Berkshire Hathaway 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

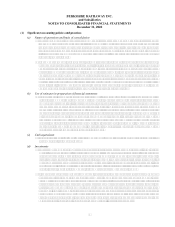

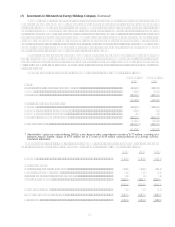

Notes to Consolidated Financial Statements (Continued)

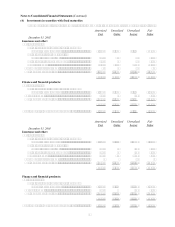

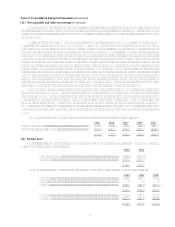

(4) Investments in securities with fixed maturities

Investments in securities with fixed maturities as of December 31, 2002 and 2001 are shown below (in millions).

Amortized Unrealized Unrealized Fair

Cost Gains Losses Value

December 31, 2002

Insurance and other:

Available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies.......................................... $ 9,091 $ 966 $ $10,057

Obligations of states, municipalities

and political subdivisions........................................... 6,346 280 (1) 6,625

Obligations of foreign governments................................ 3,813 92 (2) 3,903

Corporate bonds .............................................................. 10,007 1,031 (114) 10,924

Redeemable preferred stocks .............................................. 113 10 (4) 119

Mortgage-backed securities ................................................ 6,155 321 (8) 6,468

$35,525 $2,700 $ (129) $38,096

Finance and financial products:

Available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies.......................................... $ 3,543 $ 331 $ $ 3,874

Corporate bonds .................................................................. 1,261 40 (10) 1,291

Mortgage-backed securities ................................................ 10,202 299 10,501

$15,006 $ 670 $ (10) $15,666

Held-to-maturity, mortgage-backed securities....................... $ 1,019 $ 178 $ $ 1,197

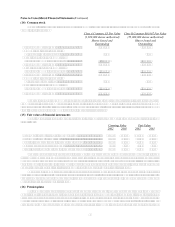

Amortized Unrealized Unrealized Fair

Cost Gains Losses Value

December 31, 2001

Insurance and other:

Available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies.......................................... $ 8,969 $ 62 $ (212) $ 8,819

Obligations of states, municipalities

and political subdivisions........................................... 7,390 98 (43) 7,445

Obligations of foreign governments................................ 2,460 55 (15) 2,500

Corporate bonds .............................................................. 5,802 427 (498) 5,731

Redeemable preferred stocks .............................................. 93 1 (4) 90

Mortgage-backed securities ................................................ 11,379 257 (2) 11,634

$36,093 $ 900 $ (774) $36,219

Finance and financial products:

Available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies.......................................... $ 2,944 $ $ (47) $ 2,897

Corporate bonds .................................................................. 1,169 (26) 1,143

Mortgage-backed securities ................................................ 17,364 33 (24) 17,373

$21,477 $ 33 $ (97) $21,413

Held-to-maturity, mortgage-backed securities....................... $ 1,461 $ 92 $ (17) $ 1,536