Berkshire Hathaway 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions (Continued)

MiTek Inc. (MiTek)

On July 31, 2001, Berkshire acquired a 90% interest in MiTek for approximately $400 million. Existing MiTek

management acquired the remaining 10% interest. MiTek produces steel connector products, design engineering

software and ancillary services for the building components market.

XTRA Corporation (XTRA)

On September 20, 2001, Berkshire acquired all of the outstanding shares of XTRA for approximately $578

million. XTRA is a leading operating lessor of transportation equipment, including over-the-road trailers, marine

containers and intermodal equipment.

Berkshire completed five acquisitions in 2000. Aggregate consideration paid for the five business acquisitions

consummated in 2000 totaled $2,370 million, consisting of $2,146 million in cash and the remainder in Berkshire Class A

and Class B common stock. Information concerning these acquisitions follows.

On February 18, 2000, Wesco Financial Corporation, an 80.1% owned subsidiary of Berkshire, acquired CORT

Business Services Corporation, a leading national provider of rental furniture, accessories and related services in the

rent-to-rent segment of the furniture industry. On July 3, 2000, Berkshire acquired Ben Bridge Jeweler, a leading

operator of upscale jewelry stores based in major shopping malls in the Western U.S. On August 1, 2000, Berkshire

acquired Justin Industries, Inc., a leading manufacturer and producer of face brick, concrete masonry products and

ceramic and marble floor and wall tile (Acme Brick) and a leading manufacturer of Western footwear under a number of

brand names (Justin Brands). On August 8, 2000, Berkshire acquired U.S. Investment Corporation, the parent of the

United States Liability Insurance Group, one of the premier U.S. writers of specialty insurance. On December 18, 2000,

Berkshire acquired Benjamin Moore & Co., a formulator, manufacturer and retailer of a broad range of architectural and

industrial coatings, available principally in the U.S. and Canada.

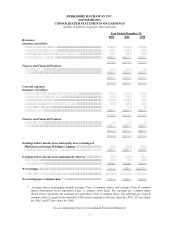

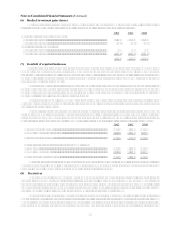

The results of operations for each of the entities acquired are included in Berkshire's consolidated results of

operations from the effective date of each acquisition. The following table sets forth certain unaudited consolidated

earnings data for 2002 and 2001, as if each of the acquisitions discussed above were consummated on the same terms at

the beginning of each year. Dollars are in millions, except per share amounts.

2002 2001

Total revenues ............................................................................................................................ $43,634 $42,120

Net earnings ............................................................................................................................... 4,402 997

Earnings per equivalent Class A common share........................................................................ 2,870 651

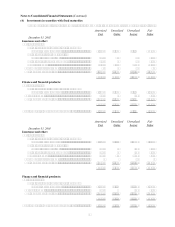

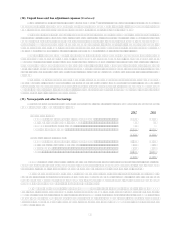

(3) Investments in MidAmerican Energy Holdings Company

On March 14, 2000, Berkshire acquired 900,942 shares of common stock and 34,563,395 shares of convertible

preferred stock of MidAmerican Energy Holdings Company ("MidAmerican") for $35.05 per share, or approximately

$1.24 billion in the aggregate. During 2002, Berkshire acquired an additional 6,700,000 shares of convertible preferred

stock for $402 million. Such investments currently give Berkshire about a 9.7% voting interest and an 83.4% economic

interest in the equity of MidAmerican (80.2% on a fully diluted basis). Berkshire and certain of its subsidiaries have

also acquired approximately $1,728 million of 11% non-transferable trust preferred securities, of which $455 million

were acquired in 2000 and $1,273 million were acquired in 2002. Mr. Walter Scott, Jr., a member of Berkshire's Board

of Directors, controls approximately 86% of the voting interest in MidAmerican.

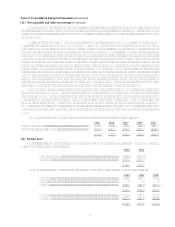

MidAmerican is a U.S. based global energy company whose principal businesses are regulated electric and natural

gas utilities, regulated interstate natural gas transmission and electric power generation. Through its subsidiaries it

owns and operates a combined electric and natural gas utility company in the U.S., two natural gas pipeline companies

in the U.S., two electricity distribution companies in the United Kingdom and a diversified portfolio of domestic and

international electric power projects. It also owns the second largest residential real estate brokerage firm in the U.S.

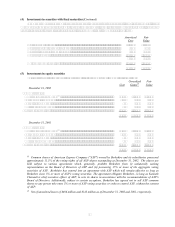

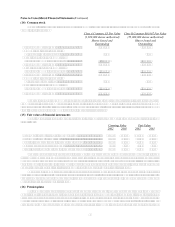

While the convertible preferred stock does not vote generally with the common stock in the election of directors, the

convertible preferred stock gives Berkshire the right to elect 20% of MidAmericans Board of Directors. The convertible

preferred stock is convertible into common stock only upon the occurrence of specified events, including modification or

elimination of the Public Utility Holding Company Act of 1935 so that holding company registration would not be

triggered by conversion. Additionally, the prior approval of the holders of convertible preferred stock is required for

certain fundamental transactions by MidAmerican. Such transactions include, among others: a) significant asset sales or

dispositions; b) merger transactions; c) significant business acquisitions or capital expenditures; d) issuances or repurchases

of equity securities and e) the removal or appointment of the Chief Executive Officer. Through its investments in common

and convertible preferred stock of MidAmerican, Berkshire has the ability to exercise significant influence on the

operations of MidAmerican.