Berkshire Hathaway 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Notes to Consolidated Financial Statements (Continued)

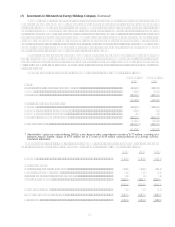

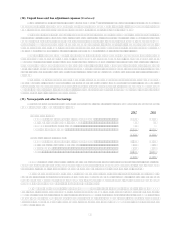

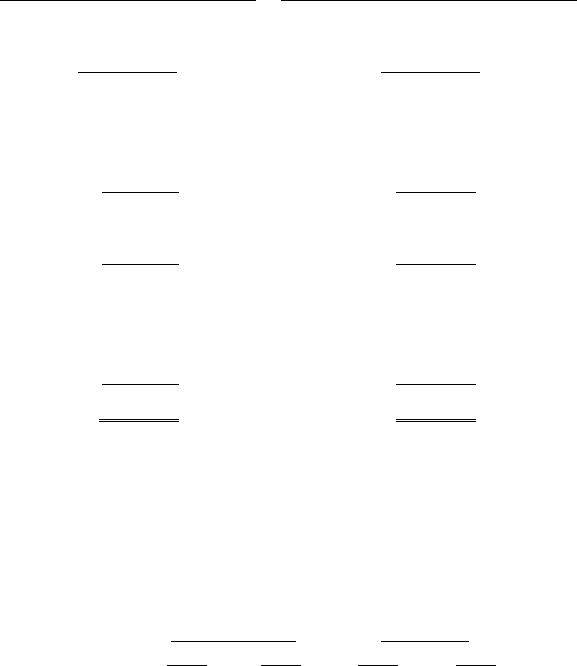

(14) Common stock

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2002 are

shown in the table below. Class A Common, $5 Par Value Class B Common $0.1667 Par Value

(1,650,000 shares authorized) (55,000,000 shares authorized)

Shares Issued and Shares Issued and

Outstanding Outstanding

Balance December 31, 1999..................................... 1,341,663 5,366,955

Common stock issued in connection

with acquisitions of businesses.............................. 3,572 1,626

Conversions of Class A common stock

to Class B common stock and other ...................... (1,331) 101,205

Balance December 31, 2000..................................... 1,343,904 5,469,786

Conversions of Class A common stock

to Class B common stock and other ...................... (20,494) 674,436

Balance December 31, 2001..................................... 1,323,410 6,144,222

Common stock issued in connection

with a business acquisition .................................... 4,505 7,063

Conversions of Class A common stock

to Class B common stock and other ...................... (16,729) 552,832

Balance December 31, 2002..................................... 1,311,186 6,704,117

Each share of Class A common stock is convertible, at the option of the holder, into thirty shares of Class B

common stock. Class B common stock is not convertible into Class A common stock. Each share of Class B common

stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class A common

stock. Class A and Class B common shares vote together as a single class.

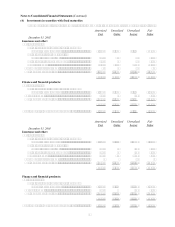

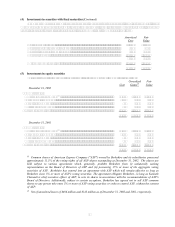

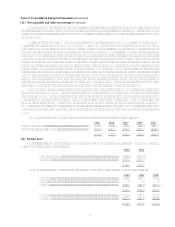

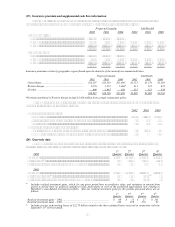

(15) Fair values of financial instruments

The estimated fair values of Berkshires financial instruments as of December 31, 2002 and 2001, are as follows

(in millions). Carrying Value Fair Value

2002 2001 2002 2001

Investments in securities with fixed maturities .................................... $38,096 $36,219 $38,096 $36,219

Investments in equity securities ........................................................... 28,363 28,675 28,363 28,675

Assets of finance and financial products businesses ............................ 33,578 41,591 33,881 41,710

Notes payable and other borrowings.................................................... 4,807 3,485 4,957 3,624

Liabilities of finance and financial products businesses....................... 28,726 37,791 29,090 37,917

In determining fair value of financial instruments, Berkshire used quoted market prices when available. For

instruments where quoted market prices were not available, independent pricing services or appraisals by Berkshires

management were used. Those services and appraisals reflected the estimated present values utilizing current risk

adjusted market rates of similar instruments. The carrying values of cash and cash equivalents, receivables and accounts

payable, accruals and other liabilities are deemed to be reasonable estimates of their fair values.

Considerable judgment is necessarily required in interpreting market data used to develop the estimates of fair

value. Accordingly, the estimates presented herein are not necessarily indicative of the amounts that could be realized in

a current market exchange. The use of different market assumptions and/or estimation methodologies may have a

material effect on the estimated fair value.

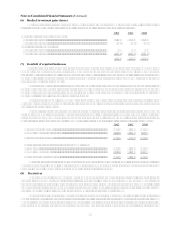

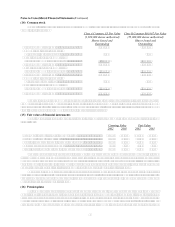

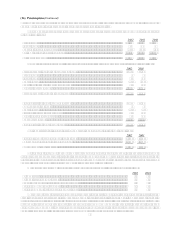

(16) Pension plans

Certain Berkshire subsidiaries individually sponsor defined benefit pension plans covering their employees.

Benefits under the plans are generally based on years of service and compensation, although benefits under certain plans

are based on years of service and fixed benefit rates. Funding policies are generally to contribute amounts required to

meet regulatory requirements plus additional amounts determined by management based on actuarial valuations. Most

plans for U.S. employees are funded through assets held in trust. However, pension obligations under plans for non-