Berkshire Hathaway 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

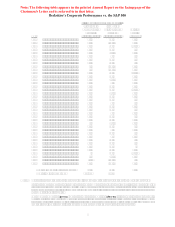

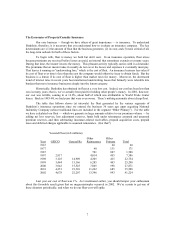

Note: The following table appears in the printed Annual Report on the facing page of the

Chairman's Letter and is referred to in that letter.

Berkshire’s Corporate Performance vs. the S&P 500

Annual Percentage Change

in Per-Share in S&P 500

Book Value of with Dividends Relative

Berkshire Included Results

Year (1) (2) (1)-(2)

1965 .................................................. 23.8 10.0 13.8

1966 .................................................. 20.3 (11.7) 32.0

1967 .................................................. 11.0 30.9 (19.9)

1968 .................................................. 19.0 11.0 8.0

1969 .................................................. 16.2 (8.4) 24.6

1970 .................................................. 12.0 3.9 8.1

1971 .................................................. 16.4 14.6 1.8

1972 .................................................. 21.7 18.9 2.8

1973 .................................................. 4.7 (14.8) 19.5

1974 .................................................. 5.5 (26.4) 31.9

1975 .................................................. 21.9 37.2 (15.3)

1976 .................................................. 59.3 23.6 35.7

1977 .................................................. 31.9 (7.4) 39.3

1978 .................................................. 24.0 6.4 17.6

1979 .................................................. 35.7 18.2 17.5

1980 .................................................. 19.3 32.3 (13.0)

1981 .................................................. 31.4 (5.0) 36.4

1982 .................................................. 40.0 21.4 18.6

1983 .................................................. 32.3 22.4 9.9

1984 .................................................. 13.6 6.1 7.5

1985 .................................................. 48.2 31.6 16.6

1986 .................................................. 26.1 18.6 7.5

1987 .................................................. 19.5 5.1 14.4

1988 .................................................. 20.1 16.6 3.5

1989 .................................................. 44.4 31.7 12.7

1990 .................................................. 7.4 (3.1) 10.5

1991 .................................................. 39.6 30.5 9.1

1992 .................................................. 20.3 7.6 12.7

1993 .................................................. 14.3 10.1 4.2

1994 .................................................. 13.9 1.3 12.6

1995 .................................................. 43.1 37.6 5.5

1996 .................................................. 31.8 23.0 8.8

1997 .................................................. 34.1 33.4 .7

1998 .................................................. 48.3 28.6 19.7

1999 .................................................. .5 21.0 (20.5)

2000 .................................................. 6.5 (9.1) 15.6

2001 .................................................. (6.2) (11.9) 5.7

2002 .................................................. 10.0 (22.1) 32.1

Average Annual Gain 1965-2002 22.2 10.0 12.2

Overall Gain 1964-2002 214,433 3,663

Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31.

Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market

rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire's results

through 1978 have been restated to conform to the changed rules. In all other respects, the results are calculated using

the numbers originally reported.

The S&P 500 numbers are pre-tax whereas the Berkshire numbers are after-tax. If a corporation such as Berkshire

were simply to have owned the S&P 500 and accrued the appropriate taxes, its results would have lagged the S&P 500

in years when that index showed a positive return, but would have exceeded the S&P in years when the index showed a

negative return. Over the years, the tax costs would have caused the aggregate lag to be substantial.