Berkshire Hathaway 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Ajit Jain’ s reinsurance division was the major reason our float cost us so little last year. If we ever

put a photo in a Berkshire annual report, it will be of Ajit. In color!

Ajit’ s operation has amassed $13.4 billion of float, more than all but a handful of insurers have ever

built up. He accomplished this from a standing start in 1986, and even now has a workforce numbering only

20. And, most important, he has produced underwriting profits.

His profits are particularly remarkable if you factor in some accounting arcana that I am about to lay

on you. So prepare to eat your spinach (or, alternatively, if debits and credits aren’ t your thing, skip the next

two paragraphs).

Ajit’ s 2002 underwriting profit of $534 million came after his operation recognized a charge of $428

million attributable to “retroactive” insurance he has written over the years. In this line of business, we

assume from another insurer the obligation to pay up to a specified amount for losses they have already

incurred – often for events that took place decades earlier – but that are yet to be paid (for example, because a

worker hurt in 1980 will receive monthly payments for life). In these arrangements, an insurer pays us a large

upfront premium, but one that is less than the losses we expect to pay. We willingly accept this differential

because a) our payments are capped, and b) we get to use the money until loss payments are actually made,

with these often stretching out over a decade or more. About 80% of the $6.6 billion in asbestos and

environmental loss reserves that we carry arises from capped contracts, whose costs consequently can’ t

skyrocket.

When we write a retroactive policy, we immediately record both the premium and a reserve for the

expected losses. The difference between the two is entered as an asset entitled “deferred charges –

reinsurance assumed.” This is no small item: at yearend, for all retroactive policies, it was $3.4 billion. We

then amortize this asset downward by charges to income over the expected life of each policy. These charges

– $440 million in 2002, including charges at Gen Re – create an underwriting loss, but one that is intentional

and desirable. And even after this drag on reported results, Ajit achieved a large underwriting gain last year.

We want to emphasize, however, that we assume risks in Ajit’ s operation that are huge – far larger

than those retained by any other insurer in the world. Therefore, a single event could cause a major swing in

Ajit’ s results in any given quarter or year. That bothers us not at all: As long as we are paid appropriately, we

love taking on short-term volatility that others wish to shed. At Berkshire, we would rather earn a lumpy

15% over time than a smooth 12%.

If you see Ajit at our annual meeting, bow deeply.

* * * * * * * * * * * *

Berkshire’ s smaller insurers had an outstanding year. Their aggregate float grew by 38%, and they

realized an underwriting profit of $32 million, or 4.5% of premiums. Collectively, these operations would

make one of the finest insurance companies in the country.

Included in these figures, however, were terrible results in our California workers’ compensation

operation. There, we have work to do. There, too, our reserving severely missed the mark. Until we figure

out how to get this business right, we will keep it small.

For the fabulous year they had in 2002, we thank Rod Eldred, John Kizer, Tom Nerney, Don Towle

and Don Wurster. They added a lot of value to your Berkshire investment.

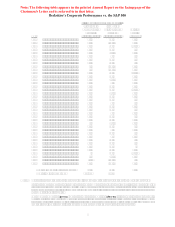

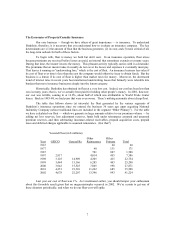

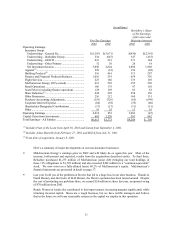

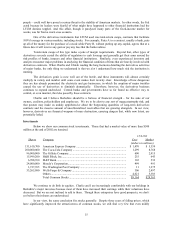

Sources of Reported Earnings

The table that follows shows the main sources of Berkshire’ s reported earnings. You will notice that

“Purchase-Accounting Adjustments” dropped sharply in 2002, the reason being that GAAP rules changed

then, no longer requiring the amortization of goodwill. This change increases our reported earnings, but has

no effect on our economic earnings.