Berkshire Hathaway 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Notes to Consolidated Financial Statements (Continued)

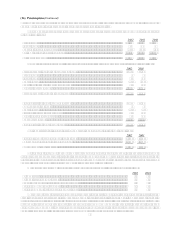

(11) Notes payable and other borrowings (Continued)

During the second quarter of 2001, Berkshire filed a shelf registration to issue up to $700 million in new debt

securities at a future date. The intended purpose of the future issuance of debt is to fund the repayment of borrowings of

certain Berkshire subsidiaries. The timing and amount of the debt to be issued under the shelf registration has not yet

been determined.

Borrowings of Berkadia LLC ("Berkadia") relate to Berkadia's loan to FINOVA Capital Corporation ("FNV

Capital"), a subsidiary of The FINOVA Group ("FNV"). On August 21, 2001, Berkshire and Leucadia National

Corporation (Leucadia), through Berkadia LLC, a newly formed and jointly owned entity formed for this purpose,

loaned $5.6 billion on a senior secured basis (the Berkadia Loan) to FNV Capital, in connection with a restructuring

of all of FNV Capitals then outstanding bank debt and publicly traded debt securities. Berkadia financed the entire

Berkadia Loan through a third party lending facility led by Fleet Bank (Fleet Loan). Both the Berkadia Loan and the

Fleet Loan are due on August 20, 2006. Under the terms of the Fleet Loan, which is collateralized by the Berkadia

Loan, Berkadia is obligated to use the proceeds received from principal prepayments on the Berkadia Loan to prepay the

Fleet Loan. Among other things, the Fleet Loan requires that FNV maintain a minimum ratio of its consolidated assets

to the outstanding Fleet Loan balance. Berkadia is required to pay down the loan to the extent such ratio is under the

minimum. Berkshire provided Berkadias lenders with a 90% primary guaranty of the Berkadia Loan and also provided

a secondary guaranty to a 10% primary guaranty provided by Leucadia. Berkshire has a 90% economic interest in both

the Berkadia Loan and the Fleet Loan. Subsequent to December 31, 2002, FNV has prepaid an additional $450 million

principal amount on the Berkadia Loan and Berkadia has prepaid an identical amount on the Fleet Loan.

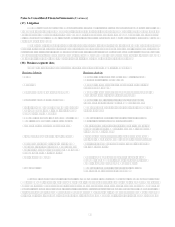

In connection with the restructuring and concurrent with Berkadias loan to FNV Capital, Berkadia received

61,020,581 shares of FNV common stock representing 50% of the total FNV outstanding shares. Berkadia initially

recorded the FNV common stock at fair value and subsequently accounted for the stock pursuant to the equity method.

Berkshire and Leucadia each possess a 50% economic interest in Berkadias ownership of FNV common stock. Due to

large operating losses of FNV between August 21, 2001 and September 30, 2001, Berkadias investment in FNV

common stock was written down to zero through the application of the equity method. Consequently, the equity method

was suspended as of September 30, 2001, because neither Berkshire nor Berkadia has guaranteed any obligations of

FNV.

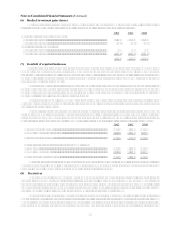

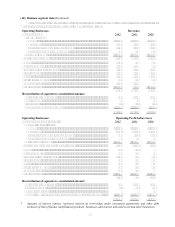

Payments of principal amounts expected during the next five years are as follows (in millions).

2003 2004 2005 2006 2007

Insurance and other.............................................................. $2,270 $ 23 $ 263 $ 99 $ 557

Finance and financial products ............................................ 1,612 1,093 500 465 93

$3,882 $1,116 $ 763 $ 564 $ 650

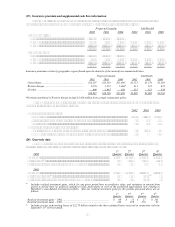

(12) Income taxes

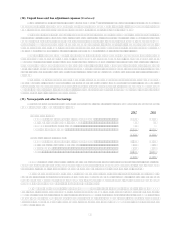

The liability for income taxes as of December 31, 2002 and 2001 as reflected in the accompanying Consolidated

Balance Sheets is as follows (in millions). 2002 2001

Payable currently ................................................................................. $ (21) $ (272)

Deferred ............................................................................................... 8,072 7,293

$8,051 $7,021

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2002 2001 2000

Federal ................................................................................................. $1,991 $ 629 $2,136

State ..................................................................................................... 87 68 32

Foreign................................................................................................. 56 (77) (150)

$2,134 $ 620 $2,018

Current ................................................................................................. $2,259 $ 109 $2,012

Deferred ............................................................................................... (125) 511 6

$2,134 $ 620 $2,018