Berkshire Hathaway 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

people – could well have posed a serious threat to the stability of American markets. In other words, the Fed

acted because its leaders were fearful of what might have happened to other financial institutions had the

LTCM domino toppled. And this affair, though it paralyzed many parts of the fixed-income market for

weeks, was far from a worst-case scenario.

One of the derivatives instruments that LTCM used was total-return swaps, contracts that facilitate

100% leverage in various markets, including stocks. For example, Party A to a contract, usually a bank, puts

up all of the money for the purchase of a stock while Party B, without putting up any capital, agrees that at a

future date it will receive any gain or pay any loss that the bank realizes.

Total-return swaps of this type make a joke of margin requirements. Beyond that, other types of

derivatives severely curtail the ability of regulators to curb leverage and generally get their arms around the

risk profiles of banks, insurers and other financial institutions. Similarly, even experienced investors and

analysts encounter major problems in analyzing the financial condition of firms that are heavily involved with

derivatives contracts. When Charlie and I finish reading the long footnotes detailing the derivatives activities

of major banks, the only thing we understand is that we don’t understand how much risk the institution is

running.

The derivatives genie is now well out of the bottle, and these instruments will almost certainly

multiply in variety and number until some event makes their toxicity clear. Knowledge of how dangerous

they are has already permeated the electricity and gas businesses, in which the eruption of major troubles

caused the use of derivatives to diminish dramatically. Elsewhere, however, the derivatives business

continues to expand unchecked. Central banks and governments have so far found no effective way to

control, or even monitor, the risks posed by these contracts.

Charlie and I believe Berkshire should be a fortress of financial strength – for the sake of our

owners, creditors, policyholders and employees. We try to be alert to any sort of megacatastrophe risk, and

that posture may make us unduly apprehensive about the burgeoning quantities of long-term derivatives

contracts and the massive amount of uncollateralized receivables that are growing alongside. In our view,

however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are

potentially lethal.

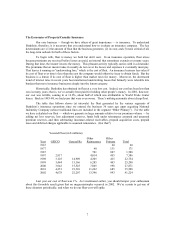

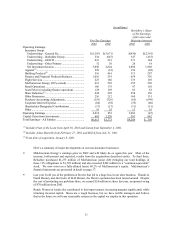

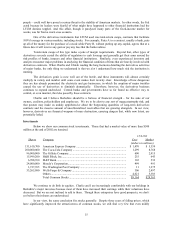

Investments

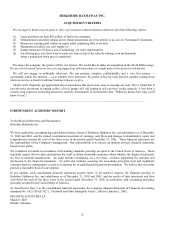

Below we show our common stock investments. Those that had a market value of more than $500

million at the end of 2002 are itemized.

12/31/02

Shares Company Cost Market

(dollars in millions)

151,610,700 American Express Company ..................................................................... $ 1,470 $ 5,359

200,000,000 The Coca-Cola Company .......................................................................... 1,299 8,768

96,000,000 The Gillette Company................................................................................ 600 2,915

15,999,200 H&R Block, Inc......................................................................................... 255 643

6,708,760 M&T Bank................................................................................................. 103 532

24,000,000 Moody’ s Corporation................................................................................. 499 991

1,727,765 The Washington Post Company ................................................................ 11 1,275

53,265,080 Wells Fargo & Company ........................................................................... 306 2,497

Others ........................................................................................................ 4,621 5,383

Total Common Stocks ............................................................................... $9,164 $28,363

We continue to do little in equities. Charlie and I are increasingly comfortable with our holdings in

Berkshire’ s major investees because most of them have increased their earnings while their valuations have

decreased. But we are not inclined to add to them. Though these enterprises have good prospects, we don’ t

yet believe their shares are undervalued.

In our view, the same conclusion fits stocks generally. Despite three years of falling prices, which

have significantly improved the attractiveness of common stocks, we still find very few that even mildly