Berkshire Hathaway 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

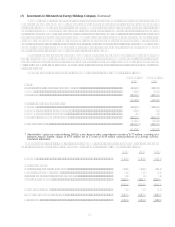

(16) Pension plans (Continued)

U.S. employees are generally unfunded. Plan assets are primarily invested in fixed income obligations of U.S.

government corporations and agencies, cash equivalents and equity securities.

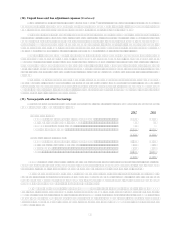

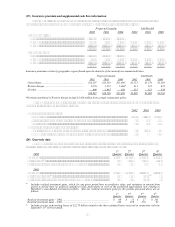

The components of net periodic pension expense for each of the three years ending December 31, 2002 are as

follows (in millions).

2002 2001 2000

Service cost ...................................................................................................................... $ 91 $ 72 $ 44

Interest cost ...................................................................................................................... 165 138 73

Expected return on plan assets.......................................................................................... (147) (137) (73)

Net amortization, deferral and other................................................................................. 6 3 (2)

Net pension expense......................................................................................................... $ 115 $ 76 $ 42

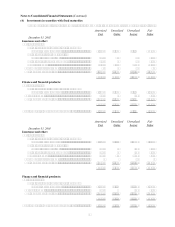

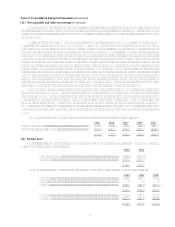

Changes in the projected benefit obligations and plan assets during 2002 and 2001 are as follows (in millions).

2002 2001

Projected benefit obligation, beginning of year................................................................ $2,376 $1,337

Service cost ...................................................................................................................... 91 72

Interest cost ...................................................................................................................... 165 138

Benefits paid..................................................................................................................... (165) (102)

Benefit obligations of acquired businesses....................................................................... 318 730

Actuarial loss and other.................................................................................................... 81 201

Projected benefit obligation, end of year.......................................................................... $2,866 $2,376

Plan assets at fair value, beginning of year....................................................................... $2,215 $1,434

Employer contributions .................................................................................................... 56 36

Benefits paid..................................................................................................................... (162) (99)

Plan assets of acquired businesses.................................................................................... 231 707

Actual return on plan assets.............................................................................................. 196 139

Expenses and other........................................................................................................... 9 (2)

Plan assets at fair value, end of year................................................................................. $2,545 $2,215

The funded status of the plans as of December 31, 2002 and 2001 is as follows (in millions).

2002 2001

Plan assets under projected benefit obligations................................................................ $ (321) $ (161)

Unrecognized net actuarial gains and other...................................................................... (104) (114)

Accrued benefit cost liability............................................................................................ $ (425) $ (275)

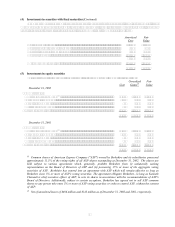

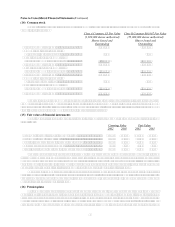

Certain actuarial assumptions which were being used to value the assets and obligations of these plans were

revised in 2001 and 2002 to better reflect the current economic environment and, in particular, the recent decline in

interest rates. The total net deficit status for plans with accumulated benefit obligations in excess of plan assets was

$324 million and $195 million as of December 31, 2002 and 2001, respectively.

Weighted average assumptions used in determining projected benefit obligations were as follows.

2002 2001

Discount rate............................................................................................................................ 6.3 6.6

Discount rate non-U.S. plans................................................................................................ 5.9 6.0

Long-term expected rate of return on plan assets .................................................................... 6.5 6.7

Rate of compensation increase ................................................................................................ 4.74.8

Rate of compensation increase non-U.S. plans..................................................................... 3.8 4.3

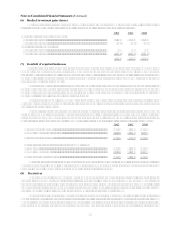

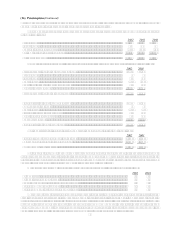

Most Berkshire subsidiaries also sponsor defined contribution retirement plans, such as a 401(k) or profit sharing

plans. The plans generally cover all employees who meet specified eligibility requirements. Employee contributions to

the plans are subject to regulatory limitations and the specific plan provisions. Berkshire subsidiaries generally match

these contributions up to levels specified in the plans, and may make additional discretionary contributions as

determined by management. The total expenses related to employer contributions for these plans were $193 million,

$70 million and $80 million for the years ended December 31, 2002, 2001 and 2000, respectively.