Berkshire Hathaway 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

Last year MEHC acquired two important gas pipelines. The first, Kern River, extends from

Southwest Wyoming to Southern California. This line moves about 900 million cubic feet of gas a day and

is undergoing a $1.2 billion expansion that will double throughput by this fall. At that point, the line will

carry enough gas to generate electricity for ten million homes.

The second acquisition, Northern Natural Gas, is a 16,600 mile line extending from the Southwest

to a wide range of Midwestern locations. This purchase completes a corporate odyssey of particular

interest to Omahans.

From its beginnings in the 1930s, Northern Natural was one of Omaha’ s premier businesses, run

by CEOs who regularly distinguished themselves as community leaders. Then, in July, 1985, the company

– which in 1980 had been renamed InterNorth – merged with Houston Natural Gas, a business less than

half its size. The companies announced that the enlarged operation would be headquartered in Omaha,

with InterNorth’ s CEO continuing in that job.

Within a year, those promises were broken. By then, the former CEO of Houston Natural had

taken over the top job at InterNorth, the company had been renamed, and the headquarters had been moved

to Houston. These switches were orchestrated by the new CEO – Ken Lay – and the name he chose was

Enron.

Fast forward 15 years to late 2001. Enron ran into the troubles we’ ve heard so much about and

borrowed money from Dynegy, putting up the Northern Natural pipeline operation as collateral. The two

companies quickly had a falling out, and the pipeline’ s ownership moved to Dynegy. That company, in

turn, soon encountered severe financial problems of its own.

MEHC received a call on Friday, July 26, from Dynegy, which was looking for a quick and

certain cash sale of the pipeline. Dynegy phoned the right party: On July 29, we signed a contract, and

shortly thereafter Northern Natural returned home.

When 2001 began, Charlie and I had no idea that Berkshire would be moving into the pipeline

business. But upon completion of the Kern River expansion, MEHC will transport about 8% of all gas

used in the U.S. We continue to look for large energy-related assets, though in the electric utility field

PUHCA constrains what we can do.

* * * * * * * * * * * *

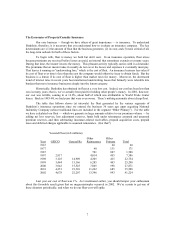

A few years ago, and somewhat by accident, MEHC found itself in the residential real estate

brokerage business. It is no accident, however, that we have dramatically expanded the operation.

Moreover, we are likely to keep on expanding in the future.

We call this business HomeServices of America. In the various communities it serves, though, it

operates under the names of the businesses it has acquired, such as CBS in Omaha, Edina Realty in

Minneapolis and Iowa Realty in Des Moines. In most metropolitan areas in which we operate, we are the

clear market leader.

HomeServices is now the second largest residential brokerage business in the country. On one

side or the other (or both), we participated in $37 billion of transactions last year, up 100% from 2001.

Most of our growth came from three acquisitions we made during 2002, the largest of which was

Prudential California Realty. Last year, this company, the leading realtor in a territory consisting of Los

Angeles, Orange and San Diego Counties, participated in $16 billion of closings.

In a very short period, Ron Peltier, the company’ s CEO, has increased HomeServices’ revenues –

and profits – dramatically. Though this business will always be cyclical, it’ s one we like and in which we

continue to have an appetite for sensible acquisitions.

* * * * * * * * * * * *

Dave Sokol, MEHC’ s CEO, and Greg Abel, his key associate, are huge assets for Berkshire. They

are dealmakers, and they are managers. Berkshire stands ready to inject massive amounts of money into

MEHC – and it will be fun to watch how far Dave and Greg can take the business.