Berkshire Hathaway 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

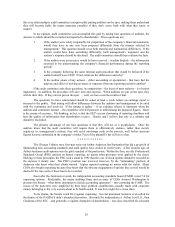

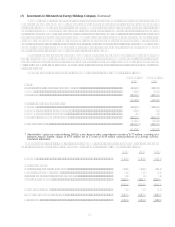

27

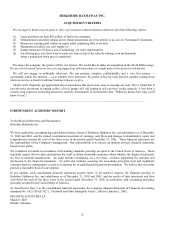

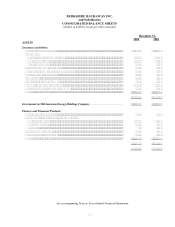

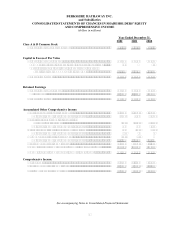

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31,

2002 2001

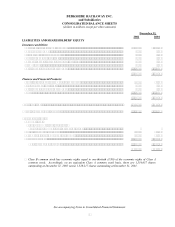

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses ............................................................................. $ 43,925 $ 40,716

Unearned premiums ....................................................................................................... 6,694 4,814

Life and health insurance benefits.................................................................................. 2,642 2,058

Other policyholder liabilities.......................................................................................... 4,218 3,319

Accounts payable, accruals and other liabilities............................................................. 5,053 4,249

Income taxes................................................................................................................... 8,051 7,021

Notes payable and other borrowings.............................................................................. 4,807 3,485

75,390 65,662

Finance and Financial Products:

Securities sold under agreements to repurchase............................................................. 13,789 21,465

Trading account liabilities.............................................................................................. 7,274 4,803

Notes payable and other borrowings .............................................................................. 4,481 9,019

Other............................................................................................................................... 3,182 2,504

28,726 37,791

Total liabilities ...................................................................................................................... 104,116 103,453

Minority shareholders interests........................................................................................ 1,391 1,349

Shareholders equity:

Common stock:*

Class A common stock, $5 par value

and Class B common stock, $0.1667 par value ........................................................ 8 8

Capital in excess of par value......................................................................................... 26,028 25,607

Accumulated other comprehensive income.................................................................... 14,271 12,891

Retained earnings ........................................................................................................... 23,730 19,444

Total shareholders equity ........................................................................................ 64,037 57,950

$169,544 $162,752

*Class B common stock has economic rights equal to one-thirtieth (1/30) of the economic rights of Class A

common stock. Accordingly, on an equivalent Class A common stock basis, there are 1,534,657 shares

outstanding at December 31, 2002 versus 1,528,217 shares outstanding at December 31, 2001.

See accompanying Notes to Consolidated Financial Statements