Berkshire Hathaway 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

contracts outstanding, involving 672 counterparties around the world. Each contract had a plus or minus

value derived from one or more reference items, including some of mind-boggling complexity. Valuing a

portfolio like that, expert auditors could easily and honestly have widely varying opinions.

The valuation problem is far from academic: In recent years, some huge-scale frauds and near-frauds

have been facilitated by derivatives trades. In the energy and electric utility sectors, for example, companies

used derivatives and trading activities to report great “earnings” – until the roof fell in when they actually

tried to convert the derivatives-related receivables on their balance sheets into cash. “Mark-to-market” then

turned out to be truly “mark-to-myth.”

I can assure you that the marking errors in the derivatives business have not been symmetrical.

Almost invariably, they have favored either the trader who was eyeing a multi-million dollar bonus or the

CEO who wanted to report impressive “earnings” (or both). The bonuses were paid, and the CEO profited

from his options. Only much later did shareholders learn that the reported earnings were a sham.

Another problem about derivatives is that they can exacerbate trouble that a corporation has run into

for completely unrelated reasons. This pile-on effect occurs because many derivatives contracts require that a

company suffering a credit downgrade immediately supply collateral to counterparties. Imagine, then, that a

company is downgraded because of general adversity and that its derivatives instantly kick in with their

requirement, imposing an unexpected and enormous demand for cash collateral on the company. The need to

meet this demand can then throw the company into a liquidity crisis that may, in some cases, trigger still more

downgrades. It all becomes a spiral that can lead to a corporate meltdown.

Derivatives also create a daisy-chain risk that is akin to the risk run by insurers or reinsurers that lay

off much of their business with others. In both cases, huge receivables from many counterparties tend to

build up over time. (At Gen Re Securities, we still have $6.5 billion of receivables, though we’ ve been in a

liquidation mode for nearly a year.) A participant may see himself as prudent, believing his large credit

exposures to be diversified and therefore not dangerous. Under certain circumstances, though, an exogenous

event that causes the receivable from Company A to go bad will also affect those from Companies B through

Z. History teaches us that a crisis often causes problems to correlate in a manner undreamed of in more

tranquil times.

In banking, the recognition of a “linkage” problem was one of the reasons for the formation of the

Federal Reserve System. Before the Fed was established, the failure of weak banks would sometimes put

sudden and unanticipated liquidity demands on previously-strong banks, causing them to fail in turn. The

Fed now insulates the strong from the troubles of the weak. But there is no central bank assigned to the job of

preventing the dominoes toppling in insurance or derivatives. In these industries, firms that are

fundamentally solid can become troubled simply because of the travails of other firms further down the chain.

When a “chain reaction” threat exists within an industry, it pays to minimize links of any kind. That’ s how

we conduct our reinsurance business, and it’ s one reason we are exiting derivatives.

Many people argue that derivatives reduce systemic problems, in that participants who can’ t bear

certain risks are able to transfer them to stronger hands. These people believe that derivatives act to stabilize

the economy, facilitate trade, and eliminate bumps for individual participants. And, on a micro level, what

they say is often true. Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions in

order to facilitate certain investment strategies.

Charlie and I believe, however, that the macro picture is dangerous and getting more so. Large

amounts of risk, particularly credit risk, have become concentrated in the hands of relatively few derivatives

dealers, who in addition trade extensively with one other. The troubles of one could quickly infect the others.

On top of that, these dealers are owed huge amounts by non-dealer counterparties. Some of these

counterparties, as I’ ve mentioned, are linked in ways that could cause them to contemporaneously run into a

problem because of a single event (such as the implosion of the telecom industry or the precipitous decline in

the value of merchant power projects). Linkage, when it suddenly surfaces, can trigger serious systemic

problems.

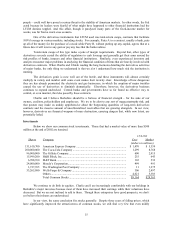

Indeed, in 1998, the leveraged and derivatives-heavy activities of a single hedge fund, Long-Term

Capital Management, caused the Federal Reserve anxieties so severe that it hastily orchestrated a rescue

effort. In later Congressional testimony, Fed officials acknowledged that, had they not intervened, the

outstanding trades of LTCM – a firm unknown to the general public and employing only a few hundred