Berkshire Hathaway 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Insurance — Underwriting (Continued)

GEICO

GEICO provides primarily private passenger automobile coverages to insureds in 48 states and the District

of Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for

coverage directly to the company over the telephone, through the mail or via the Internet. This is a significant

element in GEICO’ s strategy to be a low cost insurer and, yet, provide high value to policyholders.

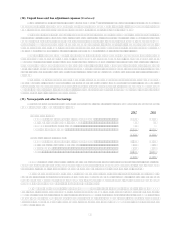

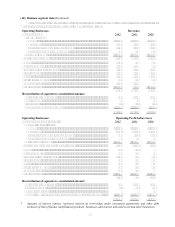

GEICO's underwriting results for the past three years are summarized below.

— (dollars in millions) —

2002 2001 2000

Amount %Amount %Amount %

Premiums written ...................................................... $6,963 $6,176 $5,778

Premiums earned....................................................... $6,670 100.0 $6,060 100.0 $5,610 100.0

Losses and loss adjustment expenses........................ 5,137 77.0 4,842 79.9 4,809 85.7

Underwriting expenses.............................................. 1,117 16.8 997 16.5 1,025 18.3

Total losses and expenses.......................................... 6,254 93.8 5,839 96.4 5,834 104.0

Pre-tax underwriting gain (loss)................................ $ 416 $ 221 $ (224)

Premiums earned in 2002 were $6,670 million, up 10.1% from $6,060 million in 2001. The growth in

premiums earned for voluntary auto was 9.6%, reflecting a 9.0% increase in policies-in-force during the past year. In

2001, premiums earned were $6,060 million, an increase of 8.0% over 2000. The increase in premiums in 2001 was

due to increased rates, as policies-in-force declined 0.8%.

Policies-in-force over the last twelve months increased 7.0% in the preferred risk auto market and increased

17.4% in the standard and nonstandard auto lines. Voluntary auto new business sales in 2002 increased 30.9%

compared to 2001. The sales closure ratio (new policies written to quotes) and the policy retention rate both improved

in 2002 aided by recent rate increases taken by competitors. Total voluntary auto policies-in-force at December 31,

2002 were 419,000 higher than at December 31, 2001, following a slight decline in policies-in-force in 2001 from

2000.

Losses and loss adjustment expenses incurred increased 6.1% to $5,137 million in 2002. GEICO’ s loss ratio

was 77.0% in 2002 compared to 79.9% in 2001. The improvement reflects the impact of rate increases and better than

expected loss experience. Claims frequency changes have been slight for most coverages. In 2002, claim frequencies

benefited from mild winter weather during the first quarter while during 2001 claim frequencies were lower than

normal due to the September 11th terrorist attack. In 2002, claim severity continued to increase but at a slower rate than

in 2001. Catastrophe losses added 0.3 points to the loss ratio in 2002 compared to 0.8 points in 2001.

GEICO companies are defendants in several class action lawsuits related to the use of collision repair parts not

produced by the original auto manufacturers, the calculation of “total loss” value and whether to pay diminished value

as part of the settlement of certain claims. GEICO intends to vigorously defend its position on these claim settlement

procedures. However, the lawsuits are in various stages of development and the ultimate outcome cannot be reasonably

determined at this time.

Underwriting expenses for 2002 were $1,117 million, an increase of $120 million (12.0%) from 2001,

following a decrease of $28 million in 2001 from 2000. Advertising expense was unchanged in 2002 as compared to

2001 and significantly lower than in 2000. Underwriting expenses reflect higher associate profit sharing expense than

in 2001.

GEICO’ s business produced outstanding underwriting results in each of the past two years reflecting

favorable claims experience and the effects of rate increases taken primarily in 2000. GEICO believes its rates are

adequate in nearly all states and expects additional policy growth in 2003 as competitors increase their rates.

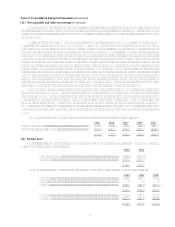

General Re

General Re conducts a reinsurance business, which provides reinsurance coverage in the United States and

worldwide. General Re’ s principal reinsurance operations are comprised of: (1) North American property/casualty,

(2) international property/casualty, which consists of reinsurance business written principally through Germany-

based Cologne Re and London market business written principally through the Faraday operations, and (3) global

life/health. At December 31, 2002, General Re had an 89% economic ownership interest in Cologne Re.