Berkshire Hathaway 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

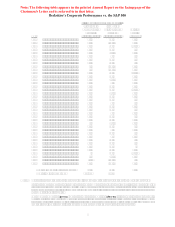

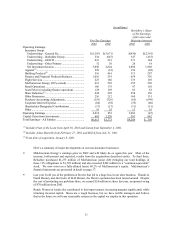

Our gain in net worth during 2002 was $6.1 billion, which increased the per-share book value of

both our Class A and Class B stock by 10.0%. Over the last 38 years (that is, since present management

took over) per-share book value has grown from $19 to $41,727, a rate of 22.2% compounded annually.∗

In all respects 2002 was a banner year. I’ ll provide details later, but here’ s a summary:

• Our various non-insurance operations performed exceptionally well, despite a sluggish economy.

A decade ago Berkshire’ s annual pre-tax earnings from our non-insurance businesses was $272

million. Now, from our ever-expanding collection of manufacturing, retailing, service and finance

businesses, we earn that sum monthly.

• Our insurance group increased its float to $41.2 billion, a hefty gain of $5.7 billion. Better yet, the

use of these funds in 2002 cost us only 1%. Getting back to low-cost float feels good, particularly

after our poor results during the three previous years. Berkshire’ s reinsurance division and

GEICO shot the lights out in 2002, and underwriting discipline was restored at General Re.

• Berkshire acquired some important new businesses – with economic characteristics ranging from

good to great, run by managers ranging from great to great. Those attributes are two legs of our

“entrance” strategy, the third being a sensible purchase price. Unlike LBO operators and private

equity firms, we have no “exit” strategy – we buy to keep. That’ s one reason why Berkshire is

usually the first – and sometimes the only – choice for sellers and their managers.

• Our marketable securities outperformed most indices. For Lou Simpson, who manages equities at

GEICO, this was old stuff. But, for me, it was a welcome change from the last few years, during

which my investment record was dismal.

The confluence of these favorable factors in 2002 caused our book-value gain to outstrip the

performance of the S&P 500 by 32.1 percentage points. This result is aberrational: Charlie Munger,

Berkshire’ s vice chairman and my partner, and I hope to achieve – at most – an average annual advantage

of a few points. In the future, there will be years in which the S&P soundly trounces us. That will in fact

almost certainly happen during a strong bull market, because the portion of our assets committed to

common stocks has significantly declined. This change, of course, helps our relative performance in down

markets such as we had in 2002.

I have another caveat to mention about last year’ s results. If you’ ve been a reader of financial

reports in recent years, you’ ve seen a flood of “pro-forma” earnings statements – tabulations in which

managers invariably show “earnings” far in excess of those allowed by their auditors. In these

presentations, the CEO tells his owners “don’ t count this, don’ t count that – just count what makes earnings

fat.” Often, a forget-all-this-bad-stuff message is delivered year after year without management so much as

blushing.

∗All figures used in this report apply to Berkshire's A shares, the successor to the only stock that

the company had outstanding before 1996. The B shares have an economic interest equal to 1/30th that of

the A.