledged against derivative

transactions with a fair value of $753 million. Further, securities with a fair value of approximately $75 million were

pledged against futures positions at two futures clearing brokers. Contractual terms with counterparties often require

additional collateral to be posted immediately in the event of a decline in the financial rating of the counterparty or its

guarantor.

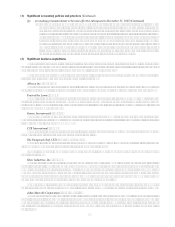

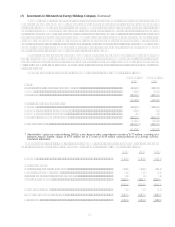

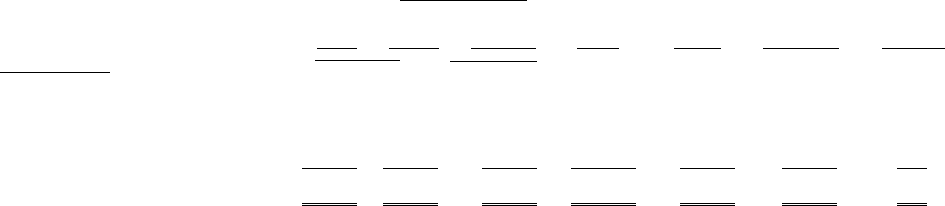

Assuming non-performance by all counterparties on all contracts potentially subject to a loss, the maximum

potential loss, based on the cost of replacement, net of collateral held, at market rates prevailing at December 31, 2002

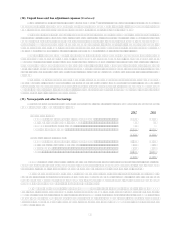

approximated $4,933 million. The following table presents GRSs derivatives portfolio by counterparty credit quality and

maturity at December 31, 2002. The amounts shown under gross exposure in the table are before consideration of netting

arrangements and collateral held by GRS. Net fair value shown in the table represents unrealized gains on financial

instrument contracts in gain positions, net of any unrealized loss owed to these counterparties on offsetting positions. Net

exposure shown in the table that follows is net fair value less collateral held by GRS. Amounts are in millions.

Gross Exposure

Net Fair Net Percentage

0 5 6 10 Over 10 Total Value Exposure of Total

Credit quality (years)

AAA ....................................... $1,201 $1,026 $1,072 $ 3,299 $ 917 $ 917 19%

AA.......................................... 3,749 3,514 3,734 10,997 3,124 2,437 49

A............................................. 3,649 2,999 3,787 10,435 2,106 1,303 26

BBB and Below...................... 489 364 105 958 435 276 6

Total $9,088 $7,903 $8,698 $25,689 $6,582 $4,933 100%

Liquidity risk can arise from funding of GRSs portfolio of open transactions. Movements in underlying market

variables affect both future cash flows related to the transactions and collateral required to cover the value of open

positions. Strategies have been developed to ensure GRS has sufficient resources to cover its potential liquidity needs

through its access to General Re Corporations (the parent company of GRS) internal sources of liquidity, commercial

paper program, lines of credit and medium-term program.

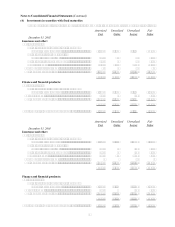

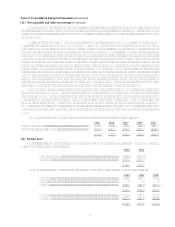

(9) Investment in Value Capital

On July 1, 1998, Value Capital L.P., (Value Capital) a limited partnership commenced operations. A wholly

owned Berkshire subsidiary is a limited partner in Value Capital. The partnerships objective is to achieve income and

capital growth from investments and arbitrage in fixed income investments. Berkshire currently accounts for this

investment pursuant to the equity method. Since inception Berkshire has contributed $430 million to the partnership and

other partners, including the general partner, have contributed $20 million. Profits and losses of the partnership are

allocated to the partners based upon each partners investment. At December 31, 2002, the carrying value of $603

million (including Berkshires share of accumulated earnings of $173 million) is included as a component of other assets

of finance and financial products businesses. Berkshire possesses no management authority over the activities

conducted by Value Capital and it does not provide any financial support of the obligations of this partnership or of the

other partners. As a limited partner, Berkshires exposure to loss is limited to the carrying value of its investment.