Berkshire Hathaway 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

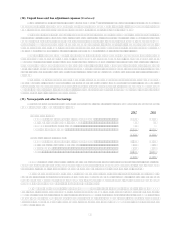

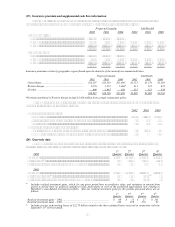

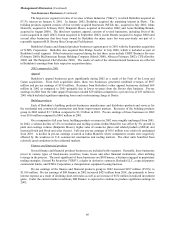

(19) Insurance premium and supplemental cash flow information

Premiums written and earned by Berkshires property/casualty and life/health insurance businesses during

each of the three years ending December 31, 2002 are summarized below. Dollars are in millions.

Property/Casualty Life/Health

2002 2001 2000 2002 2001 2000

Premiums Written:

Direct................................................................. $ 9,457 $ 8,294 $ 6,858

Assumed............................................................ 10,471 9,332 11,270 $2,031 $2,162 $2,520

Ceded ................................................................ (961) (890) (729) (132) (157) (257)

$18,967 $16,736 $17,399 $1,899 $2,005 $2,263

Premiums Earned:

Direct................................................................. $ 8,825 $ 7,654 $ 6,666

Assumed............................................................ 9,293 9,097 11,036 $2,021 $2,143 $2,513

Ceded ................................................................ (822) (834) (620) (135) (155) (252)

$17,296 $15,917 $17,082 $1,886 $1,988 $2,261

Insurance premiums written by geographic region (based upon the domicile of the insured) are summarized below.

Property/Casualty Life/Health

2002 2001 2000 2002 2001 2000

United States ................................................................ $14,297 $13,319 $11,409 $1,153 $1,176 $1,296

Western Europe............................................................ 3,870 2,352 5,064* 411 518 633

All other ....................................................................... 800 1,065 926 335 311 334

$18,967 $16,736 $17,399 $1,899 $2,005 $2,263

*Premiums attributed to Western Europe include $2,438 million from a single reinsurance policy.

A summary of supplemental cash flow information for each of the three years ending December 31, 2002 is

presented in the following table (in millions).

2002 2001 2000

Cash paid during the year for:

Income taxes............................................................................................................... $1,945 $ 905 $1,396

Interest of finance and financial products businesses................................................. 508 722 794

Other interest.............................................................................................................. 208 225 157

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses ............................ 700 3,507 901

Common shares issued in connection with acquisitions of businesses....................... 324 224

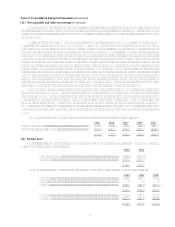

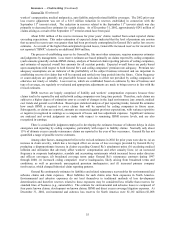

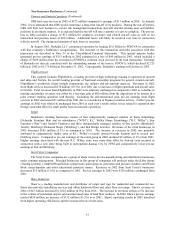

(20) Quarterly data

A summary of revenues and earnings by quarter for each of the last two years is presented in the following

table. This information is unaudited. Dollars are in millions, except per share amounts.

1

st

2

nd

3

rd

4

th

2002 Quarter Quarter Quarter Quarter

Revenues ................................................................................................. $9,521 $10,051 $10,637 $12,144

Net earnings (1)......................................................................................... 916 1,045 1,141 1,184

Net earnings per equivalent Class A common share ............................... 598 681 744 772

2001

Revenues ................................................................................................. $8,304 $10,886 $ 9,554 $ 9,899

Net earnings (loss) (1) ............................................................................... 606 773 (679)(2) 95

Net earnings (loss) per equivalent Class A common share...................... 397 506 (445) 63

(1) Includes realized investment gains, which, for any given period have no predictive value, and variations in amount from

period to period have no practical analytical value, particularly in view of the unrealized appreciation now existing in

Berkshire’s consolidated investment portfolio. After-tax realized investment gains for the periods presented above are as

follows:

1

s

t

2

nd

3

rd

4

th

Quarter Quarter Quarter Quarter

Realized investment gains

–

2002

.......................................................................

$98

$13

$27

$ 245

Realized investment gains

–

2001

.......................................................................

144

420

216

62

(2) Includes pre-tax underwriting losses of $2.275 billion related to the then estimated losses incurred in connection with the

September 11th terrorist attack.