Berkshire Hathaway 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

(3) Investments in MidAmerican Energy Holdings Company (Continued)

MidAmericans Articles of Incorporation further provide that the convertible preferred shares: a) are not

mandatorily redeemable by MidAmerican or at the option of the holder; b) participate in dividends and other

distributions to common shareholders as if they were common shares and otherwise possess no dividend rights; c) are

convertible into common shares on a 1 for 1 basis, as adjusted for splits, combinations, reclassifications and other

capital changes by MidAmerican and d) upon liquidation, except for a de minimus first priority distribution of $1 per

share, share ratably with the shareholders of common stock. Further, the aforementioned dividend and distribution

arrangements cannot be modified without the positive consent of the preferred shareholders. Accordingly, the

convertible preferred stock is, in substance, a substantially identical subordinate interest to a share of common stock and

economically equivalent to common stock. Therefore, Berkshire is accounting for its investments in common and

convertible preferred stock of MidAmerican pursuant to the equity method.

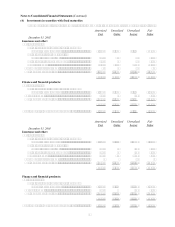

Berkshire's aggregate investments in MidAmerican are included in the Consolidated Balance Sheets as

Investments in MidAmerican Energy Holdings Company, and include the common and convertible preferred stock

investments accounted for pursuant to the equity method totaling $1,923 million at December 31, 2002 and $1,371

million at December 31, 2001. The 11% non-transferable trust preferred securities are classified as held-to-maturity and

are carried at cost.

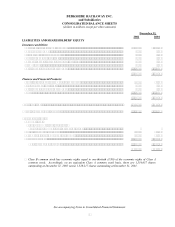

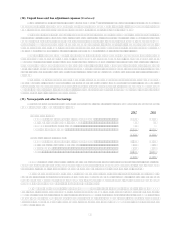

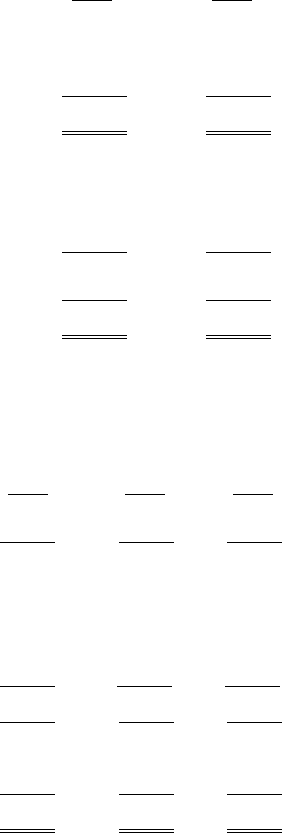

Condensed consolidated balance sheets of MidAmerican are as follows. Amounts are in millions.

December 31, December 31,

2002 2001

Assets:

Properties, plants, contracts and equipment, net ............................................................ $ 9,810 $ 6,537

Goodwill......................................................................................................................... 4,258 3,639

Other assets .................................................................................................................... 3,948 2,450

$18,016 $12,626

Liabilities and shareholders equity:

Term debt .......................................................................................................................$ 9,952 $ 7,163

Redeemable securities held by Berkshire....................................................................... 1,728 455

Redeemable securities held by others............................................................................. 429 554

Other liabilities and minority interests ........................................................................... 3,613 2,746

15,722 10,918

Shareholders equity....................................................................................................... 2,294* 1,708

$18,016 $12,626

* Shareholders’ equity was reduced during 2002 by a net charge to other comprehensive income of $177 million, consisting of a

minimum pension liability charge of $313 million net of a credit of $136 million related primarily to a foreign currency

translation adjustment.

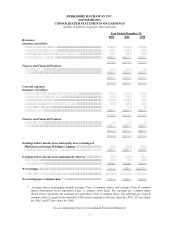

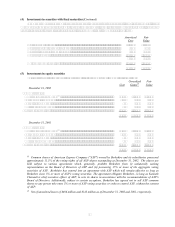

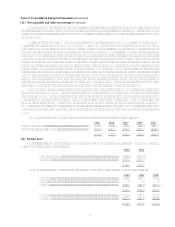

Condensed consolidated statements of earnings of MidAmerican for the years ending December 31, 2002 and 2001

and for the period March 14, 2000 through December 31, 2000 are as follows. Amounts are in millions.

2002 2001 2000

Revenues ........................................................................................................... $4,968 $4,973 $4,013

Costs and expenses:

Cost of sales and operating expenses ................................................................ 3,189 3,522 3,100

Depreciation and amortization .......................................................................... 526 539 383

Interest expense securities held by Berkshire................................................. 118 50 40

Other interest expense ....................................................................................... 640 443 336

4,473 4,554 3,859

Earnings before taxes ........................................................................................ 495 419 154

Income taxes and minority interests .................................................................. 115 276 73

Net earnings ...................................................................................................... $ 380 $ 143 $ 81