Berkshire Hathaway 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

• In a so-so year for home-furnishing and jewelry retailers, our operations did well. Among our eight

retailing operations, the best performer was Homemaker’ s in Des Moines. There, the talented

Merschman family achieved outstanding gains in both sales and profits.

Nebraska Furniture Mart will open a new blockbuster store in metropolitan Kansas City in August.

With 450,000 square feet of retail space, it could well produce the second largest volume of any

furniture store in the country – the Omaha operation being the national champion. I hope Berkshire

shareholders in the Kansas City area will come out for the opening (and keep coming).

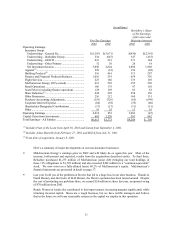

• Our home and construction-related businesses – Acme Brick, Benjamin Moore Paint, Johns-

Manville, MiTek and Shaw – delivered $941 million of pre-tax earnings last year. Of particular

significance was Shaw’ s gain from $292 million in 2001 to $424 million. Bob Shaw and Julian Saul

are terrific operators. Carpet prices increased only 1% last year, but Shaw’ s productivity gains and

excellent expense control delivered significantly improved margins.

We cherish cost-consciousness at Berkshire. Our model is the widow who went to the local

newspaper to place an obituary notice. Told there was a 25-cents-a-word charge, she requested

“Fred Brown died.” She was then informed there was a seven-word minimum. “Okay” the

bereaved woman replied, “make it ‘Fred Brown died, golf clubs for sale’ .”

• Earnings from flight services increased last year – but only because we realized a special pre-tax

gain of $60 million from the sale of our 50% interest in FlightSafety Boeing. Without this gain,

earnings from our training business would have fallen slightly in concert with the slowdown in

business-aviation activity. FlightSafety training continues to be the gold standard for the industry,

and we expect growth in the years to come.

At NetJets, our fractional-ownership operation, we are the runaway leader of the four-company field.

FAA records indicate that our industry share in 2002 was 75%, meaning that clients purchased or

leased planes from us that were valued at triple those recorded by our three competitors combined.

Last year, our fleet flew 132.7 million nautical miles, taking clients to 130 countries.

Our preeminence is directly attributable to Rich Santulli, NetJets’ CEO. He invented the business in

1986 and ever since has exhibited an unbending devotion to the highest levels of service, safety and

security. Rich, Charlie and I insist on planes (and personnel) worthy of carrying our own families –

because they regularly do.

Though NetJets revenues set a record in 2002, the company again lost money. A small profit in the

U.S. was more than offset by losses in Europe. Overall, the fractional-ownership industry lost

significant sums last year, and that is almost certain to be the outcome in 2003 as well. The bald fact

is that airplanes are costly to operate.

Over time, this economic reality should work to our advantage, given that for a great many

companies, private aircraft are an essential business tool. And for most of these companies, NetJets

makes compelling sense as either a primary or supplementary supplier of the aircraft they need.

Many businesses could save millions of dollars annually by flying with us. Indeed, the yearly

savings at some large companies could exceed $10 million. Equally important, these companies

would actually increase their operational capabilities by using us. A fractional ownership of a single

NetJets plane allows a client to have several planes in the air simultaneously. Additionally, through

the interchange arrangement we make available, an owner of an interest in one plane can fly any of

12 other models, using whatever plane makes most sense for a mission. (One of my sisters owns a

fraction of a Falcon 2000, which she uses for trips to Hawaii, but – exhibiting the Buffett gene – she

interchanges to a more economical Citation Excel for short trips in the U.S.)

The roster of NetJets users confirms the advantages we offer major businesses. Take General

Electric, for example. It has a large fleet of its own but also has an unsurpassed knowledge of how

to utilize aircraft effectively and economically. And it is our largest customer.

• Our finance and financial products line covers a variety of operations, among them certain activities

in high-grade fixed-income securities that proved highly profitable in 2002. Earnings in this arena

will probably continue for a while, but are certain to decrease – and perhaps disappear – in time.