Berkshire Hathaway 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

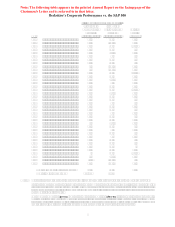

11

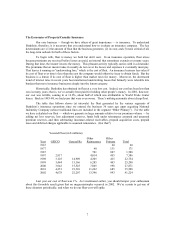

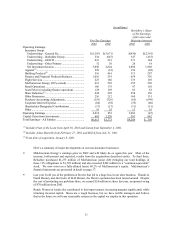

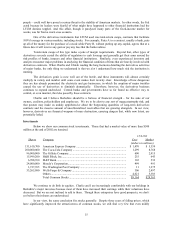

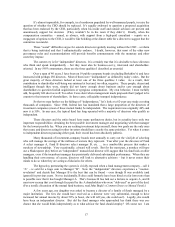

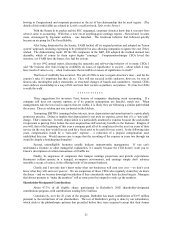

(in millions) Berkshire’s Share

of Net Earnings

(after taxes and

Pre-Tax Earnings Minority interests)

2002 2001 2002 2001

Operating Earnings:

Insurance Group:

Underwriting – General Re.................................... $(1,393) $(3,671) $(930) $(2,391)

Underwriting – Berkshire Group ........................... 534 (647) 347 (433)

Underwriting – GEICO.......................................... 416 221 271 144

Underwriting – Other Primary............................... 32 30 20 18

Net Investment Income.......................................... 3,050 2,824 2,096 1,968

Apparel(1) .................................................................. 229 (33) 156 (28)

Building Products(2) .................................................. 516 461 313 287

Finance and Financial Products Business................. 1,016 519 659 336

Flight Services .......................................................... 225 186 133 105

MidAmerican Energy (80% owned)......................... 613 565 359 230

Retail Operations ...................................................... 166 175 97 101

Scott Fetzer (excluding finance operation)............... 129 129 83 83

Shaw Industries(3)...................................................... 424 292 258 156

Other Businesses....................................................... 256 212 160 131

Purchase-Accounting Adjustments........................... (119) (726) (65) (699)

Corporate Interest Expense....................................... (86) (92) (55) (60)

Shareholder-Designated Contributions..................... (17) (17) (11) (11)

Other......................................................................... 19 25 12 16

Operating Earnings...................................................... 6,010 453 3,903 (47)

Capital Gains from Investments .................................. 603 1,320 383 842

Total Earnings – All Entities ....................................... $6,613 $1,773 $4,286 $ 795

(1) Includes Fruit of the Loom from April 30, 2002 and Garan from September 4, 2002.

(2) Includes Johns Manville from February 27, 2001 and MiTek from July 31, 2001.

(3) From date of acquisition, January 8, 2001.

Here’ s a summary of major developments at our non-insurance businesses:

• MidAmerican Energy’ s earnings grew in 2002 and will likely do so again this year. Most of the

increase, both present and expected, results from the acquisitions described earlier. To fund these,

Berkshire purchased $1,273 million of MidAmerican junior debt (bringing our total holdings of

these 11% obligations to $1,728 million) and also invested $402 million in a “common-equivalent”

stock. We now own (on a fully-diluted basis) 80.2% of MidAmerican’ s equity. MidAmerican’ s

financial statements are presented in detail on page 37.

• Last year I told you of the problems at Dexter that led to a huge loss in our shoe business. Thanks to

Frank Rooney and Jim Issler of H.H. Brown, the Dexter operation has been turned around. Despite

the cost of unwinding our problems there, we earned $24 million in shoes last year, an upward swing

of $70 million from 2001.

Randy Watson at Justin also contributed to this improvement, increasing margins significantly while

trimming invested capital. Shoes are a tough business, but we have terrific managers and believe

that in the future we will earn reasonable returns on the capital we employ in this operation.