Berkshire Hathaway 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Management's Discussion (Continued)

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

Retroactive reinsurance contracts indemnify ceding companies for losses arising under insurance or

reinsurance contracts written in the past, usually many years ago. While contract terms vary, losses under the

contracts are subject to a very large aggregate dollar limit, occasionally exceeding $1 billion under a single contract.

Generally, it is also anticipated, although not assured, that claims under retroactive contracts will be paid over long

time periods. As a result, premiums paid by ceding companies are, in part, discounted for time value. However,

these contracts do not produce an immediate underwriting loss for financial reporting purposes. The excess of the

estimated ultimate claims payable over the premiums received is established as a deferred charge asset which is

subsequently amortized over the expected claim settlement periods. Such amortization is included as a component

of losses incurred and essentially represents the net underwriting losses from this business in each of the past three

years.

Retroactive reinsurance contracts are expected to generate significant underwriting losses over time due to

the amortization of these deferred charges. This business is accepted due to the exceptionally large amounts of float

generated which totaled about $7.5 billion at December 31, 2002. Unamortized deferred charges under BHRG

contracts were $3.2 billion at December 31, 2002 and $3.1 billion as of December 31, 2001. It is currently expected

that losses incurred in 2003 will include about $400 million of deferred charge amortization from contracts in effect

as of December 31, 2002.

In 2002, BHRG wrote an increasing amount of business under quota-share contracts. Most of the

increased premium volume in 2002 derived from several new contracts with Lloyd’ s syndicates and from a new

contract with a major U.S. based insurer. In a quota-share arrangement, BHRG essentially participates

proportionately in the premiums and claims of the business written by the ceding company. BHRG was willing to

enter into these new contracts because it believed the level of rate adequacy in certain property/casualty markets was

much improved in relation to past years. BHRG’ s continued participation in this business will depend on the

availability of other sources of capacity for Lloyd’ s syndicates as well as the expectation of continued rate adequacy

of the Lloyd’ s business being reinsured. Accordingly, the level of this business expected to be written in 2003 is

uncertain.

Berkshire Hathaway Primary Group

Berkshire’ s other primary insurance businesses consist of a wide variety of smaller insurance businesses

that principally write liability coverages for commercial accounts. These businesses include: National Indemnity

Company’ s primary group operation (“NICO Primary Group”), a writer of motor vehicle and general liability

coverages; U.S. Investment Corporation (“USIC”), acquired by Berkshire in August 2000 and whose subsidiaries

underwrite specialty insurance coverages; a group of companies referred to internally as “Homestate” operations,

providers of standard multi-line insurance; and Central States Indemnity Company, a provider of credit and

disability insurance to individuals nationwide through financial institutions.

Collectively, Berkshire’ s other primary insurance businesses produced earned premiums of $712 million in

2002, $501 million in 2001 and $325 million in 2000. The increases in premiums earned during the past two years

were largely attributed to increased volume at USIC and the NICO Primary Group. Net underwriting gains of

Berkshire’ s other primary insurance businesses totaled $32 million in 2002, $30 million in 2001 and $25 million in

2000. The improvement in year-to-year comparative underwriting results was due in large part to USIC and the

NICO Primary Group offset by poor results in the workers’ compensation business of the Homestate Group.

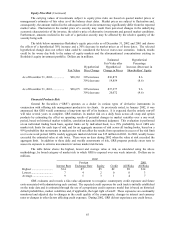

Insurance — Investment Income

Following is a summary of the net investment income of Berkshire’ s insurance operations for the past three

years.

— (dollars in millions) —

2002 2001 2000

Investment income before taxes............................................................................. $3,050 $2,824 $2,773

Applicable income taxes and minority interest ...................................................... 954 856 827

Investment income after taxes and minority interest.............................................. $2,096 $1,968 $1,946

Investment income from insurance operations in 2002 increased $226 million (8.0%) over 2001.

Investment income in 2001 exceeded amounts earned in 2000 by $51 million (1.8%). Investment income in 2000

included five quarters with respect to General Re's international reinsurance operations, as a result of the elimination