BP 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

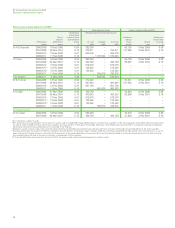

Part 1 Summary

In a volatile year for the world economy, the BP executive team produced

excellent results. While salaries were frozen for all directors in 2009, the

variable performance-related pay reflected the impressive achievements

of the year and the turnaround of performance over the past three years.

The details of executive director remuneration are set out in the table on

the opposite page.

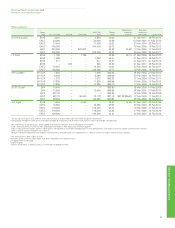

The remuneration committee sets the measures and targets for

the annual bonus element of variable pay at the beginning of the year,

based on the strategy and annual plan accepted by the board. The

strategy is built around safety, people and performance. The measures

included key safety measures (15% of bonus), staff numbers and survey

results to reflect the people priorities (15%) and a set of financial and

operational targets to measure performance (70%). Nearly all targets

were exceeded, some substantially, with particularly strong performance

on cost reduction, exploration success, production start-ups and refining

performance. This overall excellent performance was also reflected in the

market, where BP shareholders recorded the highest total shareholder

return (TSR) of all the oil majors for the year.

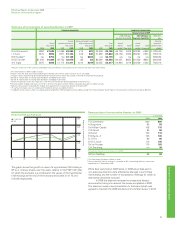

The other element of variable pay is awarded in shares based on

BP’s performance over three years, compared with the other oil majors.

Following the process approved by shareholders in the Executive

Directors’ Incentive Plan (EDIP), the committee first reviews the three-

year TSR of BP compared with its peers and then considers a set of

underlying business metrics, again in comparison with peers. When there

is a difference between the two comparisons, the committee decides

which level of vesting best represents BP’s relative three-year

performance. This year the TSR result was tightly clustered and sensitive

to calculation methodology. For example, based on a three-month

averaging of endpoints, BP came fourth whereas on a one-month

averaging it came second. On underlying metrics, BP ranked first on four

of the six reviewed (production growth, earnings per share growth,

change in return on average capital employed and free cash flow) and

second or third on the others (Refining and Marketing earnings per barrel

and net income growth). Following the process set out in the EDIP, the

committee judged BP to be tied for third place and thus shared the

vesting outcome for third and fourth place to result in a vesting of 17.5%

of the maximum award.

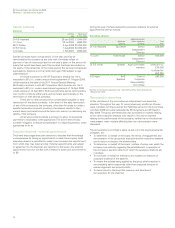

During the year the committee conducted a full review of BP’s

remuneration policy, and particularly the EDIP, which is being put before

shareholders for renewal this year. We consulted with a number of our

shareholders, reviewed the actual experience with applying EDIP rules

over the past five years and considered recent developments in the

marketplace. Overall we concluded that the basic structure of the EDIP

remains appropriate, but that some rebalancing of elements is warranted.

The key change we propose is to require a portion of the annual bonus to

be deferred, paid in shares and matched after three years subject to an

assessment of safety and environmental sustainability over the three-

year period. This change would place more focus on the long term,

highlight the importance of safety and build a larger equity stake for

executives that we believe aligns their interests well with shareholders.

To balance this additional bonus element, we propose to reduce the

maximum award of performance shares in the renewed EDIP so as to

maintain the current quantum of total remuneration. These changes are

summarized in the table below.

It has been an excellent year for BP and its shareholders. In

determining annual and long-term awards, the committee has recognized

the very real achievements of the executive team. For the future, we

believe our revised EDIP provides a sound framework with which to

competitively reward our top executives for continued success in this

long-term business.

Dr DeAnne S Julius

Chairman, Remuneration Committee

26 February 2010

82

BP Annual Report and Accounts 2009

Directors’ remuneration report

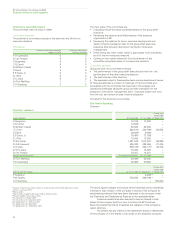

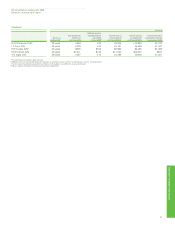

Summary of future remuneration components

Salary • Normally reviewed mid-year (no increases in 2009). Current salaries: Dr Hayward £1,045,000, Mr Conn £690,000,

Mr Dudley $1,000,000, Dr Grote $1,380,000, Mr Inglis £690,000.

Bonus • On-target bonus of 150% of salary and maximum of 225% of salary based on performance relative to targets set at

start of year relating to financial and operational metrics.

Deferred bonus and • One-third of actual bonus awarded as shares with three-year deferral, with ability to voluntarily defer an additional

match one-third.

• All deferred shares matched one-for-one, both subject to an assessment of safety and environmental performance over

the three-year period.

Performance shares • Following EDIP renewal, award of shares of up to 5.5 times salary for group chief executive, 4.75 times for the chief

executive of Exploration and Production, and 4 times for other executive directors.

• Vesting after three years based on performance relative to other oil majors.

• Three-year retention period after vesting before release of shares.

Pension • Final salary scheme appropriate to home country of executive.