Berkshire Hathaway 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

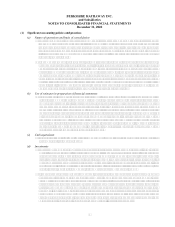

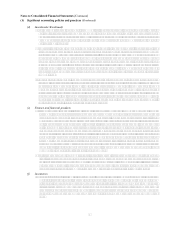

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(l) Deferred charges reinsurance assumed

The excess of estimated liabilities for claims and claim costs over the consideration received with respect to

retroactive property and casualty reinsurance contracts that provide for indemnification of insurance risk

is established as a deferred charge at inception of such contracts. The deferred charges are subsequently

amortized using the interest method over the expected claim settlement periods. The periodic

amortization charges are reflected in the accompanying Consolidated Statements of Earnings as losses

and loss adjustment expenses.

Changes to the timing and amount of estimated loss payments produce changes in the unamortized deferred

charge balance. Such changes in estimates are accounted for under the retrospective method with the

net effect included in amortization expense in the period of the change.

(m) Reinsurance

Provisions for losses and loss adjustment expenses are reported in the accompanying Consolidated

Statements of Earnings after deducting amounts recovered and estimates of amounts recoverable under

reinsurance contracts. Reinsurance contracts do not relieve the ceding company of its obligations to

indemnify policyholders with respect to the underlying insurance and reinsurance contracts.

(n) Foreign currency

The accounts of several foreign-based subsidiaries are measured using the local currency as the functional

currency. Revenues and expenses of these businesses are translated into U.S. dollars at the average

exchange rate for the period. Assets and liabilities are translated at the exchange rate as of the end of

the reporting period. Gains or losses from translating the financial statements of foreign-based

operations are included in shareholders equity as a component of accumulated other comprehensive

income. Gains and losses arising from other transactions denominated in a foreign currency are

included in the Consolidated Statements of Earnings.

(o) Deferred income taxes

Deferred income taxes are calculated under the liability method. Deferred tax assets and liabilities are

recorded based on differences between the financial statement and tax bases of assets and liabilities at

the enacted tax rates. Changes in deferred income tax assets and liabilities that are associated with

components of other comprehensive income, primarily unrealized investment gains are charged or

credited directly to other comprehensive income. Otherwise, changes in deferred income tax assets and

liabilities are included as a component of income tax expense.

(p) Accounting pronouncements to become effective subsequent to December 31, 2002

In August 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143 Accounting

for Asset Retirement Obligations, which addresses accounting and reporting for obligations associated

with the retirement of tangible long-lived assets and the associated asset retirement costs. SFAS 143

became effective for Berkshire on January 1, 2003.

In June 2002, the FASB issued SFAS 146, Accounting for Costs Associated with Exit or Disposal

Activities, which addresses financial accounting and reporting for costs associated with exit or disposal

activities. SFAS 146 generally requires that costs associated with an exit or disposal activity be

recognized as liabilities when incurred, rather than the date of commitment to an exit plan, and it

establishes that fair value is the standard for initial measurement of such liabilities. SFAS 146 applies to

exit or disposal activities that are initiated after December 31, 2002.

In November 2002, the FASB issued FASB Interpretation (FIN) No. 45, Guarantors Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others.

Initial recognition and initial measurement provisions of this interpretation are applicable on a

prospective basis to guarantees issued or modified after December 31, 2002. The disclosure

requirements are effective for financial statements of annual periods ending after December 31, 2002.

The adoption of SFAS 143, SFAS 146 and FIN 45 is not expected to have a material effect on Berkshires

consolidated financial position or results of operations.