Berkshire Hathaway 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

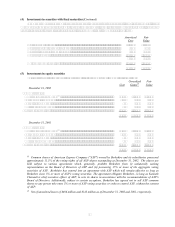

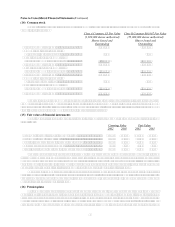

(10) Unpaid losses and loss adjustment expenses (Continued)

Estimates of unpaid losses resulting from the September 11th terrorist attack were $1.9 billion as of December 31,

2002 and $2.4 billion as of December 31, 2001. Berkshires management believes it will take many years to resolve

complicated coverage issues, which could produce a material change in the ultimate loss amount.

As previously indicated, Berkshires insurance subsidiaries are exposed to environmental, asbestos and other latent

injury claims arising from insurance and reinsurance contracts. Loss reserve estimates for environmental and asbestos

exposures include case basis reserves, which also reflect reserves for legal and other loss adjustment expenses and IBNR

reserves. IBNR reserves are determined based upon Berkshires historic general liability exposure base and policy

language, previous environmental and loss experience and the assessment of current trends of environmental law,

environmental cleanup costs, asbestos liability law and judgmental settlements of asbestos liabilities.

The liabilities for environmental, asbestos, and latent injury claims and claims expenses net of reinsurance

recoverables were approximately $6.6 billion at December 31, 2002 and $6.3 billion at December 31, 2001.

Approximately, $5.2 billion of year end 2002 reserves were assumed under retroactive reinsurance contracts written by

the Berkshire Hathaway Reinsurance Group. Claim liabilities arising from these contracts are subject to aggregate

policy limits. Thus, Berkshires exposure to environmental and latent injury claims under these contracts are, likewise,

limited. Claims paid or reserved under these policies were approximately 85% of aggregate policy limits as of the end

of 2002.

Berkshire monitors evolving case law and its effect on environmental and latent injury claims. Changing

government regulations, newly identified toxins, newly reported claims, new theories of liability, new contract

interpretations and other factors could result in significant increases in these liabilities. Such development could be

material to Berkshires results of operations. It is not possible to estimate reliably the amount of additional net loss, or

the range of net loss, that is reasonably possible.

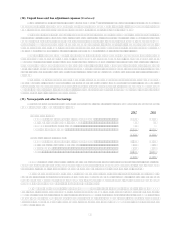

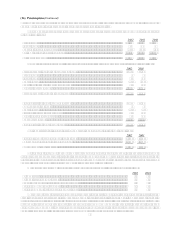

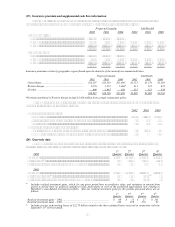

(11) Notes payable and other borrowings

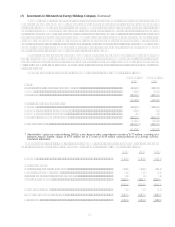

Notes payable and other borrowings of Berkshire and its subsidiaries as of December 31, 2002 and 2001 are

summarized below. Amounts are in millions.

2002 2001

Insurance and other:

Commercial paper and other short-term borrowings .................................. $2,205 $1,777

Borrowings under investment agreements.................................................. 770 478

SQUARZ notes payable due 2007.............................................................. 400

Other debt due 2003-2032 .......................................................................... 1,432 1,230

$4,807 $3,485

Finance and financial products:

Commercial paper and other short-term borrowings ................................. $ 204 $2,073

Borrowings of Berkadia LLC due 2006...................................................... 2,175 4,900

Notes payable ............................................................................................. 1,454 1,650

Other ........................................................................................................... 648 396

$4,481 $9,019

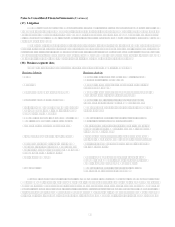

Commercial paper and other short-term borrowings are obligations of certain businesses that utilize short-term

borrowings as part of their day-to-day operations. Berkshire affiliates have approximately $3.6 billion available unused

lines of credit to support their short-term borrowing programs and, otherwise, provide additional liquidity.

Borrowings under investment agreements are made pursuant to contracts calling for interest payable, normally

semiannually, at fixed rates ranging from 2.5% to 8.6% per annum. Contractual maturities of borrowings under

investment agreements generally range from 3 months to 30 years. Under certain conditions, these borrowings may be

redeemable without premium prior to the contractual maturity dates.

On May 28, 2002, Berkshire issued 40,000 SQUARZ securities for net proceeds of $398 million. Each SQUARZ

security consists of a $10,000 par amount senior note due in November 2007 together with a warrant, which expires in

May 2007, to purchase either 0.1116 shares of Class A common stock or 3.3480 shares of Class B common stock for

$10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at

a rate of 3.00% per annum. All debt and warrants issued in conjunction with SQUARZ securities were outstanding at

December 31, 2002.