Berkshire Hathaway 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2002 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities.................................................... Inside Front Cover

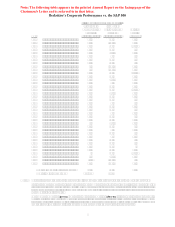

Corporate Performance vs. the S&P 500 ................................................ 2

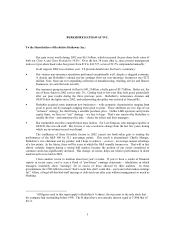

Chairman's Letter*.................................................................................. 3

Selected Financial Data For The

Past Five Years .................................................................................. 24

Acquisition Criteria ................................................................................25

Independent Auditors' Report ................................................................. 25

Consolidated Financial Statements.........................................................26

Management's Discussion....................................................................... 52

Owner's Manual...................................................................................... 68

Common Stock Data............................................................................... 75

Major Operating Companies................................................................... 76

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2003 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

... Independent Auditors' Report ...25 Consolidated Financial Statements ...26 Management's Discussion...52 Owner's Manual ...68 Common Stock Data...75 Major Operating Companies...76 Directors and Officers of the Company ...Inside Back Cover *Copyright © 2003 By Warren E. Buffett All Rights Reserved -

Page 2

... investing strategies, including commercial lending and real estate lending (BH Finance and Berkshire Hathaway Credit Corporation), transportation equipment leasing (XTRA), and risk management activities (General Re Securities). In addition, Berkshire' s other non-insurance business activities... -

Page 3

....2 Average Annual Gain î º 1965-2002 Overall Gain î º 1964-2002 Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market... -

Page 4

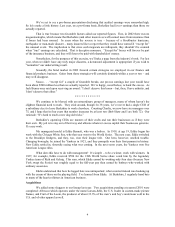

... back to low-cost float feels good, particularly after our poor results during the three previous years. Berkshire' s reinsurance division and GEICO shot the lights out in 2002, and underwriting discipline was restored at General Re. Berkshire acquired some important new businesses - with economic... -

Page 5

... s hard to teach a new dog old tricks." Berkshire' s operating CEOs are masters of their crafts and run their businesses as if they were their own. My job is to stay out of their way and allocate whatever excess capital their businesses generate. It' s easy work. My managerial model is Eddie Bennett... -

Page 6

.... The largest acquisition we initiated in 2002 was The Pampered Chef, a company with a fascinating history dating back to 1980. Doris Christopher was then a 34-year-old suburban Chicago home economics teacher with a husband, two little girls, and absolutely no business background. Wanting, however... -

Page 7

... 2001. Most of our growth came from three acquisitions we made during 2002, the largest of which was Prudential California Realty. Last year, this company, the leading realtor in a territory consisting of Los Angeles, Orange and San Diego Counties, participated in $16 billion of closings. In a very... -

Page 8

... invests the money. This pleasant activity typically carries with it a downside: The premiums that an insurer takes in usually do not cover the losses and expenses it eventually must pay. That leaves it running an "underwriting loss," which is the cost of float. An insurance business has value... -

Page 9

... - and they did it. It takes time for insurance policies to run off, however, and 2002 was well along before we managed to reduce our aggregation of nuclear, chemical and biological risk (NCB) to a tolerable level. That problem is now behind us. On another front, Gen Re' s underwriting attitude has... -

Page 10

... most states, shareholders get a special 8% discount. Here' s one footnote to GEICO' s 2002 earnings that underscores the need for insurers to do business with only the strongest of reinsurers. In 1981-1983, the managers then running GEICO decided to try their hand at writing commercial umbrella and... -

Page 11

Ajit Jain' s reinsurance division was the major reason our float cost us so little last year. If we ever put a photo in a Berkshire annual report, it will be of Ajit. In color! Ajit' s operation has amassed $13.4 billion of float, more than all but a handful of insurers have ever built up. He ... -

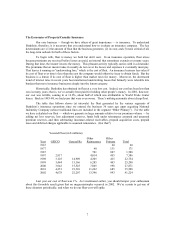

Page 12

... 2002 2001 Operating Earnings: Insurance Group: Underwriting - General Re...Underwriting - Berkshire Group ...Underwriting - GEICO...Underwriting - Other Primary ...Net Investment Income...Apparel(1) ...Building Products(2) ...Finance and Financial Products Business ...Flight Services ...MidAmerican... -

Page 13

... gains in both sales and profits. Nebraska Furniture Mart will open a new blockbuster store in metropolitan Kansas City in August. With 450,000 square feet of retail space, it could well produce the second largest volume of any furniture store in the country - the Omaha operation being the... -

Page 14

... accounting. But often there is no real market (think about our contract involving twins) and "mark-to-model" is utilized. This substitution can bring on large-scale mischief. As a general rule, contracts involving multiple reference items and distant settlement dates increase the opportunities... -

Page 15

...(or both). The bonuses were paid, and the CEO profited from his options. Only much later did shareholders learn that the reported earnings were a sham. Another problem about derivatives is that they can exacerbate trouble that a corporation has run into for completely unrelated reasons. This pile-on... -

Page 16

...Moody' s Corporation...The Washington Post Company ...Wells Fargo & Company ...Others ...Total Common Stocks ... We continue to do little in equities. Charlie and I are increasingly comfortable with our holdings in Berkshire' s major investees because most of them have increased their earnings while... -

Page 17

...and investing in stocks are alike in certain ways: Both activities require us to make a price-value calculation and also to scan hundreds of securities to find the very few that have attractive reward/risk ratios. But there are important differences between the two disciplines as well. In stocks, we... -

Page 18

... of investment-company boards meet annually to carry out the vital job of selecting who will manage the savings of the millions of owners they represent. Year after year the directors of Fund A select manager A, Fund B directors select manager B, etc...in a zombie-like process that makes a mockery... -

Page 19

... - the fund has not changed managers). Investment company directors have failed as well in negotiating management fees (just as compensation committees of many American companies have failed to hold the compensation of their CEOs to sensible levels). If you or I were empowered, I can assure you that... -

Page 20

... worth, not by their compensation. That' s the equation for Charlie and me as managers, and we think it' s the right one for Berkshire directors as well. To find new directors, we will look through our shareholders list for people who directly, or in their family, have had large Berkshire holdings... -

Page 21

... misdoings early in the process, well before specious figures become embedded in the company' s books. Fear of the plaintiff' s bar will see to that The Chicago Tribune ran a four-part series on Arthur Andersen last September that did a great job of illuminating how accounting standards and audit... -

Page 22

... their declared targets. Managers that always promise to "make the numbers" will at some point be tempted to make up the numbers. Shareholder-Designated Contributions About 97.3% of all eligible shares participated in Berkshire's 2002 shareholder-designated contributions program, with contributions... -

Page 23

... The Pampered Chef display, where you may run into Doris and Sheila. GEICO will have a booth staffed by a number of its top counselors from around the country, all of them ready to supply you with auto insurance quotes. In most cases, GEICO will be able to give you a special shareholder discount... -

Page 24

... last year, I decided to hang up my spikes. So I' ll see you on Saturday night at NFM instead Next year our meeting will be held at Omaha' s new convention center. This switch in locations will allow us to hold the event on either Saturday or Monday, whichever the majority of you prefer. Using the... -

Page 25

BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2002 Revenues: Insurance premiums earned ...Sales and service revenues...Interest, dividend and other investment income ...Revenues of finance and financial products ... -

Page 26

... about new ventures, turnarounds, or auction-like sales: "When the phone don't ring, you'll know it's me." _____ INDEPENDENT AUDITORS' REPORT To the Board of Directors and Shareholders Berkshire Hathaway Inc. We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc... -

Page 27

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions except per share amounts) December 31, 2002 2001 ASSETS Insurance and Other: Cash and cash equivalents...Investments: Securities with fixed maturities ...Equity securities ...Other investments ...Insurance ... -

Page 28

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions except per share amounts) December 31, 2001 2002 LIABILITIES AND SHAREHOLDERS' EQUITY Insurance and Other: Losses and loss adjustment expenses ...Unearned premiums ...Life and health insurance benefits...Other... -

Page 29

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 2002 2001 2000 Revenues: Insurance and Other: Insurance premiums earned...Sales and service revenues ...Interest, dividend and other investment income ... -

Page 30

... and maturities of securities with fixed maturities ...Proceeds from sales of equity securities...Loans and investments originated in finance businesses...Principal collection on loans and investments originated in finance businesses...Acquisitions of businesses, net of cash acquired...Other...Net... -

Page 31

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2002 2001 2000 Class A & B Common Stock Balance at beginning and end of year ...$ 8 $ 8 $ 8 Capital in Excess of Par Value ... -

Page 32

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2002 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. (Â"BerkshireÂ" or Â"CompanyÂ") is a holding company owning subsidiaries engaged in a number of diverse business... -

Page 33

... 20% voting interests based upon the facts and circumstances including representation on the Board of Directors, contractual veto or approval rights, participation in policy making processes, the existence or absence of other significant owners and the expected duration of the investment. Berkshire... -

Page 34

... Consolidated Balance Sheets at discounted amounts. Discounted amounts pertaining to workersÂ' compensation risks are based upon an annual discount rate of 4.5%, which is the same discount rate used under statutory accounting principles. The discounted amounts for structured settlement reinsurance... -

Page 35

... and the associated asset retirement costs. SFAS 143 became effective for Berkshire on January 1, 2003. In June 2002, the FASB issued SFAS 146, Â"Accounting for Costs Associated with Exit or Disposal Activities,Â" which addresses financial accounting and reporting for costs associated with exit or... -

Page 36

... line of high-quality custom picture framing products primarily under the Larson-Juhl name. Fruit of the Loom (Â"FOLÂ") On April 30, 2002, Berkshire acquired the basic apparel business of Fruit of the Loom, LTD. FOL is a leading vertically integrated basic apparel company manufacturing and marketing... -

Page 37

... power projects. It also owns the second largest residential real estate brokerage firm in the U.S. While the convertible preferred stock does not vote generally with the common stock in the election of directors, the convertible preferred stock gives Berkshire the right to elect 20% of MidAmerican... -

Page 38

...stock. Therefore, Berkshire is accounting for its investments in common and convertible preferred stock of MidAmerican pursuant to the equity method. Berkshire's aggregate investments in MidAmerican are included in the Consolidated Balance Sheets as Investments in MidAmerican Energy Holdings Company... -

Page 39

... to Consolidated Financial Statements (Continued) (4) Investments in securities with fixed maturities Investments in securities with fixed maturities as of December 31, 2002 and 2001 are shown below (in millions). Amortized Cost December 31, 2002 Insurance and other: Available-for-sale: Obligations... -

Page 40

... securities Data with respect to investments in equity securities are shown below. Amounts are in millions. Unrealized Cost Gains(2) December 31, 2002 Common stock of: American Express Company(1) ...The Coca-Cola Company ...The Gillette Company...Wells Fargo & Company ...Other equity securities... -

Page 41

... to BerkshireÂ's equity method investment in MidAmerican. Dollar amounts are in millions, except per share amounts. 2002 2001 2000 Net earnings as reported ...Goodwill amortization, after tax...Net earnings as adjusted ...Earnings per equivalent share of Class A common stock: As reported ...Goodwill... -

Page 42

...the partnership are allocated to the partners based upon each partnerÂ's investment. At December 31, 2002, the carrying value of $603 million (including BerkshireÂ's share of accumulated earnings of $173 million) is included as a component of other assets of finance and financial products businesses... -

Page 43

... to the provisions of FIN 46, Berkshire will be required to consolidate the accounts of Value Capital in the third quarter of 2003. This change will have no effect on reported net earnings but based upon December 31, 2002 balances will increase BerkshireÂ's reported assets by about $20 billion with... -

Page 44

... 3.3480 shares of Class B common stock for $10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00% per annum. All debt and warrants issued in conjunction with SQUARZ securities were outstanding at December 31, 2002. 43 -

Page 45

Notes to Consolidated Financial Statements (Continued) (11) Notes payable and other borrowings (Continued) During the second quarter of 2001, Berkshire filed a shelf registration to issue up to $700 million in new debt securities at a future date. The intended purpose of the future issuance of debt ... -

Page 46

... reinsurance assumed, deferred policy acquisition costs, unrealized gains and losses on investments in securities with fixed maturities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired... -

Page 47

...two-hundredth (1/200) of the voting rights of a share of Class A common stock. Class A and Class B common shares vote together as a single class. (15) Fair values of financial instruments The estimated fair values of BerkshireÂ's financial instruments as of December 31, 2002 and 2001, are as follows... -

Page 48

... projected benefit obligations were as follows. Discount rate...Discount rate Â- non-U.S. plans...Long-term expected rate of return on plan assets ...Rate of compensation increase ...Rate of compensation increase Â- non-U.S. plans...2002 6.3 5.9 6.5 4.7 3.8 2001 6.6 6.0 6.7 4.8 4.3 Most Berkshire... -

Page 49

... programs for general aviation aircraft Retail sales of home furnishings, appliances, electronics, fine jewelry and gifts FlightSafety and NetJets (Â"Flight servicesÂ") Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, JordanÂ's Furniture, BorsheimÂ's, Helzberg Diamond... -

Page 50

.... Operating Businesses: Insurance group: Premiums earned: GEICO...General Re ...Berkshire Hathaway Reinsurance Group...Berkshire Hathaway Primary Group...Investment income...Total insurance group...Apparel...Building products ...Finance and financial products...Flight services ...Retail ...Scott... -

Page 51

... 282 Operating Businesses: Insurance group: GEICO ...General Re...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Total insurance group...Apparel...Building products...Finance and financial products...Flight services ...Retail ...Scott Fetzer Companies ...Shaw Industries... -

Page 52

... finance and financial products businesses...Other interest ...Non-cash investing and financing activities: Liabilities assumed in connection with acquisitions of businesses ...Common shares issued in connection with acquisitions of businesses...(20) Quarterly data A summary of revenues and earnings... -

Page 53

...Berkshire' s principal insurance businesses are: (1) GEICO, the sixth largest auto insurer in the U.S., (2) General Re, one of the four largest reinsurers in the world, (3) Berkshire Hathaway Reinsurance Group ("BHRG") and (4) Berkshire Hathaway Primary Group. Berkshire' s management views insurance... -

Page 54

... primarily private passenger automobile coverages to insureds in 48 states and the District of Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to the company over the telephone, through the mail or via the Internet. This is... -

Page 55

... of new business written. Premiums earned in 2001 included $400 million from one retroactive reinsurance contract and a large quota share agreement. An aggregate excess reinsurance contract produced earned premiums of $404 million in 2000. There were no such contracts written in 2002. The North... -

Page 56

...in claims exceeding General Re' s attachment point; (b) escalating medical inflation and utilization that adversely affect workers' compensation and other casualty lines; (c) an increased frequency in corporate bankruptcies, scandals and accounting restatements which increased losses under directors... -

Page 57

... business in continental Europe and parts of Asia, partially offset by increases in the United Kingdom and Australia. London market premiums in local currencies increased 41.9% primarily due to increased participation in Faraday Syndicate 435 from 60.6% in 2001 to 96.7% in 2002. Premiums earned... -

Page 58

...cedant reports for continental Europe and certain other international markets are generally required less frequent or are due later than those provided by North American cedants. Global life/health General Re' s global life/health affiliates reinsure such risks worldwide. Premiums earned in 2002 for... -

Page 59

... "Homestate" operations, providers of standard multi-line insurance; and Central States Indemnity Company, a provider of credit and disability insurance to individuals nationwide through financial institutions. Collectively, Berkshire' s other primary insurance businesses produced earned premiums of... -

Page 60

...of these investments. However, the Company also believes that over time these investments will produce reasonable returns in relation to credit risk. Non-Insurance Businesses Berkshire's numerous non-insurance businesses grew significantly through the acquisition of a number of businesses subsequent... -

Page 61

... in proprietary trading strategies, General Re Securities ("GRS"), a dealer in derivative contracts, Berkadia LLC, a special purpose commercial lender, and XTRA Corporation, a transportation equipment leasing business. Pre-tax earnings of the finance and financial products group in 2002 increased... -

Page 62

... common management. Principal businesses in this group of companies sell products under the Kirby (home cleaning systems), Campbell Hausfeld (air compressors, paint sprayers, generators and pressure washers) and World Book (encyclopedias and other educational products) names. Revenues in 2002 from... -

Page 63

...and convertible preferred stock of MidAmerican. Berkshire' s earnings from these investments totaled $435 million in 2002 and $165 million in 2001. MidAmerican' s earnings in 2002 benefited from acquisitions of two natural gas pipelines and acquisitions of three real estate brokerage businesses. The... -

Page 64

Financial Condition Berkshire' s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated shareholders' equity at December 31, 2002 totaled $64.0 billion. Consolidated cash and invested assets, excluding assets of finance and financial products businesses, ... -

Page 65

... troubled by short term equity price volatility with respect to its investments provided that the underlying business, economic and management characteristics of the investees remain favorable. Berkshire strives to maintain above average levels of shareholder capital to provide a margin of safety... -

Page 66

...prices or management's estimates of fair value as of the balance sheet dates. Market prices are subject to fluctuation and, consequently, the amount realized in the subsequent sale of an investment may significantly differ from the reported market value. Fluctuation in the market price of a security... -

Page 67

... fair value pricing models. Berkshire' s finance businesses maintain significant balances of finance receivables, which are carried at amortized cost. Considerable judgment is required in determining the assumptions used in certain pricing models, which may address interest rates, loan prepayment... -

Page 68

Critical Accounting Policies (Continued) Berkshire' s Consolidated Balance Sheet as of December 31, 2002 includes goodwill of acquired businesses of approximately $22.3 billion. These amounts have been recorded as a result of Berkshire' s numerous prior business acquisitions accounted for under the ... -

Page 69

...effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which... -

Page 70

... and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and availability of businesses and the need for insurance capital determine any... -

Page 71

..., Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and "float," the funds of others that our insurance business holds because it receives premiums before needing to pay out... -

Page 72

... existing shareholders' money: Owners unfairly lose if their managers deliberately sell assets for 80¢ that in fact are worth $1. We didn't commit that kind of crime in our offering of Class B shares and we never will. (We did not, however, say at the time of the sale that our stock was overvalued... -

Page 73

...can't control Berkshire's price. But by our policies and communications, we can encourage informed, rational behavior by owners that, in turn, will tend to produce a stock price that is also rational. Our it's-as-bad-to-be-overvalued-as-to-be-undervalued approach may disappoint some shareholders. We... -

Page 74

... of the heavy lifting in this business to the managers of our subsidiaries. In fact, we delegate almost to the point of abdication: Though Berkshire has about 45,000 employees, only 12 of these are at headquarters. Charlie and I mainly attend to capital allocation and the care and feeding of our key... -

Page 75

... one executive becoming responsible for investments and another for operations. If the acquisition of new businesses is in prospect, the two will cooperate in making the decisions needed. Both executives will report to a board of directors who will be responsive to the controlling shareholder, whose... -

Page 76

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 77

... Corporation H. H. Brown Shoe Group Halex (1) Helzberg's Diamond Shops HomeServices of America (2) Johns Manville Jordan's Furniture Justin Brands Kansas Bankers Surety Company Kern River Gas Transmission Company (2) Kingston (1) Kirby (1) Larson-Juhl Meriam Instrument (1) MidAmerican Energy Company... -

Page 78

... Taxes MARK D. MILLARD, Director of Financial Assets Letters from Annual Reports (1977 through 2002), quarterly reports, press releases and other information about Berkshire may be obtained on the Internet at berkshirehathaway.com. Berkshire' s 2003 quarterly reports are scheduled to be posted on...