Berkshire Hathaway 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

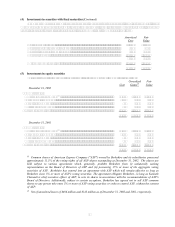

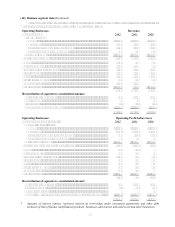

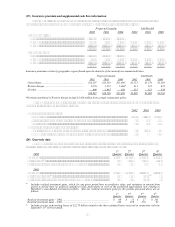

(18) Business segment data (Continued)

A disaggregation of Berkshires consolidated data for each of the three most recent years is presented in the tables

which follow on this and the following page. Amounts are in millions.

Operating Businesses: Revenues

Insurance group: 2002 2001 2000

Premiums earned:

GEICO.................................................................................................... $ 6,670 $ 6,060 $ 5,610

General Re.............................................................................................. 8,500 8,353 8,696

Berkshire Hathaway Reinsurance Group................................................ 3,300 2,991 4,712

Berkshire Hathaway Primary Group....................................................... 712 501 325

Investment income..................................................................................... 3,067 2,844 2,796

Total insurance group................................................................................... 22,249 20,749 22,139

Apparel......................................................................................................... 1,619 726 678

Building products ......................................................................................... 3,702 3,269 178

Finance and financial products..................................................................... 2,126 1,658 1,505

Flight services .............................................................................................. 2,837 2,563 2,279

Retail ............................................................................................................ 2,103 1,998 1,864

Scott Fetzer Companies................................................................................ 899 914 963

Shaw Industries ............................................................................................ 4,334 4,012

Other businesses........................................................................................... 1,983 1,488 1,436

41,852 37,377 31,042

Reconciliation of segments to consolidated amount:

Realized investment gains ......................................................................... 637 1,363 3,955

Other revenues........................................................................................... 29 35 54

Eliminations............................................................................................... (56) (65) (26)

Purchase-accounting adjustments.............................................................. (109) (67) (136)

$42,353 $38,643 $34,889

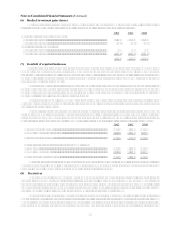

Operating Businesses: Operating Profit before taxes

Insurance group operating profit: 2002 2001 2000

Underwriting profit (loss):

GEICO.................................................................................................... $ 416 $ 221 $ (224)

General Re.............................................................................................. (1,393) (3,671) (1,254)

Berkshire Hathaway Reinsurance Group................................................ 534 (647) (162)

Berkshire Hathaway Primary Group....................................................... 32 30 25

Net investment income.............................................................................. 3,050 2,824 2,773

Total insurance group operating profit (loss) ............................................... 2,639 (1,243) 1,158

Apparel......................................................................................................... 229 (33) 6

Building products ......................................................................................... 516 461 34

Finance and financial products..................................................................... 1,016 519 530

Flight services .............................................................................................. 225 186 213

Retail ............................................................................................................ 166 175 175

Scott Fetzer Companies................................................................................ 129 129 122

Shaw Industries ............................................................................................ 424 292

Other businesses........................................................................................... 691 377 320

6,035 863 2,558

Reconciliation of segments to consolidated amount:

Realized investment gains ......................................................................... 603 1,320 3,955

Interest expense* ....................................................................................... (86) (92) (92)

Corporate and other................................................................................... 2 8 22

Goodwill amortization and other purchase-accounting adjustments ......... (119) (630) (856)

$ 6,435 $ 1,469 $ 5,587

* Amounts of interest expense represent interest on borrowings under investment agreements and other debt

exclusive of that of finance and financial products businesses and interest allocated to certain other businesses.