Berkshire Hathaway 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

Both companies came with outstanding CEOs: Steve McKenzie at Albecca and John Holland at

Fruit. John, who had retired from Fruit in 1996, rejoined it three years ago and rescued the company from

the disastrous path it had gone down after he’ d left. He’ s now 70, and I am trying to convince him to make

his next retirement coincident with mine (presently scheduled for five years after my death – a date subject,

however, to extension).

We initiated and completed two other acquisitions last year that were somewhat below our normal

size threshold. In aggregate, however, these businesses earn more than $60 million pre-tax annually. Both

operate in industries characterized by tough economics, but both also have important competitive strengths

that enable them to earn decent returns on capital.

The newcomers are:

(a) CTB, a worldwide leader in equipment for the poultry, hog, egg production and grain

industries; and

(b) Garan, a manufacturer of children’ s apparel, whose largest and best-known line is

Garanimals®.

These two companies came with the managers responsible for their impressive records: Vic

Mancinelli at CTB and Seymour Lichtenstein at Garan.

The largest acquisition we initiated in 2002 was The Pampered Chef, a company with a fascinating

history dating back to 1980. Doris Christopher was then a 34-year-old suburban Chicago home economics

teacher with a husband, two little girls, and absolutely no business background. Wanting, however, to

supplement her family’ s modest income, she turned to thinking about what she knew best – food

preparation. Why not, she wondered, make a business out of marketing kitchenware, focusing on the items

she herself had found most useful?

To get started, Doris borrowed $3,000 against her life insurance policy – all the money ever

injected into the company – and went to the Merchandise Mart on a buying expedition. There, she picked

up a dozen each of this and that, and then went home to set up operations in her basement.

Her plan was to conduct in-home presentations to small groups of women, gathered at the homes

of their friends. While driving to her first presentation, though, Doris almost talked herself into returning

home, convinced she was doomed to fail.

But the women she faced that evening loved her and her products, purchased $175 of goods, and

TPC was underway. Working with her husband, Jay, Doris did $50,000 of business in the first year.

Today – only 22 years later – TPC does more than $700 million of business annually, working through

67,000 kitchen consultants.

I’ ve been to a TPC party, and it’ s easy to see why the business is a success. The company’ s

products, in large part proprietary, are well-styled and highly useful, and the consultants are knowledgeable

and enthusiastic. Everyone has a good time. Hurry to pamperedchef.com on the Internet to find where to

attend a party near you.

Two years ago, Doris brought in Sheila O’ Connell Cooper, now CEO, to share the management

load, and in August they met with me in Omaha. It took me about ten seconds to decide that these were

two managers with whom I wished to partner, and we promptly made a deal. Berkshire shareholders

couldn’ t be luckier than to be associated with Doris and Sheila.

* * * * * * * * * * * *

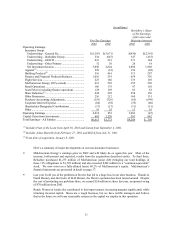

Berkshire also made some important acquisitions last year through MidAmerican Energy Holdings

(MEHC), a company in which our equity interest is 80.2%. Because the Public Utility Holding Company

Act (PUHCA) limits us to 9.9% voting control, however, we are unable to fully consolidate MEHC’ s

financial statements.

Despite the voting-control limitation – and the somewhat strange capital structure at MEHC it has

engendered – the company is a key part of Berkshire. Already it has $18 billion of assets and delivers our

largest stream of non-insurance earnings. It could well grow to be huge.